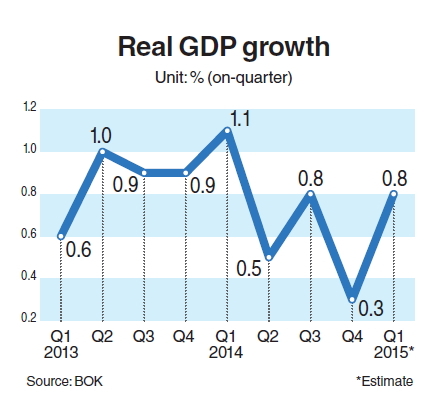

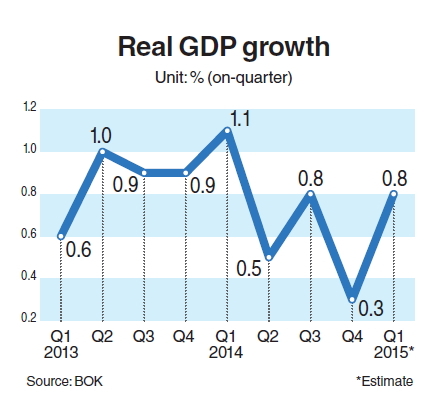

South Korea’s economic growth continued to stagnate in January to March, drawing concern as private consumption and slowing exports pulled growth below 1 percent for the fourth consecutive quarter.

The Bank of Korea said Thursday that the economy expanded 0.8 percent in the first quarter, compared to October-December 2014. On-year growth reached 2.4 percent.

Quarter-on-quarter growth remained below 1 percent last year, sliding from 1.1 percent in the first three months to 0.5 percent, 0.8 and 0.3 percent in the following quarters, respectively.

Gasoline and diesel prices were estimated to have bottomed out in late January amid low international crude oil prices, but consumer sentiment remained weak, according to a report from the Hyundai Economic Research Institute.

The BOK lowered the yearly benchmark interest rate to 1.75 percent in March to prop up the economy. Analysts said the second quarter, ending in June, would be key for gauging this year’s GDP growth.

If the benefits from the rate cut are minimal this quarter, the 2015 growth rate may not pass 3 percent, some think tanks predict.

“It is hard to predict that yearly growth will exceed 3 percent. It may stay at 2.9 percent,” said a report from NH Investment and Securities. The brokerage firm, however, forecast that quantitative easing in the eurozone starting in March will be favorable for Korea’s exports to EU countries.

By sector, private consumption grew by 0.6 percent and corporate facilities investment growth and exports were flat.

In contrast, BOK data showed investment in the construction sector increased by 7.5 percent.

Key factors for measuring GDP include the foreign exchange rate for exporters and oil prices for individual consumption.

The Korean won has continued to gain value against the U.S. dollar, euro and Japanese yen over the past few months, which could undermine automakers and other major exporters.

Oil prices, which are still believed to be quite low compared to previous years, are indicating a rebound in the coming months to a burdensome level again. High oil prices are historically not a boon to the overall Korean economy.

Some market participants project that the BOK may push for another rate cut by 25 basis points to 1.5 percent later this year.

By Kim Yon-se (

kys@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)