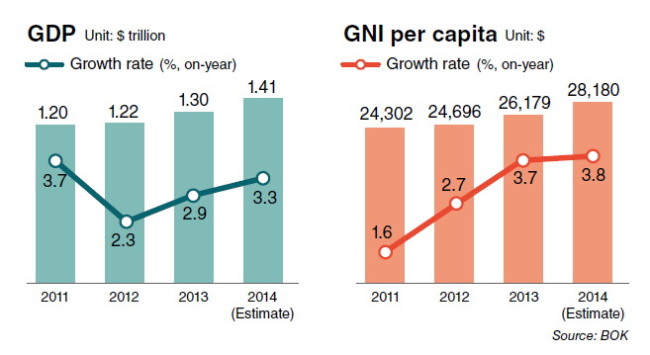

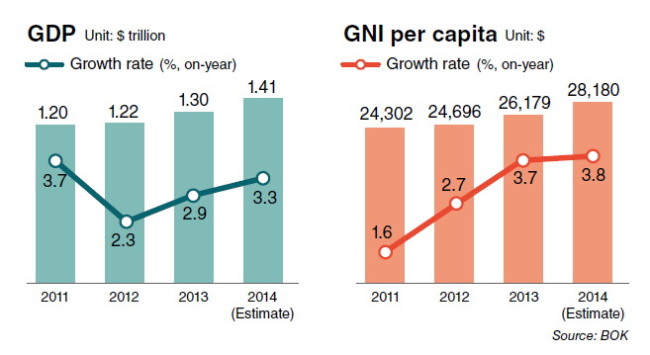

South Korea’s gross national income surpassed $28,000 per capita in 2014, in part due to a strong Korean won against the U.S. dollar, while the economy expanded 3.3 percent, well below its 4 percent target, according to data from the Bank of Korea Wednesday.

In a revised report released by the Korean central bank, the loss of 3.8 percent on the won-dollar foreign exchange pushed the GNI per capita up to $28,180 last year from $26,179 the year before.

This marked the fifth straight year for the country’s GNI to stand in the $20,000 range. Market observers initially expected the GNI per capita, a gauge of the population’s purchasing power, to surpass $30,000 last year, but the economic slowdown kept it in the $20,000 range.

Korea’s GNI per capita surpassed $20,000 for the first time in 2006, and continued to increase until 2008, when the global financial crisis erupted in the U.S. In 2009, the figure fell below $20,000 to $18,303.

Also, the country’s personal gross disposable income, a gauge of purchasing power of households after subtracting corporate and state income from its gross national income, came to $15,786 last year, up $1,081 from $14,704 a year ago.

Its gross savings rate stood at 34.7 percent in 2014, up 0.4 percentage point from 34.3 percent a year before, reflecting the growing propensity to save rather than spend amid the slowdown and high debt levels.

Korea’s GDP growth rate of 3.3 percent last year was on par with the central bank’s initial estimate, accelerating from 2.9 percent in 2013, according to the BOK data.

The expansion was in large part due to increased facility investment, which grew 5.8 percent last year, compared to a contraction of 0.8 percent in 2013.

However, Korea saw growth of exports ― the country’s main growth driver ― slow to 2.8 percent in 2014, compared to 4.3 percent the previous year.

“Samsung Electronics’ decreased earnings related to mobile devices in the third and fourth quarters of last year affected (exports),” said a BOK official.

“The increased facility investment came as the transport sector expanded the number of its large airplanes. Also, this was in part due to increased investment in ultrahigh-definition (TV) machineries for the FIFA World Cup in Brazil (last year).”

The construction sector grew just 0.6 percent, compared to 3 percent on-year as the government had reduced infrastructure development spending amid increasing tax revenue shortfall, according to the BOK.

The GDP deflator, the broadest measure of inflation for all goods and services, stood at 0.6 percent last year, down from 0.9 percent the previous year.

The revised report followed the central bank’s unexpected key rate cut to a record low of 1.75 percent earlier this month.

The central bank’s monetary policy committee decided to cut its benchmark interest rate as it feared that the country’s growth and inflation would fall well short of its expectations.

“Although the central bank cut its rate twice last year, it had to make an additional rate cut to support the economic recovery,” BOK Gov. Lee Ju-yeol said.

By Park Hyong-ki (

hkp@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)