At a time of low economic growth, dividends are rising as a means to promote a smooth economic circulation among the public.

As Korean corporations generate more profit every year, foreign investors often mention that they receive too low returns, while ordinary Korean citizens criticize the superrich for receiving too high.

But this year, the Korean government implemented a policy to expand dividends, increasing corporations’ dividend overall.

Samsung Group

The new policy has done well for Samsung and other major Korean corporations. Samsung Group’s controlling family in particular received 200 billion won ($187 million) in dividends last year.

Group chief Lee Kun-hee received 175.8 billion won due to the increased “inclination for dividends,” a ratio of net profit versus total amount of dividends, which increased to 13 percent this year.

Lee received 100 billion from Samsung Electronics, 74.7 billion won from Samsung Life Insurance and 1.1 billion won from Samsung C&T.

Lee’s son and Samsung Electronics vice chairman Jay-yong received 21.1 billion won in dividends, 16.8 billion won of which was from Samsung Electronics.

Lee Kun-hee’s wife, Leeum Samsung Museum director Hong Ra-hee, received dividends of 21.6 billion won. His daughters, Hotel Shilla president Lee Boo-jin and Cheil Industries president Lee Seo-hyun, received about 1.5 billion won each.

LG GroupAt LG Group, 44 family member owners received a combined 83 billion won in 2014, about 1.9 billion won per person.

LG Group chairman Koo Bon-moo and his three brothers received 48.2 billion won from listed companies LG Corp. and LG International Corp., as well as from unlisted company LG CNS. Koo had the highest dividend income with 19.4 billion won.

Koo’s wife Kim Young-shik received 7.5 billion won from LG and LG International, and his son, LG Corp. general manager Koo Kwang-mo, received 10.4 billion won in dividends, 10.2 billion won of which were from LG Corp.

LG International paid out dividends last year despite recording losses, as LG International’s net loss was 13.7 billion won, but the total dividends were 11.6 billion won.

Hyundai Motor GroupHyundai Motor chairman Chung Mong-koo received 82.3 billion won in dividends, with 74 billion won from five listed Hyundai affiliates and 8.1 billion won from Hyundai Engineering, a nonlisted company.

Hyundai Motor’s inclination for dividend increased from 6.3 percent to 11 percent this year.

Chung’s son and Hyundai Motor vice chairman Chung Eui-sun received 51.4 billion won from three listed companies.

Notably, Chung Eui-sun received 20.4 billion won from Hyundai Engineering (interim dividend included), receiving more than his father as the largest shareholder. Hyundai Engineering had an inclination for dividend of 53 percent.

Lotte GroupThe Lotte family received 21.6 billion won in the 2014 business year. Lotte chairman Shin Dong-bin received 9.9 billion won in dividends from nine subsidiaries such as Lotte Shopping, Lotte Confectionery and Lotte Chilsung, a 2.8 billion won increase from the previous year.

Shin Dong-bin’s brother, former vice chairman of Lotte Holdings Japan Shin Dong-ju, received 9.2 billion won from eight Lotte subsidiaries.

Group founder Shin Kyuk-ho and his daughter and Lotte Shopping president Shin Young-ja received 1.3 billion won and 1 billion won, respectively.

Although Lotte shrunk in net profit in several subsidiaries, its total amount of dividends did not decrease. Lotte Shopping’s net profit in 2014 was 526.6 billion won, a 260 billion won decrease from the previous year, but total dividends this year were 59.1 billion (14.8 billion increase from previous year) and the inclination of dividend increased from 5 percent to 11 percent.

Lotte Confectionery’s net profit plummeted by 97 percent in 2014 (55.2 billion won to 1.7 billion won), but its dividends rose by 1.7 billion won, making its inclination of dividend 438 percent.

AmorePacificAlso noteworthy is AmorePacific chairman Suh Kyung-bae, who rose as the second-richest stockholder in South Korea in the past year.

Suh received 20.4 billion won in dividends from AmorePacific and its listed company, a 5 billion won increase from the previous year. AmorePacific’s net profit in 2014 was 379.1 billion won and the inclination of dividend was 12 percent for AmorePacific and 16 percent for the listed company, which has not changed much in the past three years.

Suh’s eldest daughter Suh Min-jeong received a dividend of 3.4 billion won, of which 900 million won was from Etude House and 1.7 billion from Innisfree, which are both nonlisted companies.

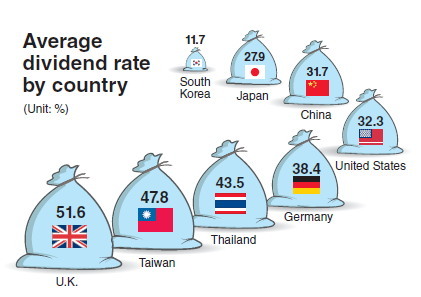

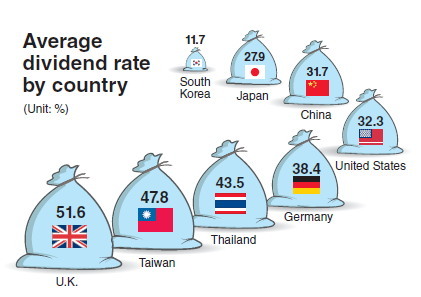

Korea’s dividend ratio compared to overseas

Even with the increased dividends Korean corporate heads received, foreign investors pointed out it is still lower than the global average. According to Morgan Stanley, South Korea’s inclination for dividends is only 11.7 percent, far less than that of the U.K. (51.6 percent), U.S. (32.3 percent) or China (31.7 percent).

In addition to government policy and foreign investors, however, Korean corporations also have to consider public sentiment, which consider the corporation heads’ dividends excessive, and maintain balance between vitalizing the economy and taking a reasonable dividend.

By The Korea Herald Superrich Team (

sangyj@heraldcorp.com)

Kwon Nam-keun, Hong Seung-wan, Sung Yeon-jin, Bae Ji-sook, Yoon Hyun-jong, Min Sang-seek, Kim Hyun-il, Sang Youn-joo