|

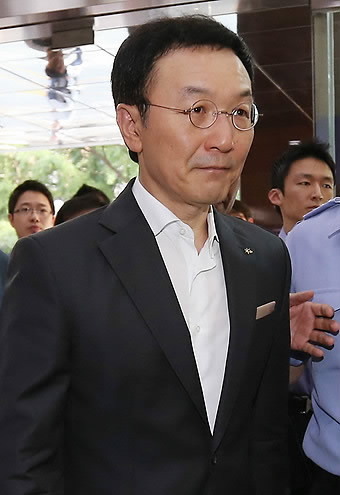

Lim Young-rok |

The nation’s financial watchdog on Friday imposed light punishments on the chairman of KB Financial Group and the head of its flagship Kookmin Bank over managerial errors.

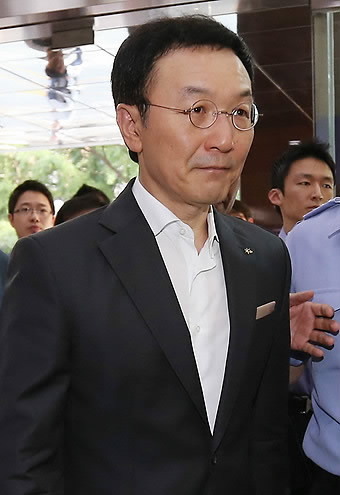

The Financial Supervisory Service’s disciplinary committee gave warnings to KB financial chairman Lim Young-rok and Kookmin Bank president Lee Kun-ho, backing off from its initial stance that it could impose heavy penalties.

|

Lee Kun-ho |

In June, the authority launched an investigation into misconduct committed by Lim and Lee, both of whom had been involved into a series of scandals ranging from loan fraud in Tokyo, financial irregularities and an internal power struggle surrounding the replacement of a computer system at Kookmin Bank.

The worsening situation at the financial group peaked when Lim and Lee clashed over the computer system replacement.

While the FSS had warned of heavy sanctions against Lim for a leak of customer data and the wrangling over changing the computer system, the watchdog’s board of audit concluded Lim is only responsible for poor management of KB Financial and KB Bank.

The penalty against Lee was also lowered to a warning level after the investigators failed to clarify who should bear responsibility for the loan fraud in Tokyo and the clash over the computer system replacement.

The FSS also reprimanded 87 executives and officials involved in the misconduct.

“We will release a statement once we receive an official notice from the watchdog,” a spokesman from the bank said. Kookmin is expected to receive the notice in two weeks, the spokesman said.

The upcoming statement of the bank, however, is unlikely to quell the lingering controversy that the FSS was also responsible for fanning KB’s internal dispute.

“Basically, the watchdog has dragged (its feet) on the issue for months, threatening them with a tough suspension,’’ an analyst from the Korea Development Bank said.

“That took a serious toll not only on KB Financial and KB Bank’s relationship but also the overall management of the country’s largest bank (by assets).’’

Management at KB Financial and Kookmin Bank was stalled for months, forcing the postponement of a staff reshuffle and key business plans including the acquisition of LIG Insurance.

KB Financial posted a net profit of 765.2 billion won ($752 million) during the first six months of the year, with Kookmin Bank earning 546.2 billion won, or 71.4 percent.

The labor union of Kookmin Bank has demanded that both leaders step down to take responsibility for tarnishing the company’s reputation by causing internal strife.

While KB seems to have avoided the worst-case scenario of Lim and Lee being forced to resign, they are now tasked with mending fences over the internal feud.

“Despite the watchdog’s final judgment, I doubt the Lim-Lee conflict, which reflects a power struggle between the holding company and its subsidiary bank, will disappear,” said an official at a local bank, wishing to stay anonymous.

“It will take time for Lim and Lee to recover KB employees’ and peoples’ trust and wipe away their dishonor,” he added.

By Suk Gee-hyun (

monicasuk@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)