SEJONG -- Three major global rating firms have been relatively pessimistic on the outlook for South Korea’s economic growth this year, compared to projections from the Finance Ministry and the Bank of Korea.

The rating firms -- Fitch Ratings, Standard & Poor’s and Moody’s Investors Service -- have estimated that the growth of gross domestic product this year will stay under 2.6 percent, the figure projected by the central bank. The Finance Ministry has forecast that the economy will expand at 2.6-2.7 percent.

Fitch, in its January report, cited “weak” private consumption and export growth for its outlook, predicting that growth would “further decelerate to 2.5 percent in 2019 and 2020,” compared to figures for 2018 and 2017.

|

(Graphic by Heo Tae-seong/The Korea Herald) |

The credit rating firm, whose dual headquarters are located in London and New York, predicted that government measures to stimulate economic activity including through income-led demand growth and public investments could “only partly offset” the lackluster consumption and outbound shipments.

Fitch also said that “two substantial minimum wage hikes last year likely contributed to a slight pickup in the unemployment rate.”

S&P, which had earlier forecast a 2.5 percent growth for the Korean economy this year, recently commented on the possible slowdown in performance of Korean enterprises.

In its report earlier this month, the US-based rating firm said that the credit ratings of Korean firms will be under pressure to be downgraded over the next 12 months.

It cited the global slowdown in demand faced by major industries as the main unfavorable factor. It hinted that Samsung Electronics and Hyundai Motor could face difficulties, mentioning Korea’s growth engines such as semiconductors, smartphones and vehicles.

S&P also cited “trade disputes and protectionism” as a negative external factor for local firms.

After three years of improvement in credit ratings from 2015 to 2017, Korean companies seem to have entered a cycle of gradual decline from the second half of last year, according to the firm.

“Korea’s major companies will be in a greater danger of credit rating downgrades over the next year,” it cautioned.

Slack performance of conglomerates would certainly have the effect of pulling down the export-driven economy’s growth rate. So far this year (from Jan. 1 to March 20), Korea saw its exports fall by 7.8 percent on-year, according to data from the Korea Customs Service.

As for domestic demand, recent indices are aggravating worries over weak consumption.

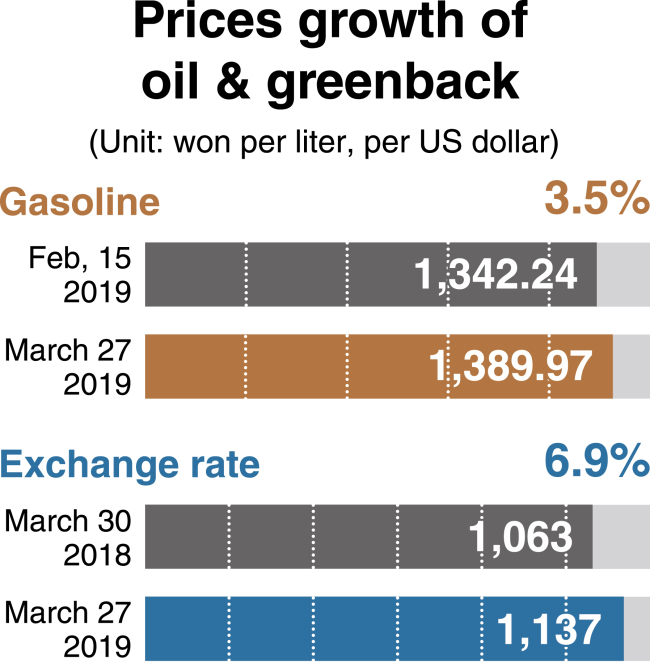

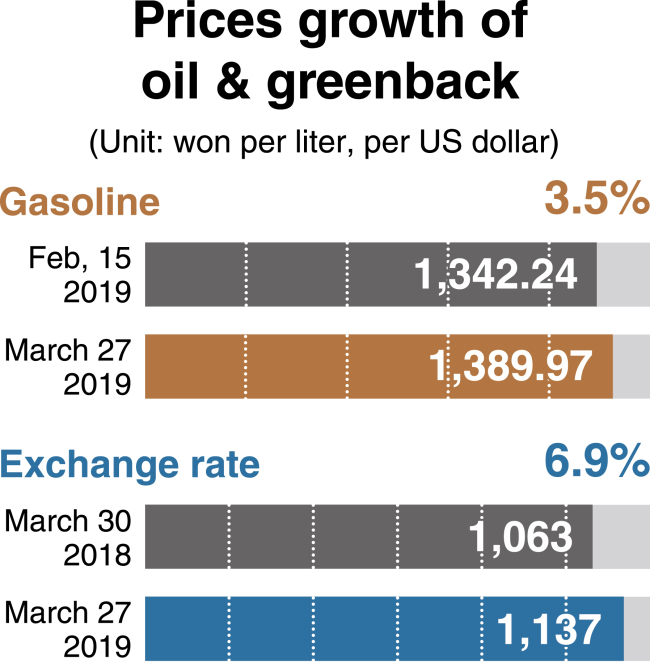

The US greenback rose by 6.96 percent over the past year to trade at 1,137 won as of Wednesday, compared to 1,063.0 won during the last trading session of March 2018.

Though the strong dollar could benefit the price competitiveness of Korean products overseas, it could weaken the purchasing power of domestic citizens and further undermine the lackluster consumer sentiment. In addition, processing-trade firms and import-oriented retailers would possibly suffer from high raw material prices.

As history has shown, since the 1990’s whenever the exchange rate hovered over 1,200 won per dollar it has led to a variety of problems in terms of financial soundness for the consumer, corporate and state sectors.

|

Speakers at a forum hosted by Fitch Ratings debate on South Korea’s sovereign rating at a hotel in Hong Kong, Sept. 11, 2018. (Fitch Ratings) |

Local consumption has been restricted by the record collective household debt, whose ratio to GDP peaked at 96.6 percent in the third quarter of 2018. The ratio posted a growth by 0.9 percentage point from the previous quarter, which is the second-highest among 43 major countries, according to the Bank of International Settlements.

Further, the nation saw gasoline prices rise by 3.55 percent in less than two months from 1,342.24 won per liter on Feb. 15 to 1,389.97 won on Wednesday. Dubai crude prices have surged by 24.2 percent so far this year -- from $53.89 per barrel on Jan. 2 to trade at $66.97 on Tuesday.

“The recent bounce-back in crude prices are posing a threat to the household economy and increasing the cost burden for manufacturers,” said a brokerage research analyst in Yeouido, Seoul.

New York-headquartered Moody’s said that “weaker demand for intermediate products from China, particularly semiconductors, had an adverse impact on exports as well as on the investment outlook.” The rating firm has revised down its outlook on Korea’s 2019 GDP growth to 2.1 percent, from its earlier estimate of 2.3 percent.

The three rating firms are set to begin their yearly assessment of Korea’s sovereign rating in the coming weeks.

By Kim Yon-se (

kys@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)