|

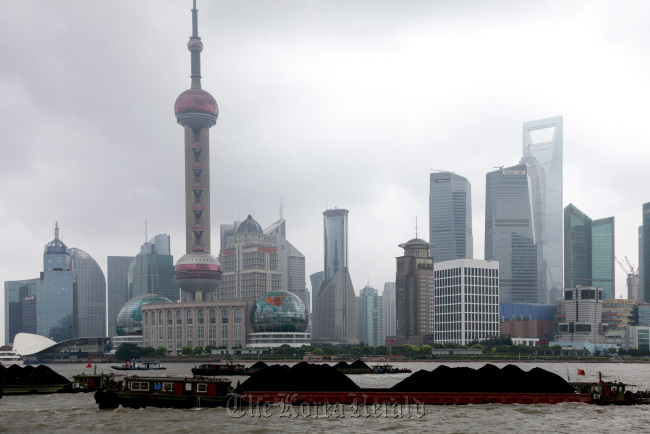

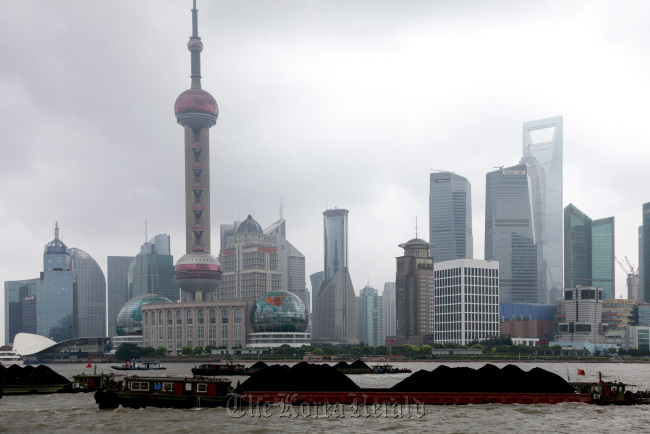

Barges on the Huangpu River loaded with coal steam past the skyscrapers of Lujiazui financial district in Shanghai. (Bloomberg) |

China must “unswervingly” continue its property controls and prevent prices from rebounding, Premier Wen Jiabao said Saturday, after the central bank cut interest rates and triggered a surge in property stocks.

Local governments that introduced or covered up a loosening of curbs on residential real-estate must be stopped, Wen said during a visit to Changzhou city in eastern Jiangsu province, according to the official Xinhua News Agency. Restricting speculative demand and investment in property must be made a long-term policy, he said.

Wen’s comments underscore the government’s determination to maintain restrictions on housing purchases even as it cuts interest rates and boosts infrastructure spending to reverse a slowdown in the world’s second-biggest economy. China’s new-home prices rose for the first time in 10 months in June, according to SouFun Holdings Ltd., owner of the nation’s biggest real- estate website.

“We must unswervingly continue to implement all manner of controls in the property market to allow prices to return to reasonable levels,” Wen was quoted as saying when he met residents and local government officials in charge of affordable housing. “We cannot allow prices to rebound, or all our efforts will come to naught,” he said.

Market expectations about property prices are changing and citizens are worried prices will rise again, he said. Signals in the market are “chaotic” and misleading and speculative information must be stopped, Wen said, according to Xinhua.

Developers Gain

Shares of property developers listed in China rose the most in four months on July 6, the day after the People’s Bank of China announced the second cut in borrowing costs in a month. The stocks gained even as the central bank’s statement signaled property restrictions won’t be relaxed.

The gauge tracking developers on the Shanghai Composite Index added 3.5 percent, the most since March and the biggest gain among five industry groups on the benchmark. China Vanke Co., the biggest listed developer on the mainland, climbed to the highest since November 2010. Poly Real Estate Group Co., the second largest, surged to the highest in two and a half years.

“As long as there are no new curbs to come and it’s only the implementation of existing policies, home prices will still rise,” Jinsong Du, a Hong Kong-based property analyst at Credit Suisse Group AG, said by telephone Saturday.

Wen called for the government’s differentiated mortgage policy and other restrictions on purchases to be maintained. His comments add to the PBOC’s July 5 warning to banks to stick to the government’s lending curbs.

Curb Speculation

“All financial institutions must continue to strictly implement a differentiated housing credit policy to continue curbing property-buying for speculation and investment purposes,” it said in its statement announcing the interest- rate cut.

China started imposing restrictions on home purchases two years ago as prices surged after the government started a stimulus package to shield the economy from the impact of the global financial crisis. Measures included raising down-payments and mortgage-rate requirements, limiting purchases in some cities and trialing a tax on homes in Shanghai and Chongqing.

Property controls are still in a “critical period” and the task remains “arduous,” Wen said Saturday. Cases of illegal acquisition of property-rights must be investigated, he said.

Property Tax

The government must “promote the study and implementation of changes to the property-tax mechanism, and to speed up the establishment of a comprehensive long-term mechanism and policy framework for controlling the property market,” Xinhua cited Wen as saying.

Home prices fell in a record 54 of 70 cities tracked by the government in May from a year ago, the government said on June 18, as developers cut prices to boost transactions. Even so, sales rebounded for the first time this year, rising 19 percent from April, the data showed.

Evergrande Real Estate Group Ltd., the country’s biggest developer by volume, said it posted a 33 percent rise in contracted sales in May from a year earlier to a record 10.4 billion yuan.

About 30 cities have issued “fine-tuning” policies since the second half of 2011 to revive plunging sales, according to Centaline Property Agency Ltd., the nation’s biggest real-estate brokerage.

Prices of new homes in June rose for the first time in 10 months, according to a survey of 100 cities by SouFun released on July 2. Buying sentiment has improved after monetary policy easing this year and some developers have called off discounts or even raised prices as sales picked up, it said in a statement.

“The worst is probably over,” Standard Chartered Plc economists Stephen Green and Lan Shen wrote in a June 28 note. Data suggest “buyers are coming back into the market to take advantage of discounted prices offered by developers” and apartment sales volumes are improving in the top 25 cities.

(Bloomberg)