|

(FSS, FSC) |

South Korea’s financial authorities are considering regulating short selling of local stocks, similar to rules being implemented in Hong Kong, to rein in the market given the massive dumping by foreign investors in the wake of the COVID-19 outbreak.

However, they are yet to reach a consensus, according to officials Monday.

The Financial Supervisory Service has reviewed allowing investors to short sell only locally listed stocks with a certain market capitalization. The scheme would be similar to what has been introduced by the Stock Exchange of Hong Kong to specify designated securities eligible for short selling.

Short selling is a strategy when an investor borrows a stock, sells it, and then buys it back to return it to the lender, betting that the share price will drop.

The Hong Kong government allows stocks to be sold short only if their market cap exceeds HK$3 billion ($385 million) and their daily turnover surpasses 60 percent of the whole market cap. It is currently the only market that imposes such restrictions on short sales.

FSS Gov. Yoon Suk-heun has voiced concerns that the domestic market is an “uneven playing field” where foreign investors have benefited the most while individual investors have suffered from plummeting stock prices.

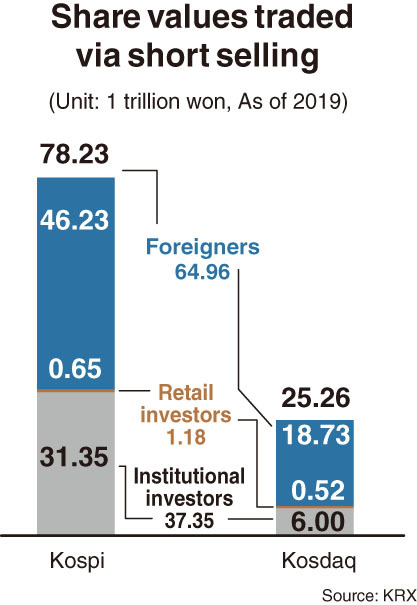

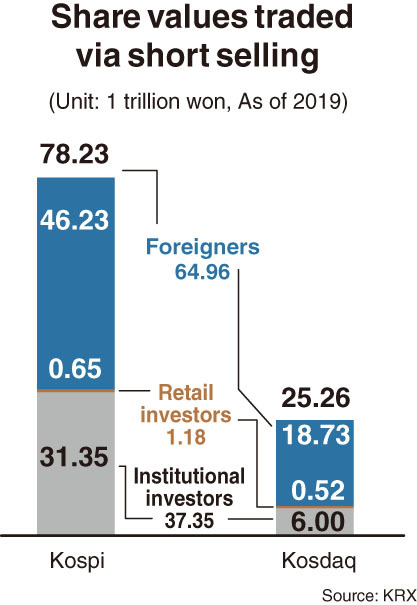

The trading value from short sales marked 103.5 trillion won ($86.4 billion) last year. Of this amount, foreign investors’ trading accounted for 65 trillion won, or 62.8 percent. While institutional and retail investors marked 37.3 trillion won and 1.1 trillion won, or 36.1 percent and 1.1 percent, respectively, according to data compiled by the Korea Exchange.

Amid the prolonged coronavirus outbreak, retail investors’ investment losses have increased rapidly, since their trading volume in small-cap stocks on the benchmark Kospi and tech-heavy Kosdaq accounts for over 90 percent.

Regarding the data, the FSS is positive about constraining short sales of larger-cap stocks, which may have a larger ripple effect, as in the stock market in Hong Kong.

“We’re currently reviewing short selling regulations, along with which stocks to be included, depending on their market cap. To finalize the regulations, we need to consult with the Financial Services Commission,” an official of the FSS said.

FSC Chairman Eun Sung-soo had previously been quoted as saying he is “positively considering” the restrictions. The financial regulator, however, is concerned about a potential fall in the local market’s liquidity and efficiency, if foreign investors offload funds.

“A short selling strategy can be good functionally to raise liquidity and stock prices in a sluggish market,” an FSC official said, maintaining a cautious tone. “We haven’t yet decided on adopting the regulations. Before we make a decision, we need to consider that the Korea stock market has more regulations than other countries. Further, we need to consider foreign investors and credit ratings.”

By Jie Ye-eun (

yeeun@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)