SEJONG -- As the 2010s is due to expire in two weeks, South Korea continues to face heightened economic uncertainties.

The year 2000 was a new starting point for the fourth-largest economy in Asia. After overcoming the 1997-98 financial crisis, Korea posted 8.9 percent economic growth in the last year of the 20th century.

The nation’s gross domestic product growth was robust in the early 2000s. Following a 7.7 percent rise in 2002, buoyed by the Korea-Japan FIFA World Cup, its economy was resilient to the credit card fiasco -- which yielded credit defaulters en masse -- to attain a level of growth above 3 percent (3.1 percent) in 2003.

From 2004 to 2007, the economic growth ranged between 4.3 percent and 5.8 percent with per capita GDP exceeding $20,000 for the first time in 2006.

|

An employee at a commercial bank branch in Seoul looks at a document submitted by a loan-product applicant. (Yonhap) |

But Korea has seen growth slow over the past decade. After posting 3.7 percent in 2011, the figure ranged between 2.4-3.2 percent from 2012 to 2018.

Further, there is a high possibility that the GDP growth will stay under the psychologically significant 2 percent mark in 2019, the first time in 10 years since 2009 (a 0.8 percentage point growth), when the nation was hit by the US subprime mortgage crisis.

On an annual basis, the economy expanded only 1.7 percent in the first quarter of 2019, 2 percent in the second quarter and 2 percent in the third quarter.

Apart from falling profitability and lackluster exports in the business sector, indices for the household sector could reveal the fundamental reasons behind the slack GDP growth, according to analysts.

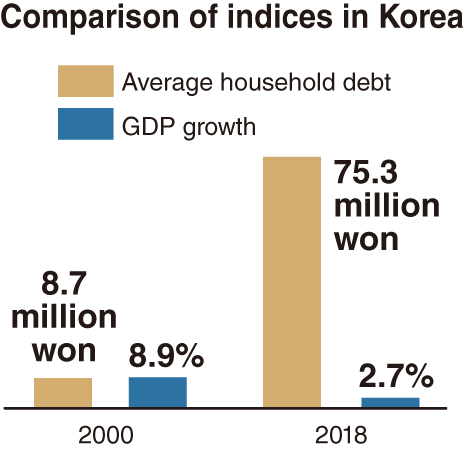

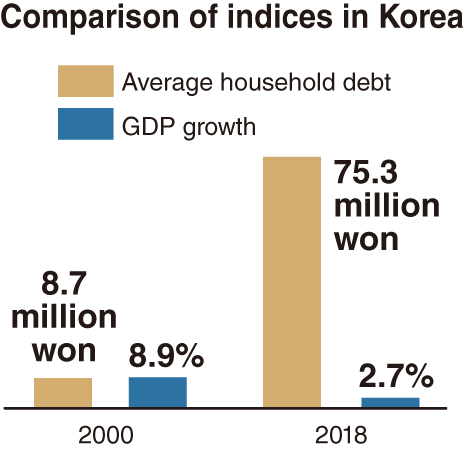

While the average debt per Korean household was 8.77 million won in 2000, the figure has since soared 758 percent to 75.31 million won ($65,000) as of 2018. Outstanding household debt, on a collective basis, is hovering at nearly 1.6 quadrillion won in 2019, compared to about 400 trillion won in 2000, which is a 300 percent increase.

In contrast, the average household income -- for households with two members or more -- increased only 100 percent over the corresponding 19 years from 2.4 million won to 4.8 million won.

|

(Graphic by Kim Sun-young/The Korea Herald) |

Ultimately, Korea was posting the eighth-highest among 32 major countries in terms of average debt-to-disposable income, 186 percent, for the household sector as of 2018. The nation also saw the ratio of household debt to GDP reach 97.7 percent last year, the seventh-highest among 43 major economies.

The outlook for the coming decades is also gloomy: the ratio of working-age population, aged 15-64, has faced a stead downhill after peaking at 73.2 percent in April 2016. It fell by more than 1 percentage point to stand at 72.1 percent in November 2019, which is the lowest in more than 11 years.

The income or asset polarization has widened between the haves and have-nots over the past two decades. Some market insiders predict the nation’s income bracket groups may resemble the shape of sandglass in the future, mentioning that much of the middle-income bracket has collapsed.

Though the Roh Moo-hyun administration (2003-2008) pushed for balanced regional growth, the gap of property prices between Seoul and other major cities or provinces has greatly widened, particularly over the past three years.

Many self-employed people, owning micro businesses, are likening the current situation to that of the 1997 financial crisis, and some argues the conditions are worse than the past crisis.

“Except for the wealthy bracket, most ordinary households have insufficient capacity to spend due to their heavy debt and unstable job status,” said a financial research analyst in Yeouido, Seoul.

Pointing out that the country is standing at crucial crossroads, he said it is important to lift a variety of regulations for the business sector and real estate sector to attain a gradual, steady recovery in the economy.

Meanwhile, policymakers have continued to say that the sagging economy could rebound in 2020 after touching the bottom in 2019.

By Kim Yon-se (

kys@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)