|

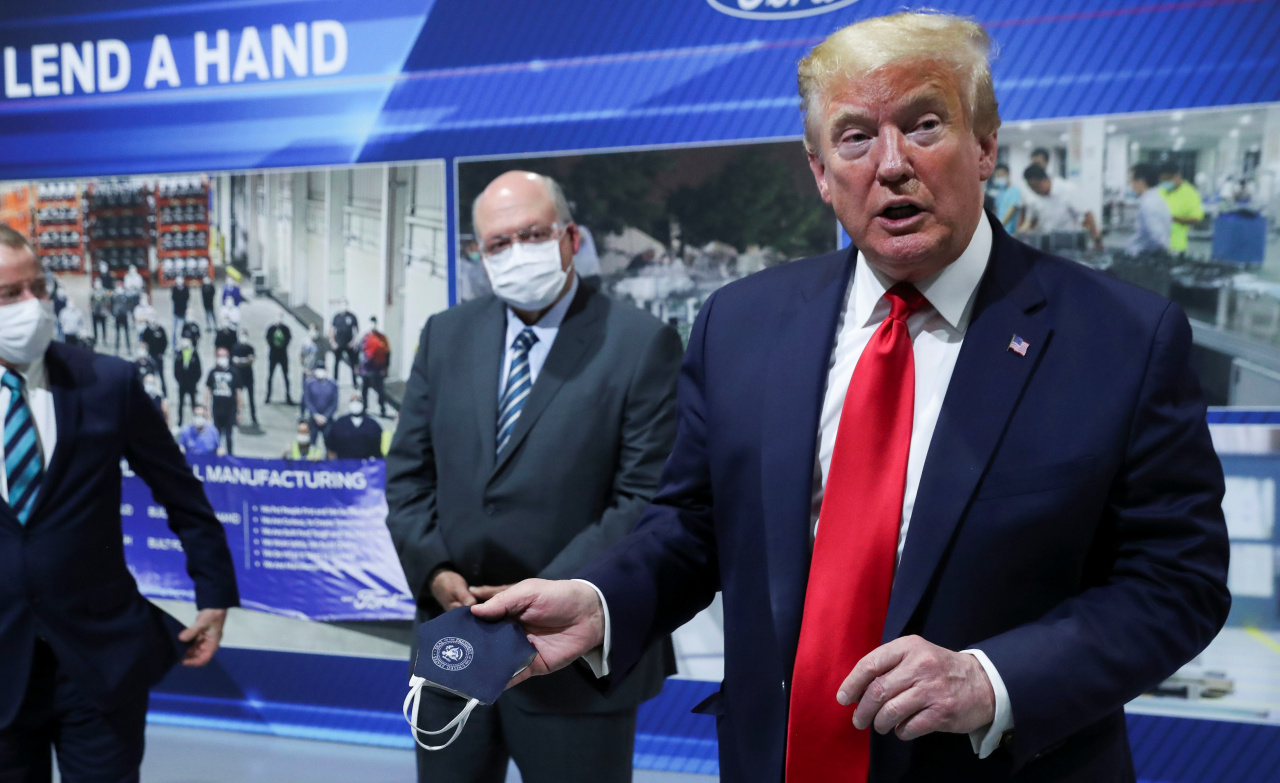

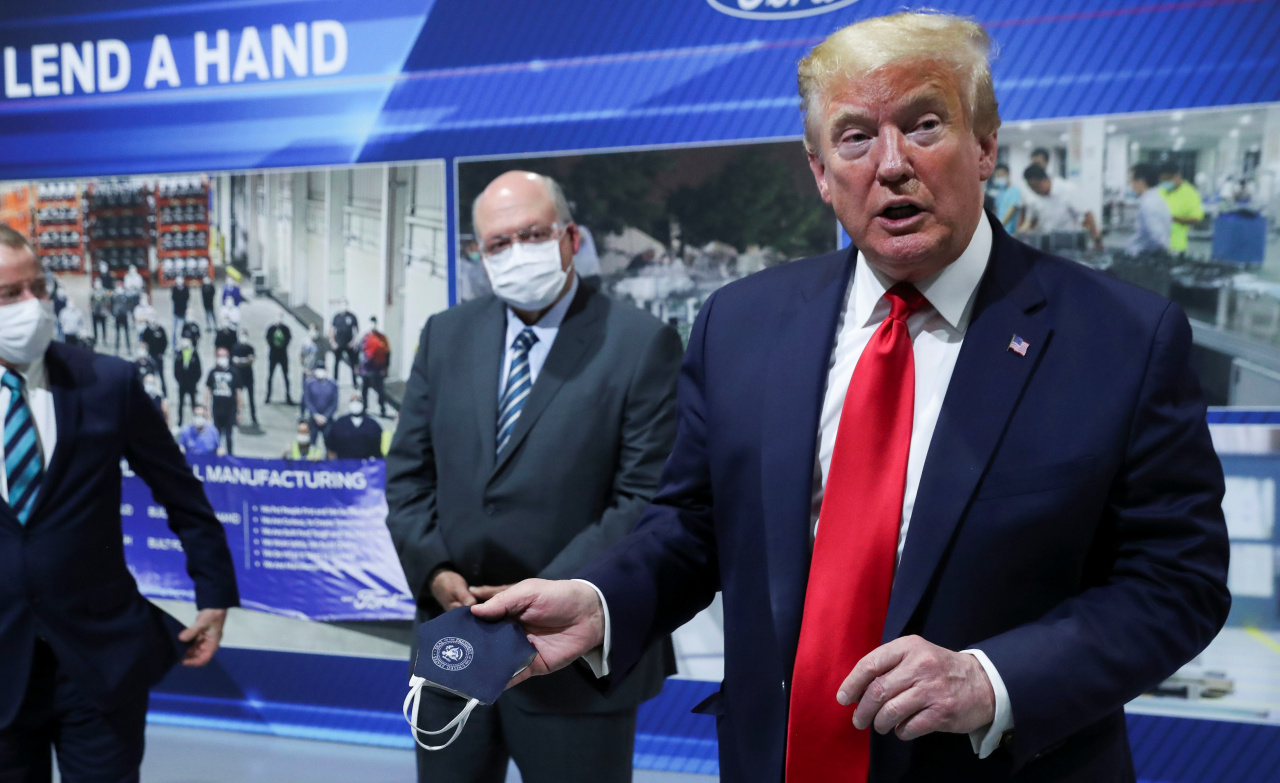

US President Donald Trump holds a protective face mask with a presidential seal on it that he said he had been wearing earlier in his tour as Ford Motor Company CEO Jim Hackett looks on at the Ford Rawsonville Components Plant that is manufacturing ventilators, masks and other medical supplies during the coronavirus disease pandemic in Ypsilanti, Michigan, US, May 21, 2020. (Reuters-Yonhap) |

US-based firms in several sectors are likely to face a prolonged struggle due to the pandemic, and are even at the risk of producing more zombie firms, a report by South Korea’s central bank said Sunday.

“The United States government’s active support has helped resolve the liquidity crunch of US-based firms, but the financial indexes of sectors classified as consumer discretionary, industrial products and energy have been relatively weak compared to others,” the weekly report on overseas economies by the Bank of Korea said.

Consumer discretionary spending refers to goods and services that are considered non-essential by consumers, but desirable if they have enough money to purchase them. Auto firms such as General Motors and Ford Motor, e-commerce and tech giant Amazon, hospitality businesses including Hilton and Marriott are usually classified as consumer discretionary.

Industrial products, on the other hand, includes manufacturers of aircraft and electrical components such as Boeing, Lockheed Martin and General Electric.

The Bank of Korea explained that the report was based on the US firms’ financial statements and data. It expressed concerns over the firms’ increased issuance of corporate debt to cope with economic fallout from the COVID-19 pandemic, as weak repayment capacities could slow down the recovery of the real economy.

The named sectors were vulnerable to “short-term liquidity shocks” and weighed down by heavy debt repayment burdens. Their weak repayment capacity adds to the vulnerability, the BOK added.

On top of it, the debts in the sectors have been deteriorating, with the distressed debt ratio – a barometer for corporate default – having surged in March. Firms in the energy, consumer discretionary and industrial products sectors accounted for 65 percent of companies that saw an increased in distressed debt ratio in the cited period, the BOK noted.

“It seems inevitable that the sectors will see a spike in default rates and a decline in credit ratings,” the BOK said.

“The weakened sectors can deal a strong blow to the real economy and when corporate performance continues to struggle despite the government’s financial support, there are possibilities that the current situation may produce more zombie businesses.”

According to US Federal data released last week, US nonfinancial business debt increased by 18.8 percent on-quarter to $16.8 trillion in the first three months of the year due to an increase in loans and corporate debt issuance.

By Jung Min-kyung (

mkjung@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)