|

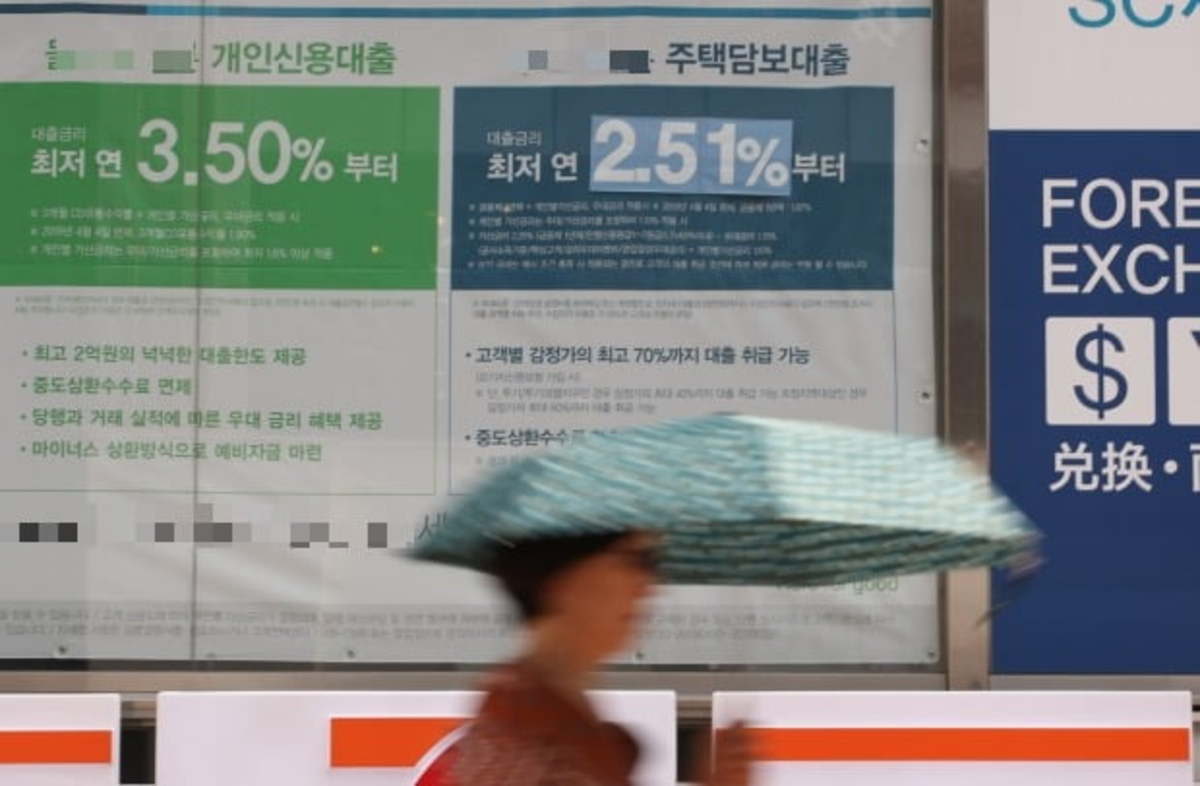

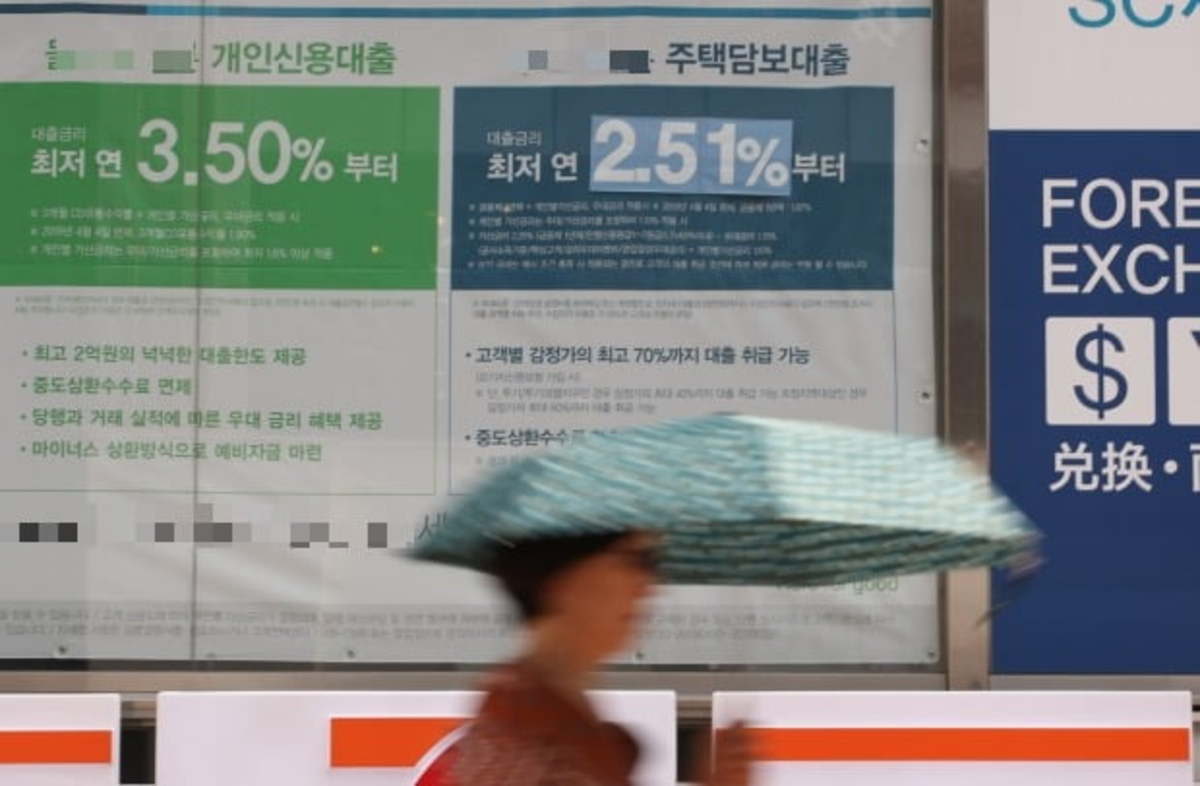

A poster at a bank in Seoul advertising personal and home-backed loans. (Yonhap) |

South Korea's household credit grew at a faster clip in the third quarter compared to three months earlier, driven by a rise in banks' home-backed loans, central bank data showed Tuesday.

Household credit reached a record high of 1,682.1 trillion won ($1.51 trillion) as of September, up 44.9 trillion won from three months earlier, according to the data from the Bank of Korea (BOK).

Household credit refers to credit purchases and loans for households that have been extended by financial institutions, including commercial lenders and mutual savings banks.

The third-quarter tally compared with a 25.8 trillion won on-quarter rise in the second quarter. In the January-March period, household credit grew at the slowest pace in one year amid the virus outbreak.

Household lending extended by banks and other financial institutions reached 1,585.5 trillion won in the July-September period, up 39.5 trillion won from three months earlier.

Mortgage loans rose 17.4 trillion won on-quarter to 890.4 trillion won in the third quarter, accelerating from a 14.8 trillion won increase in the second quarter. The reading almost doubled from a 9.5 trillion won on-quarter gain the same period of last year.

In the third quarter, loan demand to buy stocks also rose in line with the country's bull stock market. Despite the virus outbreak, Seoul's stock market gained ground amid ample liquidity sparked by a long streak of low rates.

Credit purchases stood at 96.6 trillion won as of end-September, up 5.4 trillion won from three months earlier, the BOK said.

Korea's household debt has been repeatedly cited as the main drag on Asia's fourth-largest economy, as households' high indebtedness is feared to curb domestic demand and thus crimp economic growth. (Yonhap)