SEJONG -- Prices of the US dollar and gasoline directly affect a large proportion of South Korean businesses and households in terms of manufacturing costs and purchasing power.

While monetary authorities sometimes have intervened in the foreign exchange market and hamper the cheap dollar in an attempt to promote exports, the greenback’s current strong position versus the Korean won suggests the local economy has been sagging.

Simultaneously, a hike in international prices of crude oil, which is traded in dollars, has posed an aggravated burden on the economy whenever the won lost ground to the greenback.

Market indices were quite unfavorable to the Korean economy during the second quarter of the year, amid the bright outlook on the US economy, compared to the lackluster conditions in Korea, and a spike in crude prices from a variety of uncertainty over global oil supply.

|

Headquarters of the Korea Exchange in Munhyeon-dong, Busan (Yonhap) |

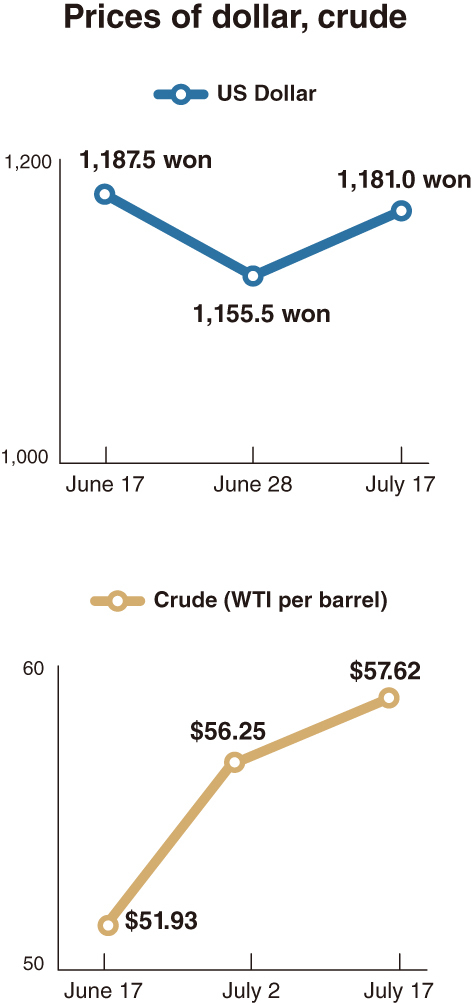

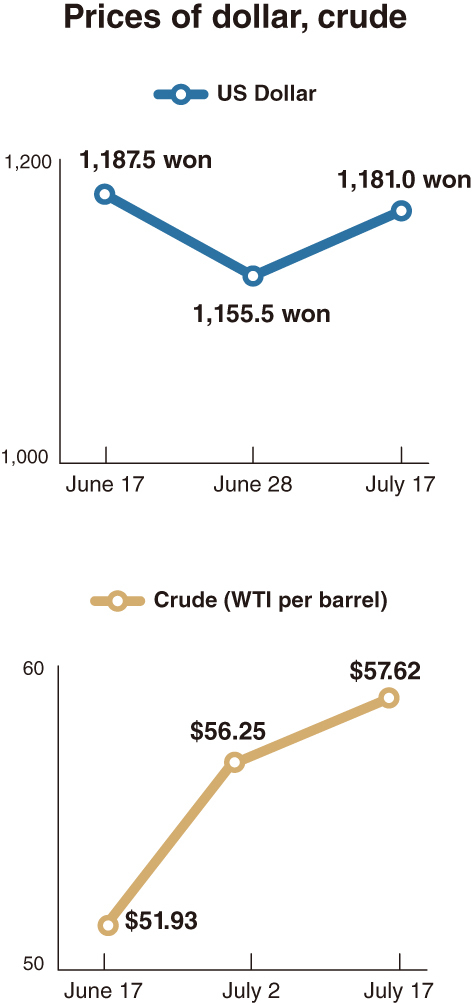

It seemed that the indices went to a certain extent of stabilization starting from June. Unluckily, however, the dollar and crude prices bounced back from the end of June or early July.

The dollar, which traded at 1,155.5 won on June 28, climbed by 2.2 percent in less than a month to close at 1,181.3 won on July 17, as a V-shape bounce-back since 1,187.5 won on June 17.

Compared to 1,116 won at the end of 2018, the dollar has risen by 65.3 won (5.8 percent) this year.

Amid the situation, the rating-setting meeting of the US Federal Open Market Committee, slated for July 30-31, is drawing close attention among local market participants.

“The US decision and following remarks will determine midterm direction of the exchange rates. Some predict the dollar could surpass 1,200 won later this year,” said a currency-futures trading analyst in Seoul.

Whenever the dollar has hovered over 1,200 won since the 1990s, it has led to a variety of problems in terms of financial soundness for the consumer, corporate and state sectors.

The Korean won has also lost ground to major key currencies such as the euro and Japanese yen.

The euro rose by 46.41 won (3.6 percent) in three months -- from 1,278.16 won on April 19 to 1,324.57 on July 17.

The Japanese currency, which traded under 1,000 won per 100 yen in the middle of December 2018, climbed by more than 90 won (9.1 percent) in seven months to reach 1,090.84 won on July 17, 2019.

Compared to the early part of President Moon Jae-in’s term, the Japanese currency has shot up by 16.4 percent from 936.38 won per 100 yen, posted on Jan. 12, 2018.

The nation’s gasoline prices had stopped their recent losing streak as of July 14. After falling for the 37 consecutive trading days, those rebounded for the fourth consecutive day to trade at 1,490.47 per liter on July 17.

Gasoline prices recorded growth of 12.3 percent (166.23 won) in less than six months from 1,324.24 won per liter on Feb. 15.

Though there were reported progress in resolving conflicts between Iran and the US, uncertainty over crude prices is still lingering on, which involves some petroleum producers’ output reduction efforts and frequent geopolitical tensions, analysts say.

|

(Graphic by Han Chang-duck/The Korea Herald) |

Western Texas Intermediate rose by 12.6 percent in about a month from $51.14 a barrel on June 12 to $57.62 on July 17. Dubai and Brent crudes also posted a similar prices growth recently.

Compared to $42.53 on Dec. 24, 2018, WTI prices surged by 35.5 percent in only seven months.

On the capital market, the Kospi has dropped to 2,072.92, losing 139.83 points (6.3 percent) in less than three months from 2,212.75 on May 2.

After peaking at 2,598.19 on Jan. 29, 2018, the benchmark stock prices index remained in a relatively bearish stance over the past 1 1/2 years.

Many analysts predict that it would be difficult for the nation to see apparent improvement in indices in the coming weeks.

Among major hurdles they picked are the low interest rates, trade disputes with Japan, global protectionism and little breakthrough in the Moon government’s economic policies.

By Kim Yon-se (

kys@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)

![[Graphic News] International marriages on rise in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050091_0.gif)