China’s economic expansion would be cut almost in half if Europe’s debt crisis worsens, a scenario that would warrant “significant” fiscal stimulus from the nation’s government, the International Monetary Fund said.

Based on the IMF’s “downside” forecast for the global economy, China’s growth could drop by as much as 4 percentage points from the fund’s current projection, which is for 8.2 percent this year, the organization said in a report released Monday by its China office in Beijing.

The outlook expands on the IMF’s warning last month that the world could plunge into another recession if Europe’s woes deepen. Premier Wen Jiabao reiterated last week his government will “fine-tune” policies to support growth amid the region’s debt crisis and the cooling domestic property market.

“China’s growth rate would drop abruptly if the euro area experiences a sharp recession,” the Washington-based IMF said. “However, a track record of fiscal discipline has given China ample room to respond to such an external shock.”

The government should cushion the impact of a deeper slowdown with measures including tax cuts that amount to about 3 percent of gross domestic product, it said.

|

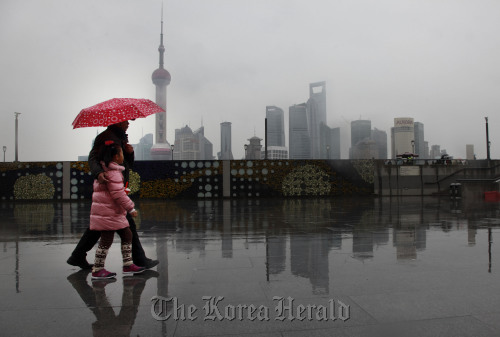

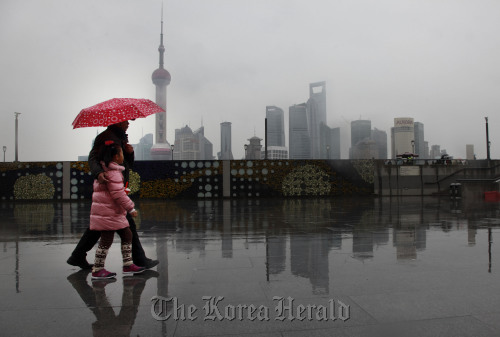

Pedestrians walk near the Lujiazui Financial District in the distance in Shanghai. (Bloomberg) |

China’s economy is unlikely to experience a “hard landing” and the nation has room to boost fiscal spending, Anoop Singh, director of the IMF’s Asia-Pacific department, said last week in Washington. China should strengthen domestic consumption, he said.

The organization last month cut its 2012 forecast for China’s growth from an earlier estimate of 9 percent. It estimates expansion of 8.8 percent next year.

Singapore’s Prime Minister Lee Hsien Loong said China’s economy may have a “rough landing, but they will get through it,” in an interview that aired Sunday on CNN.

China’s gross domestic product expanded 8.9 percent in the final three months of 2011 from a year earlier, the least in 10 quarters, and down from a 9.1 percent gain in the third quarter. Growth may slow to 7.5 percent this quarter, Nomura Holdings Inc. forecasts.

The IMF said in its report Monday that “monetary conditions should be fine-tuned to allow for some modest additional credit to the economy,” echoing Wen’s pledges last month. At the same time, “residual concerns about credit quality and bank balance sheets from the 2009-10 stimulus would mean that any monetary response to an unfolding European crisis should be limited,” the fund said.

Chinese officials have held off a cut in lenders’ reserve requirements that banks including Barclays Capital Asia Ltd. had forecast for January and have also so far refrained from lowering interest rates to support growth. Wen said last month that curbs on the property market will be maintained to bring prices down to a reasonable level.

Monday’s report omitted providing new comments on the value of China’s yuan beyond saying that “upward pressures on the currency have diminished recently” and the “pace of reserves accumulation should resume this year.”

China’s foreign-exchange reserves, the world’s largest at $3.18 trillion, fell for the first time in more than a decade in the fourth quarter of 2011.

The IMF, in its annual assessment of China’s economy published in July, pressed for gains in the yuan, saying the currency “remains substantially below the level consistent with medium-term fundamentals.”

In a more recent report prepared for a Jan. 19-20 meeting of Group of 20 officials, the IMF staff said that the currency had been allowed to appreciate “faster than in the past,” and that the pace of accumulation of foreign-exchange reserves had slowed since a G-20 meeting of leaders in November.

“The authorities need to continue to allow the exchange rate to appreciate closer to equilibrium and to move ahead with financial sector reform,” according to last month’s report.

(Bloomberg)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)