SEJONG -- South Korea’s policymakers are struggling to invigorate the sluggish economy, having suffered minus 0.37 percent on-quarter growth in the first quarter this year.

The nation posted 1.04 percent on-quarter economic growth in the second quarter, on the back of the base effect from the deep slump in the previous quarter.

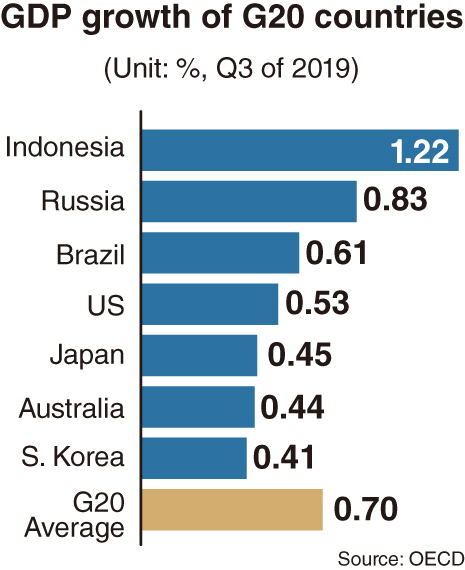

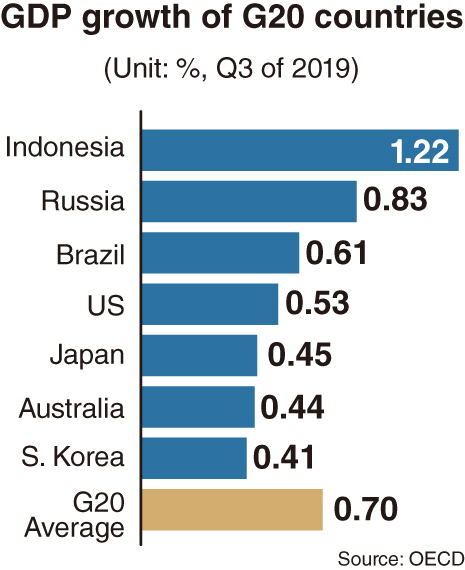

But its third-quarter growth stayed at 0.41 percent due to continuous lackluster export performance and slower-than-expected improvement in private consumption.

The figure fell behind the growth rate of the US (0.53 percent) and Japan (0.45 percent) for the corresponding quarter.

|

An employee at a convenience store in Seoul tidies goods on a display stand. Many small businesses, including convenience store branches, in Korea have been suffering financial burdens from a spike in labor costs over the past two years. (Yonhap) |

According to data from the Organization for Economic Cooperation and Development, Korea also lagged behind countries like Indonesia (1.22 percent), Russia (0.83 percent), Brazil (0.61 percent), Australia (0.44 percent) and Spain (0.43 percent). These countries are similar to Korea with respect to size of their economies.

Korea also fell short of the average 0.7 percent expansion among the Group of 20 countries, which comprise, among others, Canada, the UK, France, Italy, Russia, Turkey, South Africa, Argentina and Mexico.

In addition, the nation was outstripped by many of the 36 OECD members in third-quarter growth. Ireland’s economy expanded 1.68 percent, trailed by Poland (1.33 percent), Hungary (1.15 percent), Israel (1.01 percent) and Estonia (1 percent).

Among the other members whose figure stayed above that of Korea were Slovenia (0.77 percent), Chile (0.74 percent), Finland (0.73 percent), New Zealand (0.71 percent), Latvia (0.71 percent) and Greece (0.58 percent).

While Switzerland tied with Korea at 0.41 percent, the figures for Netherlands and Spain were higher at 0.44 percent and 0.43 percent, respectively.

The OECD also included some nonmembers -- China with 1.5 percent growth, India (1.06 percent), Bulgaria (0.75 percent), Colombia (0.57 percent) and Romania (0.55 percent).

|

(Graphic by Kim Sun-young/The Korea Herald) |

Korea is estimated to be ranked 28th in the growth rate among 45 major economies, compared by the OECD. Figures for some countries were based on provisional data.

The country’s traditionally export-driven economy has recorded a negative growth of 10.3 percent in outbound shipments during the Jan. 1-Dec. 20 period on-year.

The doldrums in exports is attributed to factors such as the tariff dispute between the US and China, trade war between Korea and Japan, and the economic slowdown in China. The three countries are the main trading partners of Korea.

Simultaneously, domestic demand has been sagging as a large number of self-employed have closed their businesses due to huge cost burdens; continuous drop in employment among the middle-aged; and lack of capacity to spend on mortgages held by ordinary households.

“The fourth quarter estimates are drawing wide attention whether Korea will record 2 percent on-year economic growth,” a financial-industry analyst said. “More significantly, the fourth-quarter growth would be a barometer to gauge whether the economy can rebound in 2020.”

Many critics have already pointed out that the Moon Jae-in administration has sought to raise economic growth with pump-priming measures that would involve taxpayers’ money.

A core concerns among some economists is that using public funds will possibly undermine the nation’s long-term potential growth and harm fiscal soundness by increasing national debt.

Aside from the pessimistic views over policies, some think tanks are citing negative external factors and demographic problems.

LG Economic Research Institute said that “local manufacturers’ lackluster situation will continue next year due to the turbulent international trade situation, which could dent the semiconductor industry.”

Additionally, it mentioned the decrease in working-age population, saying that the speed of decline will be faster next year, which would have an unfavorable effect on private consumption.

By Kim Yon-se (

kys@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)