Economic policymakers in the government said early this year sliding oil prices would be a blessing for the Korean economy. Their argument was that a decline in oil prices would result in an increase in household income and consumption while helping manufacturing companies cut production costs.

But such expectations have proved simply wrong, even as oil prices fell to the lowest level since 2009.

The policymakers, who set this year’s growth target at 4 percent, now concede the annual growth rate would dip below 3 percent. Many firms in shipbuilding, shipping, machinery and construction sectors have been struggling with mounting losses, with some facing an increasing risk of default.

The Korean economy, which relies heavily on exports, has seen benefits from low oil prices more than offset by the deteriorating profitability of exporting manufacturers whose turnover is closely linked to crude price movement. In particular, shipyards, petrochemicals plants and machinery factories clustered along the southeastern coastal area are bearing the brunt of the impact, prompting concerns that the regional economy dependent on them may be drawn into a crisis.

“Appreciating low oil prices as a blessing for our economy might have just been nonsense from the outset,” said Shon Ji-woo, an analyst at SK Securities.

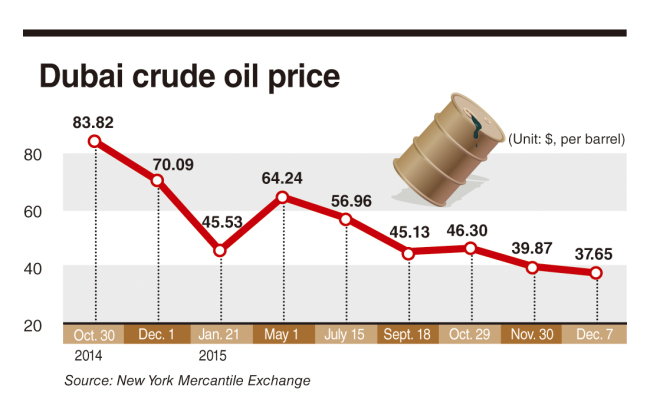

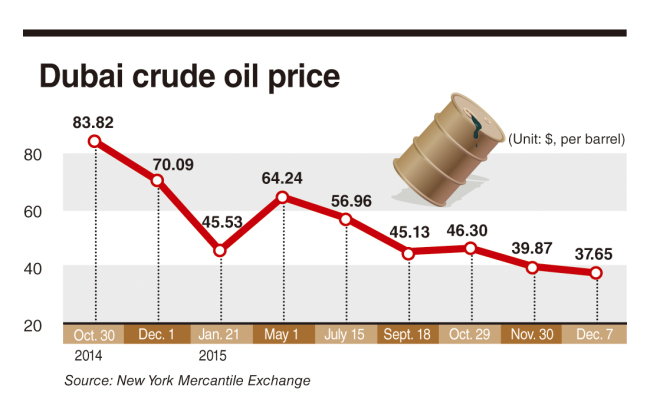

In June last year, crude traded above $100 a barrel, but has since plunged on a global oversupply, sluggish demand growth and a strong dollar.

The decision by the Organization of Petroleum-Exporting Countries last week not to cut their output is putting more downward pressure on crude prices. Following the OPEC meeting in Vienna, the price of Dubai oil, which accounts for the largest part of Korea’s crude imports, tumbled below $40, little more than half what it was a year earlier.

In the short term, the global oil market is set to be further oversupplied with an extra 500,000 barrels per day likely to come from Iran when sanctions are lifted and China’s slowdown expected to deepen.

A steep fall in demand in emerging markets reliant on revenues from oil and other commodities poses a serious challenge for Korean exporters.

According to government data, Korea’s exports to emerging markets decreased by 6.4 percent in the first 10 months of the year, compared with an average annual increase of 11.4 percent between 2010 and 2014. Shipments to Middle East countries, in particular, fell by 9 percent in the January-October period.

“In the 1980s, falling oil prices contributed to boosting Korea’s growth as the world economy expanded robustly,” said Shon, the energy analyst. “But we now see whatever positive effect of a fall in crude prices being blanketed by a slump in demand.”

Economists here also take note of the trend oil-producing countries have been pulling investment capital from Korean markets in what appears to be part of efforts to guard against the continuous ebb in their oil revenues. According to local financial authorities, the amount of Korean companies’ stocks held by Saudi Arabia, the United Arab Emirates and Norway decreased from 41.3 trillion won ($35.4 billion) in July last year to 31.2 trillion won in September.

“Coupled with U.S. rate hikes that are likely to start later this month, the withdrawal of oil money from Korea and other emerging countries could have a significant impact on global financial markets,” said Bae Min-geun, a researcher at LG Economic Research Institute.

Many experts note government policymakers and corporate executives should abandon vague expectations of a possible rebound in crude prices and work out specific and fundamental measures to prevent the negative impact of lower oil prices from further hurting the economy. They particularly raise the need to rebalance the country’s economic structure from export-reliant heavy industries to high-tech consumer goods manufacturing and service sectors.

As distant as the prospect might appear now, some analysts still caution against the possibility of the global oil market becoming volatile down the road when reduced spare production capability is matched with further conflicts and turbulences in crude-producing regions.

They note policymakers in oil-consuming countries like Korea should thus keep up efforts to tighten fuel efficiency regulations and strengthen support for developing alternatives, including renewable energy.

Korea also needs to take advantage of the glut in the global oil market to diversify sources of imports now centered on the Middle East, they say.

By Kim Kyung-ho (

khkim@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)