|

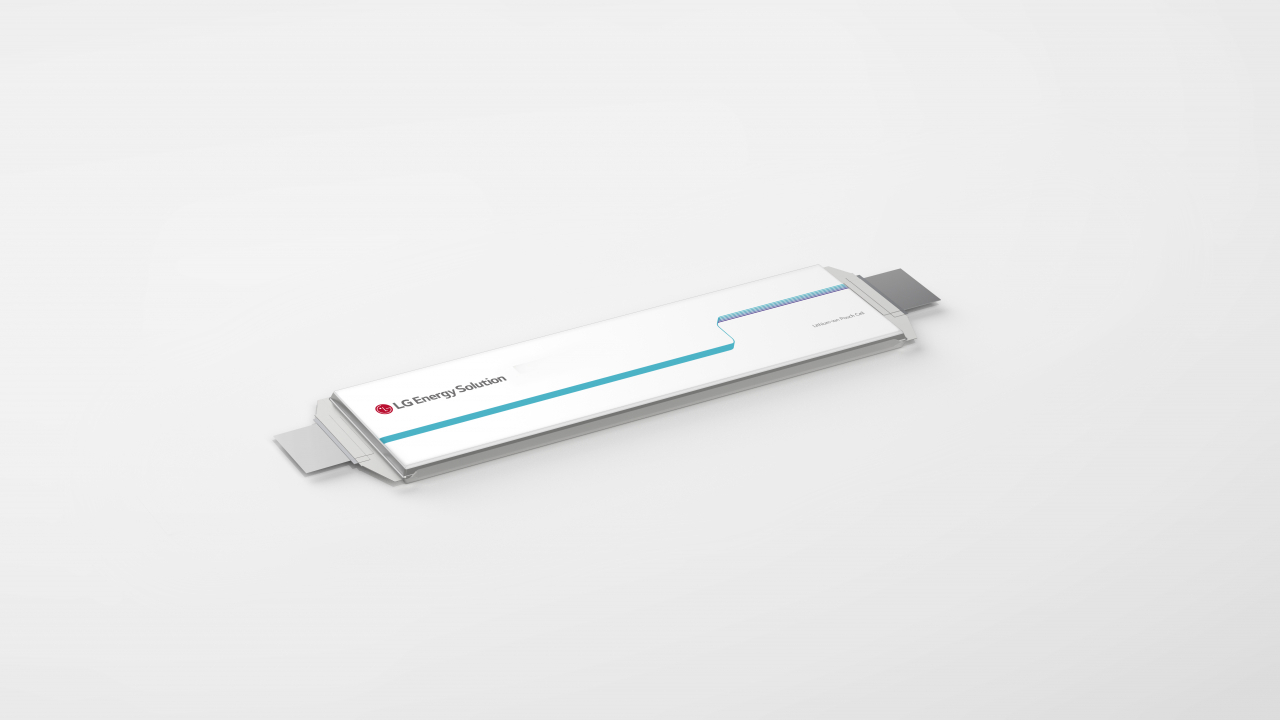

LG Energy Solution's battery for electric vehicle (LG Energy Solution) |

LG Energy Solution reported a twofold jump in operating profit last year, driven by increased demand for electric vehicle batteries and energy storage systems, the South Korean battery maker said Friday.

Revenue rose 43.4 percent to 25.6 trillion won ($20.8 billion) in 2022, and its operating profit hit 1.2 trillion won, a 57.9 percent increase on-year. Sales and operating profit both hit new heights last year.

“We were able to record the highest annual revenue as the shipments of our products increased due to the improved demand for electric vehicle battery and power grid’s energy storage systems in the second half of last year and the increased prices of major raw materials,” said Lee Chang-sil, chief financial officer at LG Energy Solution, in a conference call.

The CFO attributed the jump in the company’s yearly operating profit to improved productivity and expansion of metal sourcing for better prices.

Although LG Energy Solution’s fourth-quarter revenue of 8.5 trillion won was its highest quarterly figure ever, the company’s operating profit in the October to December period dipped by 54.5 percent on quarter to 237.4 billion won.

The battery maker explained that the quarterly drop in operating profit was due to incentives given to employees and increased expenses for energy storage systems’ battery replacement. Removing the effects of these one-off factors, the operating profit would be similar to the previous quarter, the firm said.

For 2023, LG Energy Solution also laid out a goal of achieving a 25 to 30 percent increase in yearly revenue. The company said it plans to invest over 9.45 trillion won to expand its global manufacturing capacity, which would be 150 percent more than last year’s 6.3 trillion investment.

The company expects to bring up its worldwide production capacity to 300 gigawatt-hours, enough to manufacture 4.3 million high-performance EVs, by the end of this year with plants either under construction or being expanded in Korea, China, Poland and the US.

The battery maker’s order backlog reached 385 trillion won by the end of last year, compared to 2021's 260 trillion won, the firm said.

As North America is expected to be the fastest-growing market for EVs this year, LG Energy Solution said it is well prepared to cope with the implementation of the US government’s Inflation Reduction Act.

From this year, the IRA requires EV batteries to be made with at least 50 percent of components manufactured and assembled in North America. Also, 40 percent or more of the minerals in EV batteries need to be from the US or countries that signed free trade agreements with the US. Under the IRA, $7,500 in incentives will be given to made-in-America EVs.

“From early on, we have put efforts into establishing supply chains in North America," Lee said, adding that they will likely qualify for the incentives.

The CFO pointed out that the IRA’s requirements appear to have been suspended for 2023 and 2024, although the US government is expected to announce more details about the law in March.

Lee said the company is closely monitoring Washington’s decision on the guidelines of the advanced manufacturing production credit, or AMPC, in the IRA as it will have a direct impact on the Korean battery maker’s US manufacturing.

“Cost-competitiveness is more important than anything. Aside from various changes in policy, our focus is on being more cost-competitive,” said Lee.

![[KH Explains] Samsung chief says he is still ‘hungry’ for foundry growth](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/10/08/20241008050604_0.jpg)