SEJONG -- Stock prices on the nation’s first-tier bourse have been on a bearish run amid the trade war between South and Japan that began late last month.

The Kospi has stayed under 2,000 points for the 18th consecutive trading session since August 2, when it fell to 1,998.13 from 2,017.34 a session earlier.

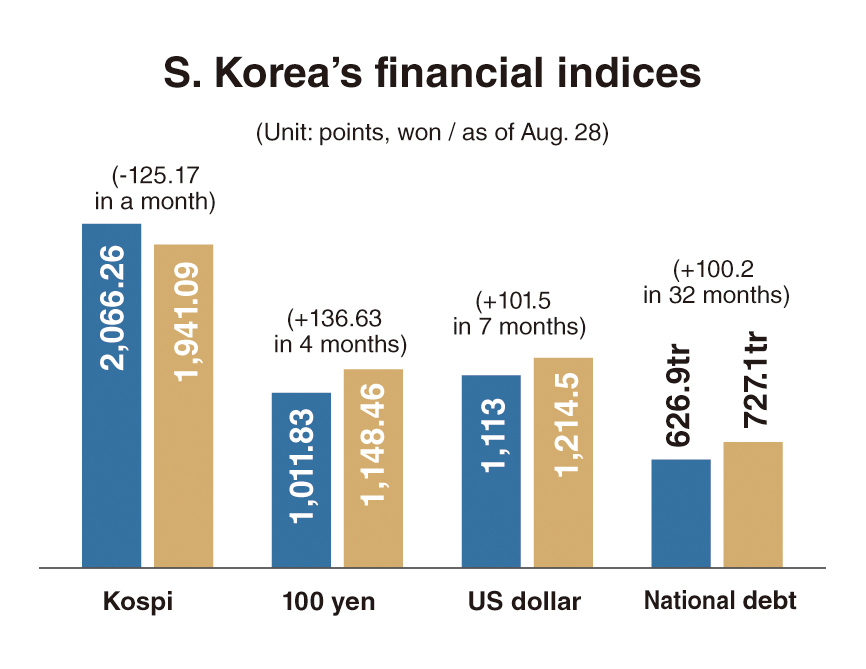

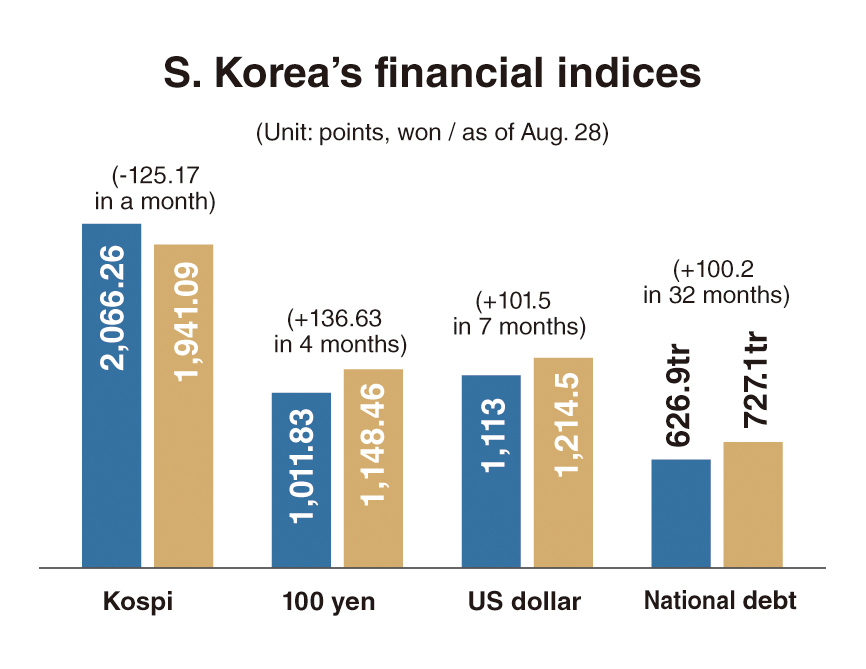

The benchmark index closed at 1,941.09 on Aug. 28, down 8.8 percent or 189.53 points from two months earlier in June 28, when it reached 2,130.62. It also marked more than a 100 point drop in a month from 2,066.26 on July 26.

Compared to 2,303.12 on Aug. 28, 2018, the Kospi has lost 362.03 points or 15.7 percent over the past year.

|

A signboard offered by the nation’s main bourse operator shows that the benchmark Kospi stayed under 2,000 during a trading session earlier this month. (Korea Exchange) |

According to the Korea Exchange, foreign investors net-sold local stocks worth 2.3 trillion won ($1.8 billion) over the past month.

“Foreign investors took a net buyer position throughout July in overall,” said an equity analyst in Seoul. “But they shifted position to dump shares since the end of last month.”

He said that “it is estimated that their selling spree could be attributable to the deadlock in Korea’s diplomatic relations with Japan, though there were other negative external factors and domestically sluggish economic indices.”

Foreign investors net-sold local stocks on the main bourse for the 13th consecutive trading session from July 31 to Aug. 19. And they net-purchased during only two sessions this month until Aug. 28.

A research report from Korea Investment & Securities picked both the Seoul-Tokyo trade dispute and tariff dispute between China and the US for downside risks.

Kyobo Securities raised the possibility that the Kospi may dip below the 1,900 mark in the coming weeks, predicting that the index will range between 1,850 and 1,980 points in September. Daishin Securities suggested 1,870-2,000 for its next month outlook.

Some critics pick the interest rate cut by the Bank of Korea to 1.5 percent per annum on July 18 for a straight outflow of foreign capital.

After the monetary easing last month, the US dollar climbed 36 won or 3 percent from 1,178.5 won on July 18 to 1,214.5 won on Aug. 28.

Compared to two months earlier on June 28, when the exchange rate stayed at 1,155.5 won, the greenback rose by 59 won or 5.1 percent. Given that the dollar traded at 1,113 won on Jan. 31, it jumped more than 100 won in only seven months.

|

(Graphic by Kim Sun-young/The Korea Herald) |

The Korean won also lost ground versus the Japanese currency, which traded over 1,100 won per 100 yen for the 16th consecutive trading session since Aug. 2.

While it stood at 991.32 won per 100 yen on Dec. 13, 2018, it closed at 1,148.46 won on Aug. 28, posting a 15.8 percent rise in only eight months. The 100 yen stayed at 1,011.83 won about four months ago on April 17.

On the basis of comparison with the end of 2018, the Kospi dropped by 99.95 points; the dollar rose by 98.5 won; and the Japanese currency surged by 132.76 won per 100 yen so far this year.

An economist in Seoul pointed out that the capital market represents scores of the Moon Jae-in administration’s performance in economic affairs. He forecast that more lingering tension with Japan would further undermine investor sentiment.

Domestically, President Moon has been continually advised by the private sector to drop the taxpayer money-led stimulus policies.

According to the National Assembly Budget Office, the national debt was estimated to reach 727.1 trillion won, an all-time high, as of Aug. 28. This marked an increase of 15.9 percent or 100.2 trillion won in less than three years -- it stood at 626.9 trillion won at the end of 2016.

And per capita national debt also has reached a record 14.02 million won.

The free flow of state funds may benefit some economic activities, especially in the public sector. But the continual injections of taxpayer money could damage fiscal soundness and negatively affect sovereign credit ratings.

By Kim Yon-se (

kys@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)