The most pressing task for many financial chiefs in the remaining half of the year may be to stay out of the public eye and this is all the more true for those who are facing heavy sanctions.

Even those who have been off the authorities’ radar are now becoming anxious as they face the end of their given term, not knowing for sure whether they will be reappointed.

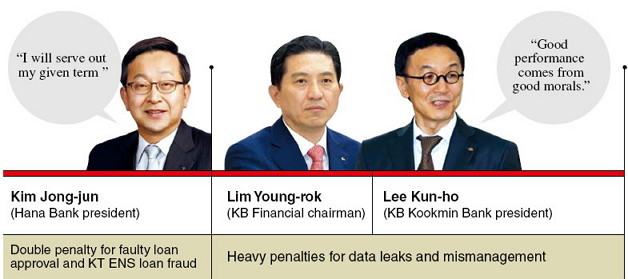

Ever since the massive customer information leak scandal broke out in January this year, there have been warning signs for KB Financial Group chairman Lim Young-rok and KB Kookmin Bank president Lee Kun-ho.

The two were hit hard early in June as the Financial Supervisory Service announced severe sanctions, holding them responsible for a series of financial irregularities, including an information leak, loan fraud in Tokyo and a recent leadership dispute.

But the FSS’ disciplinary committee failed to reach a conclusion in its past two sessions, and the final measure has been delayed to the end of this month, giving room for KB chiefs to prepare their defense.

“(KB’s) performance should be based on morality and legitimacy,” Lee said Tuesday at the bank’s monthly meeting.

“Our goal this year is not just to attain the financial target line, but also to recover the customers’ trust.”

|

(Graphic by Park Gee-young) |

Hana Bank president Kim Jong-jun, also appears to be unwavering despite the threat of penalties, which has him treading on thin ice.

Back in April, Kim was issued a warning for approving an unqualified loan during his time as Hana Capital chief and thus causing undue financial losses to the group.

“I will faithfully serve my given term, regardless of the sanctions,” Hana officials quoted Kim as saying, shortly after the FSS announcement.

But Kim now faces a greater challenge as the FSS is slated to confirm further sanctions against him for his negligence of supervisory duty concerning the bank’s improper loan to KT ENS. The corresponding decision is expected to be finalized in August, after the KB case is settled.

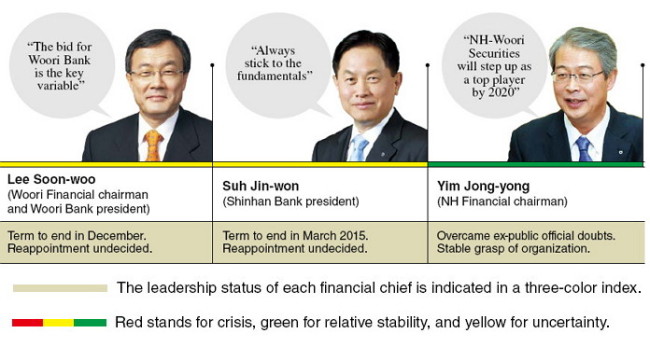

Apart from KB and Hana, the other major financial groups are doing relatively well, but some now face a possible leadership replacement within this year or early next year.

The greatest concern for Lee Soon-woo, chairman of Woori Financial Group and president of Woori Bank, is whether he will be reelected for another term in December so that he may tackle the slower-than-expected sale of Woori Bank.

But as the government recently renewed its pledge to privatize Woori Bank at all costs, industry observers consider it highly likely that Lee will remain in his post, at least until the winning bid takes shape.

Shinhan Financial Group, which stands unrivalled in terms of net profits, has more time to spare.

The group was the only one among the nation’s top financial units to see its on-year net profit rise in the first quarter this year ― 16.1 percent from the same period last year and 62.7 percent from the previous quarter.

Its outstanding performance was largely attributed to its key affiliate Shinhan Bank and this, in turn, is expected to help chief Suh Jin-won win another term next March.

NH Financial Group, which became the nation’s fourth-largest financial unit this year after absorbing Woori’s securities houses, is continuing its rather stable growth under the leadership of chairman Yim Jong-yong.

Yim’s bigger challenge, in fact, was to overcome negative perceptions because of his past career as a vice finance minister, making him a member of the so-called Mofia ― a term referring to former high-ranking government officials who find an easy way into financial top posts.

By Bae Hyun-jung (

tellme@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)