|

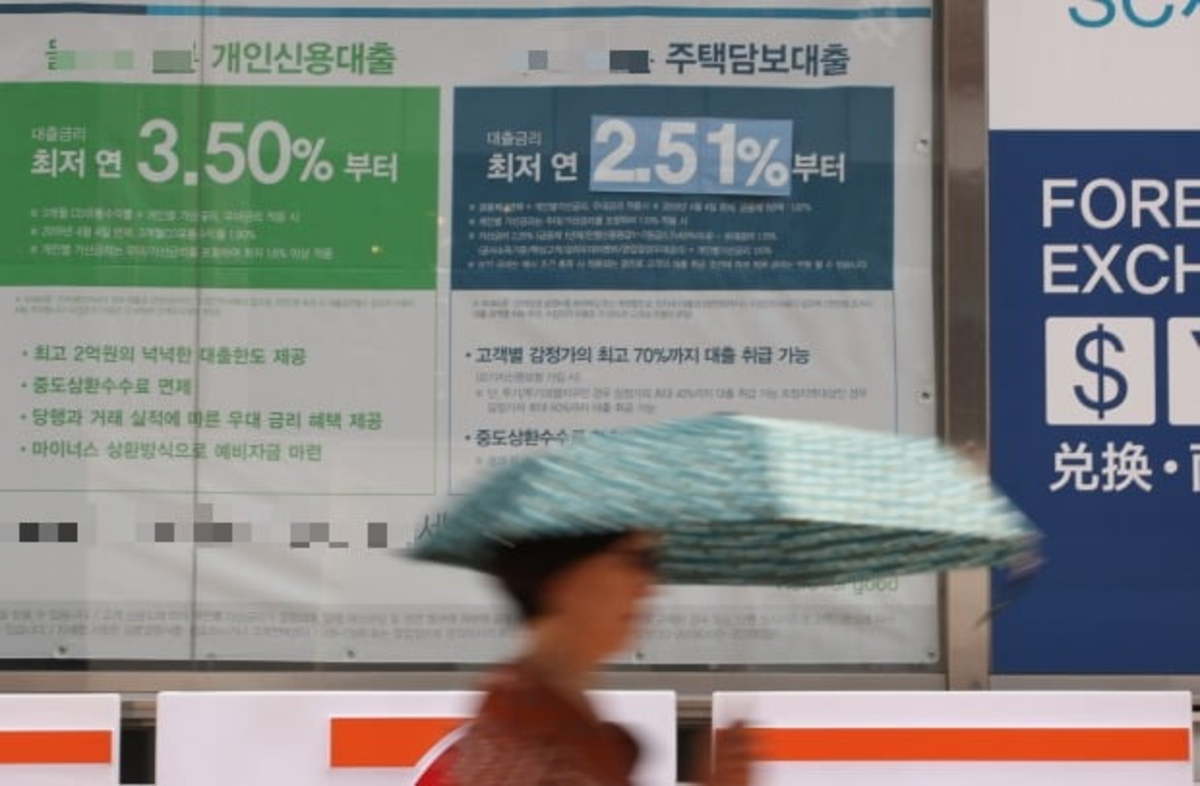

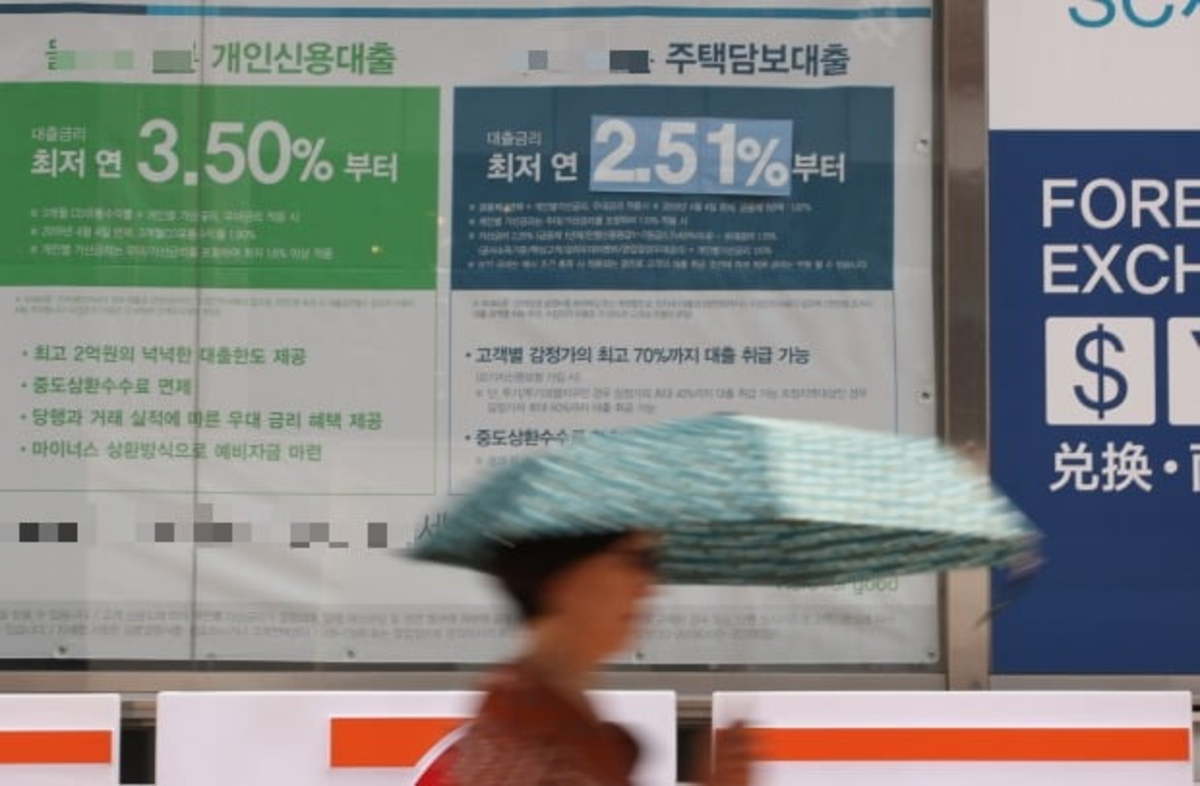

This undated file photo shows a poster at a bank in Seoul advertising personal and home-backed loans. (Yonhap) |

A top financial regulator called Thursday for banks to minimize "unnecessary" household loans as policymakers warn of growing financial imbalances amid a surge in home prices.

Eun Sung-soo, chairman of the Financial Services Commission (FSC), made the remarks at a meeting with chief executives of 13 banks earlier in the day.

Eun's remarks also came as the Bank of Korea has hinted that it could conduct its first post-pandemic rate hike later this year as the nation's economic recovery is faster than expected.

"A tighter management of household debt is needed in the second half," Eun told the meeting, according to the FSC.

Eun asked banks to minimize "unnecessary and non-urgent household loans," the FSC said in a statement.

South Korea's household credit grew at a slower pace in the first quarter, as banks tightened rules on loans.

Household credit reached a record high of 1,765 trillion won ($1.56 trillion) as of March, up 37.6 trillion won from three months earlier.

The first-quarter tally compared with a 45.5 trillion-won on-quarter rise in the fourth quarter of last year.

Household debt has been one of the downside risks facing the economy, with such debt already reaching nearly 100 percent of the nation's gross domestic product. (Yonhap)