|

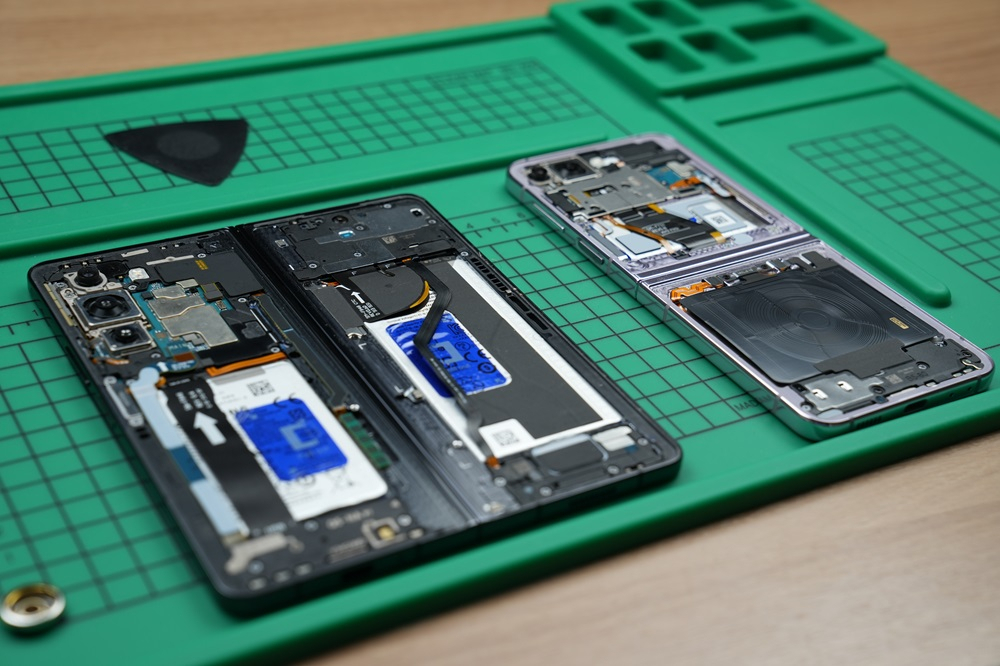

Samsung Galaxy Z5 Fold and Flip (Samsung Electronics) |

Samsung Electronics, a pioneer in foldable smartphones, is ramping up efforts to expand the still-nascent and high-priced segment, fueling speculation that the tech giant could come out with cheaper versions with mass-market appeal as soon as this year.

A recent news report said Samsung is expected to launch two models for the upcoming Galaxy Z Fold6 later this year, including a cheaper one without the pricey S-Pen stylus. Foldable displays are priced higher to support the scribble function on the screen, which includes the digitizer.

By ditching the stylus feature, the Seoul-based Electronics Times said, Samsung is seeking to reduce both production costs and product prices.

Samsung denied the speculation again, apparently sticking to its premium strategy.

Industry watchers, however, say that Samsung-made cheaper foldable phones are “not too far from reality,” considering the high price barrier to the budding market.

Since the 2020 debut of the first Galaxy Z series, annual shipments of foldable phones are estimated to have reached 16 million units as of 2023, according to market tracker Counterpoint Research.

Samsung, the unrivaled market leader, made up more than 70 percent of total foldable phone sales, while smaller rivals in the segment like Google and China’s Huawei and Oppo debuted their own versions into the market.

But foldable phones still largely remained a niche segment, taking up a tiny 1.3 percent of the global shipments of 1.2 billion smartphones.

“When it comes to the high-end OLED displays, there are not many options to reduce the costs,” said Yi Choong-hoon, CEO and top analyst of Seoul-based display market tracker UBI Research. “Samsung could lower the prices by using older-version displays or cheaper luminescent materials. But it seems more likely that they seek to lower other functions such as the camera and processor.”

|

Samsung Electronics' Galaxy Z5 Fold and Flip models (Samsung Electronics) |

But he agreed it would be a tricky decision for Samsung to launch a cheaper foldable phone after years of premium marketing, especially as the Chinese runners-up are still struggling in the arena of price competitiveness.

Huawei and Honor were the No. 2 and No. 3 foldable phone makers after Samsung, with 9 percent and 8 percent market shares, respectively. Their bestsellers, the Huawei Mate X3 and Honor Magic V2, are priced at $2,400 and $2,170, respectively, compared to the latest Samsung Galaxy Z Fold5 selling for under $2,000.

But sources say Chinese handset makers are pouring more resources into the burgeoning market, citing a surge in panel orders.

In the fourth quarter of last year, China’s BOE Technology outpaced Samsung Display in foldable OLED panel shipments for the first time.

“Samsung Display actually maintained its shipment volume. BOE seems to be extending supplies to Huawei and Honor that are increasingly selling more foldable phones on their home turf,” an industry official said on condition of anonymity.

Amid the escalating rivalry with the Chinese runners-up, some sources have predicted that Samsung could respond to the cheaper pricing by offering hefty discounts rather than launching cheaper foldable phones immediately.

The upcoming Galaxy Z6 Fold and Flip series are highly likely to feature Samsung's new artificial intelligence model Galaxy AI, following its first adoption for the latest flagship Galaxy S24.

Samsung regaining the No. 1 smartphone maker title largely hinges on its premium lineup. Its archrival Apple dethroned Samsung in terms of shipments last year for the first time in 13 years

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)