Korea’s financial firms are poised to expand their presence in the Middle East as part of efforts to diversify foreign direct investment sources.

Previously, the nation mainly resorted to funds from Europe and the United States.

Targeting royal societies in countries such as Qatar and the United Arab Emirates, the financial sector is seeking to establish high-level communication channels with royal families and sovereign wealth funds in the Middle East.

As the initial step, senior executives of major financial groups including Hana Financial are widening the scope of their business talks with Arab countries’ central bankers and financial regulators.

|

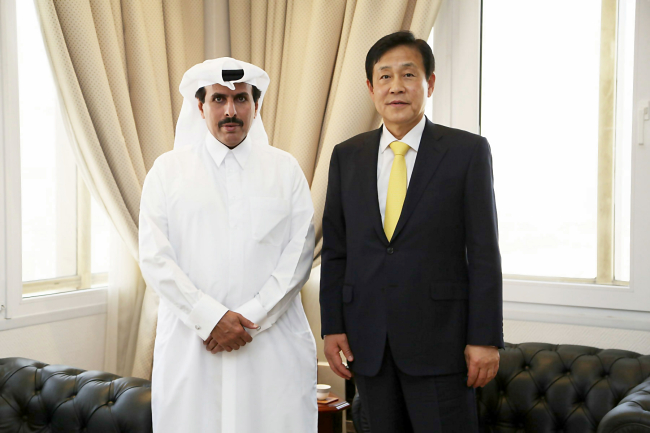

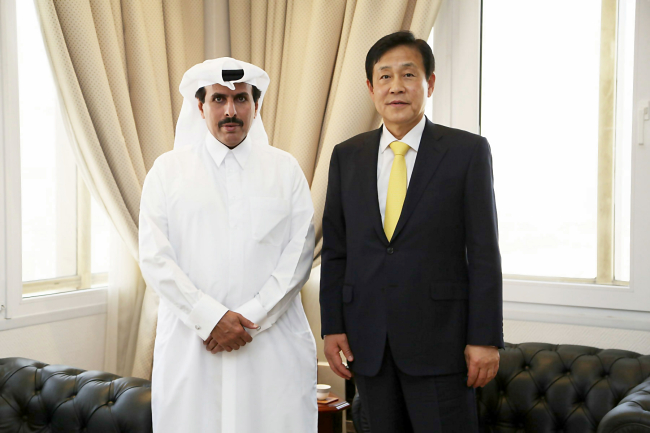

Korea’s Hana Financial Group chairman Kim Jung-tai (right) poses with Qatar Central Bank Gov. Abdullah Bin Saud Al-Thani after talks about market information exchanges and cooperation at the governor’s office in Doha in late January. (Hana Financial) |

Kim Jung-tai, chairman of Hana Financial Group, exchanged a variety of investment information with Abdullah Bin Saud Al-Thani, governor of Qatar Central Bank, earlier this year.

“Kim’s visit came amid the Korean administration’s plans to expand economic coordination with Qatar as this April marks the 40th anniversary of diplomatic ties between the two sides,” said a Hana spokesman.

He also said the group is targeting financial support to Korean construction firms, which plan to participate in upcoming biddings for facilities for the 2022 FIFA World Cup finals in Qatar.

Korea’s financial authorities are also actively promoting the move. The Financial Supervisory Service earlier dispatched a delegation to the Middle East, aimed at vitalizing mutual investment in banking businesses, stocks and bonds.

Among participants were Woori Bank, KB Kookmin Bank, Hana Bank, Korea Exchange Bank, Shinhan Bank, Daewoo Securities and Samsung Fire & Marine Insurance. Public agencies such as the Korea Exchange and the Korea Finance Corp. joined the delegation.

“Three of the world’s top 10 sovereign wealth funds are based in the Middle East,” an FSS official said.

Since last year, the state-run Export-Import Bank of Korea has continued to unveil its policy to increase its investment in Korean enterprises’ development and construction projects in overseas markets including the Middle East.

By Kim Yon-se (

kys@heraldcorp.com)