|

The interior of the headquarters of the Organization for Economic Cooperation and Development in Paris (OECD) |

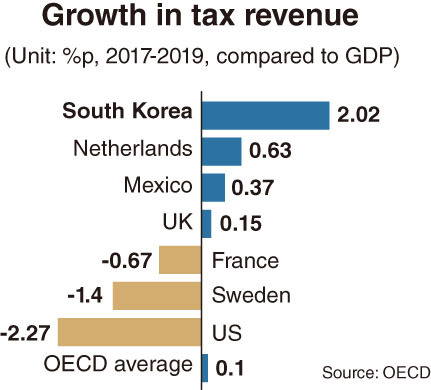

SEJONG -- South Korea topped the list among members of the Organization for Economic Cooperation and Development in the growth of tax revenue -- the state’s income from taxation -- between 2017 and 2019.

According to the France-based organization, Korea’s tax revenue was equivalent to 27.38 percent of its gross domestic product in 2019. This represents a 2.02 percentage point climb from 2017, when the Moon Jae-in administration took office and tax revenue was 25.36 percent of GDP.

The pace of growth was the fastest among the 35 OECD members for which 2019 figures were available. Two member nations, Australia and Japan, of the total 37 were excluded from the analysis because the data had not yet been compiled.

Korea far exceeded the OECD average of 0.1 percentage point growth over the corresponding two-year period -- from 33.74 percent of GDP in tax revenue in 2017 to 33.84 percent in 2019.

While Korea was the only country whose tax revenue increased by more than 2 percentage points, there were four members within the 1 percentage point range.

|

(Graphic by Kim Sun-young/The Korea Herald) |

Luxembourg ranked second among the 35 members with 1.61 percentage points, followed by Poland with 1.26 percentage points, Norway with 1.15 percentage points and Germany with 1.02 percentage points.

Among the countries that saw growth between 0 and 1 percentage point were Spain (0.78), Colombia (0.7), New Zealand (0.7), the Netherlands (0.63), Italy (0.54), Chile (0.5), Denmark (0.49), the Czech Republic (0.49), Mexico (0.37), Canada (0.34), the UK (0.15), Switzerland (0.12) and Greece (0.09).

Further, 11 members posted negative growth in their governments’ income from taxation during the 2017-2019 period.

Hungary recorded the biggest decline, 2.51 percentage points. Next was the US, which saw its figure fall by 2.27 percentage points -- from 26.74 percent of GDP in 2017 to 24.47 percent in 2019. This was followed by Israel with minus 2.07 percentage points.

Turkey posted minus 1.6 percentage point growth, trailed by Iceland at minus 1.48, Sweden at minus 1.4, Belgium at minus 0.75, Finland at minus 0.74, France at minus 0.67, Latvia at minus 0.19 and Ireland at minus 0.1.

The international comparison suggests that the Moon administration has been active in taxation.

According to the data, publicized by Rep. Choo Kyung-ho of the main opposition People Power Party, who credited the National Tax Service, the nation’s corporate taxes increased by 12.9 trillion won ($11.8 billion) from 59.2 trillion won in 2017 to 72.1 trillion won in 2019.

Over the corresponding period, taxes levied on personal income increased by 6.9 trillion won, taxes on property by 2 trillion won, comprehensive real estate taxes by 1.1 trillion won and inheritance taxes by 812.3 billion won, Choo noted.

Gift taxes and acquisition taxes grew by 731.6 billion won and 451.4 billion won.

President Moon Jae-in, when he was the chief of the main opposition party in 2015, denounced the Park Geun-hye administration, accusing then-President Park of breaking her promise to maintain the nation’s social welfare programs without increasing taxes.

Moon, when he was a presidential candidate in early 2017, said he could improve the country’s social safety net without increasing taxes.

But the tax increase was inevitable to fund a series of massive extra budgets, and consequently a large portion of households have faced sharp hikes in property tax, capital gains tax and income tax.

By Kim Yon-se (

kys@heraldcorp.com)