2Q16 operating profit to meet consensus at W591bn

MC division to narrow losses based on efficient operations ¨

Fundamentals to improve on ramp-up of EV parts business ¨

Retain BUY for a target price of W77,000

LG Electronics is projected to have posted 2Q16 operating profit of W591bn (+17% QoQ, +142.3% YoY) on sales of W14.42tr (+7.9% QoQ, +3.5% YoY), meeting the consensus (W597bn).

The figure is expected to have missed our previous projection (W626bn) with the G5 recording sluggish sales and LG Innotek turning negative. However, OLED TVs and premium home appliances are humming along.

Operating profit is expected to drop 33.7% QoQ to W392bn in 3Q given low seasonal demand for air conditioners and high LCD TV panel prices. Full-year operating profit should hit a new high since 2009 at W1.9tr (+59.6% YoY).

MC division to narrow losses based on efficient operations

The MC (smartphone) division will gradually narrow operating losses caused by poor G5 sales by increasing efficiency of operations, such as employee relocation and platform integration. Huawei smartphone sales in the U.S. have declined on the U.S. government’s decision to place trade regulations on Chinese telecom equipment imports. LG smartphone sales are projected to grow in the U.S., the biggest market for the company, through strong positioning.

Fundamentals to improve on ramp-up of EV parts business

LG Electronics is expected to supply 11 core parts (motors, inverters, battery packs, etc.) for GM’s Chevrolet Bolt from 3Q. Its competitiveness in B2B is rising with the ramp-up of EV parts business.

Retain BUY for a target price of W77,000

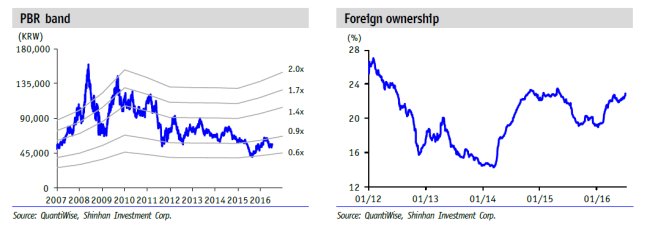

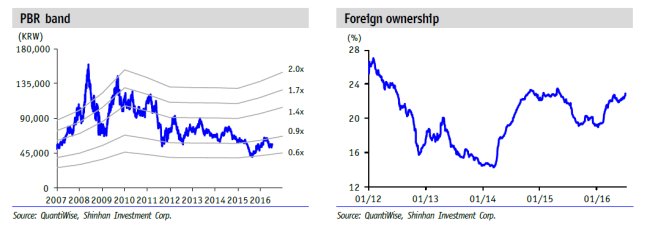

LG Electronics’ shares price has been weak as it became the target of short selling by foreign investors due to weak sales of the G5. However, losses at the MC division will likely decline. The current share price, which reflects the MC division at zero value, is believed to be at the bottom. The company is attractive in the long term given structural changes taking place. Shares are expected to show short-term gains on short covering.

Source: Shinhan Investment