|

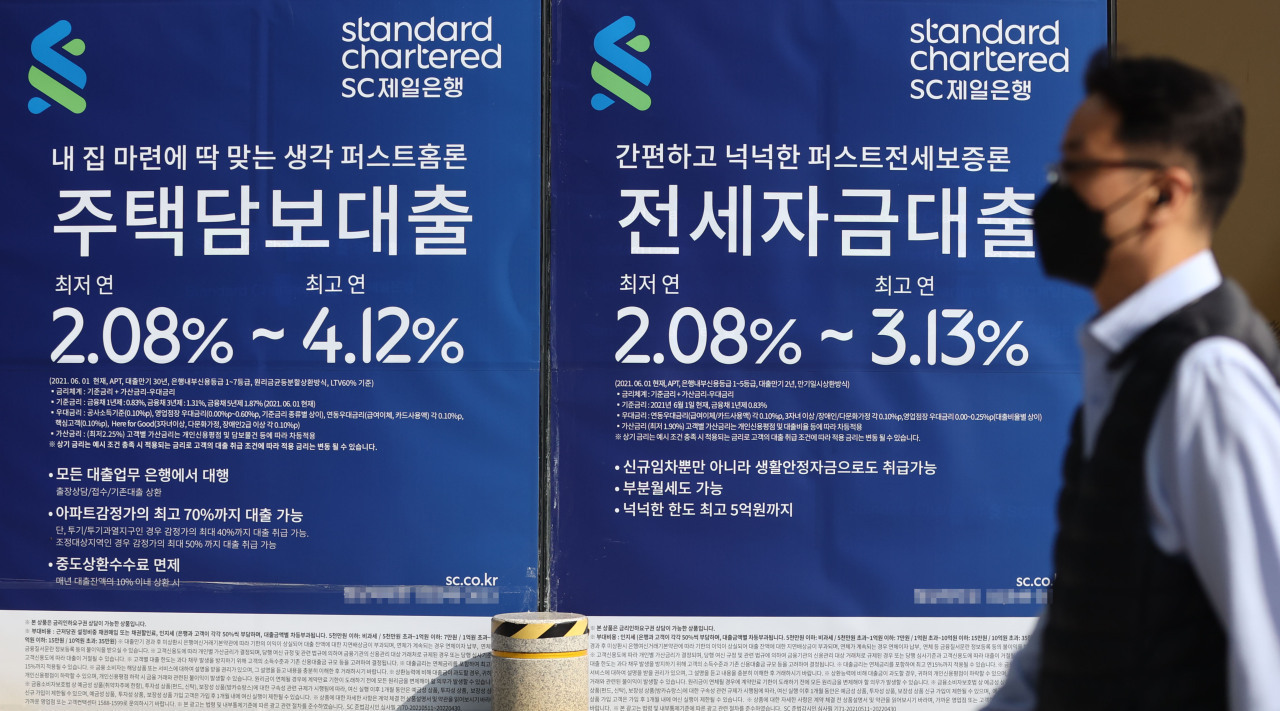

A man passes by advertisements in Seoul promoting Standard Chartered Korea's mortgage products. (Yonhap) |

South Korean banks' household loans declined in December due to the central bank's rate hike and tight lending rules, data from the Bank of Korea (BOK) showed Thursday.

Outstanding bank loans to local households had come to 1,060.7 trillion won ($982 billion) as of the end of last year, down 200 billion won from the previous month, according to the BOK.

The December reading compared with a 2.9 trillion-won on-month gain in November.

It marked the first on-month decline for any December since 2004, when the BOK began compiling related data.

For all of 2021, banks' household loans increased 71.8 trillion won, the third-largest gain.

The BOK said banks' household loans fell last month amid hikes in lending rates and lenders' tight lending rules.

The country's central bank raised the benchmark interest rate by a quarter percentage point to 1 percent in November to curb inflation and household debt. It followed a 0.25 percentage point hike in August.

The data showed banks' mortgage loans grew 2 trillion won on-month to 778.8 trillion won. It marked the slowest growth since February 2018.

Unsecured and other non-mortgage loans had come to 280.7 trillion won as of end-December, down 2.2 trillion won from the previous month. It also marked the fastest on-month fall for any December since 2004.

The BOK said it is too early to say if banks' household loans could continue to grow slowly, as demand for home-lending loans still remains high.

Household loans by banks and non-banking institutions grew by 200 billion won in December from the previous month, according to the Financial Supervisory Service. It sharply slowed from a 5.9 trillion won on-month gain in November.

Financial authorities seek to keep the on-year growth of aggregate household debt in the 4-5 percent range for this year.

Last year, household loans grew 7.1 percent.

Household debt has sharply increased amid record-low interest rates and demand for loans to buy homes spurred by skyrocketing housing prices.

Household credit had come to a record high of 1,844.9 trillion won as of end-September, up 36.7 trillion won from three months earlier, according to separate BOK data.

Meanwhile, banks' loans to businesses fell 2.8 trillion won on-month in December to 1,065.7 trillion won.

The fall came as companies repaid part of their debt to improve their year-end balance sheets.

Bank lending to large companies fell 1.7 trillion won on-month to 179.3 trillion won, while loans to smaller firms declined 1 trillion won to 886.4 trillion won. (Yonhap)