Heightened uncertainty will continue, as the conditions contributing to the global business difficulties are unlikely to subside soon. Most of the key global economies are facing prolonged sluggish or contracting growth prospects along with fiscal debt and political gridlock over structural reforms needed for sustained momentum.

Korea’s major companies must prepare for greater pressure and devise preemptive measures. In particular, Japan’s currency depreciation has removed the favorable foreign exchange rate factor that helped Korean exporters in recent years.

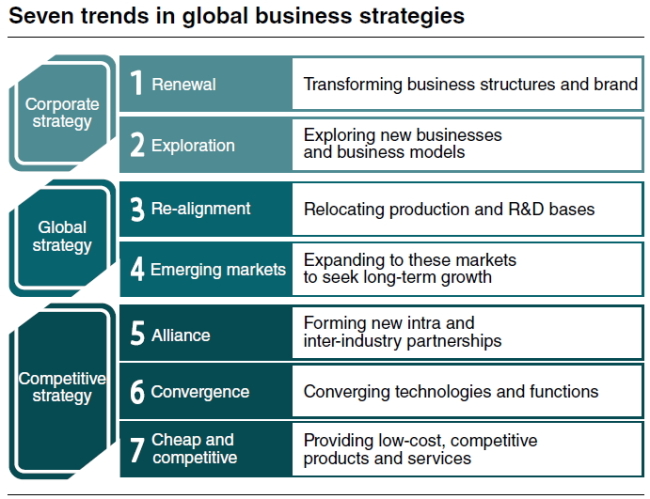

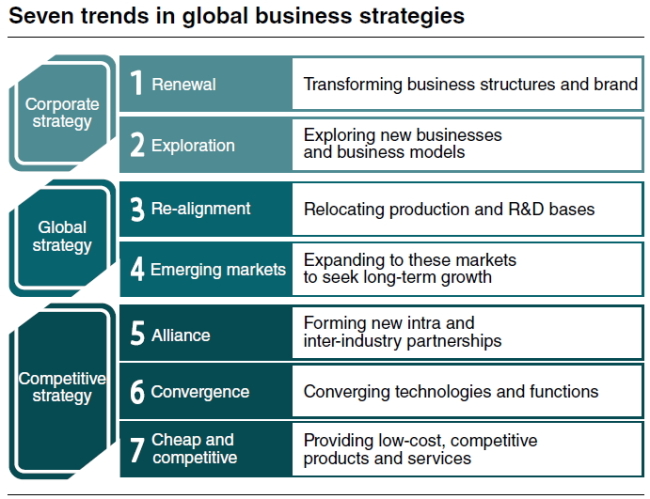

Samsung Economic Research Institute examined the strategies that leading global companies are employing to cope with the challenges and identified seven trends by focusing on global companies’ corporate strategy, globalization and competitive strategy.

Transforming business structures and brands

Many leading companies are rationalizing their business portfolios and improving financial and organizational structures. At some companies, aggressive downsizing is underway to sell off sluggish business units in order to raise profitability and cash. Japanese electronics giant Sony agreed to sell its battery business, Panasonic its digital camera and mobile phone divisions and Sharp its overseas TV plants.

The sale of noncore businesses to focus on more promising businesses is also being promoted. Microsoft decided to sell Mediaroom, its IPTV platform, to Ericsson to dedicate its TV resources to Xbox.

Exploring new businesses and models

Organic growth is limited among companies that depend on market expansion. To this end, leading global companies are seeking inter-industry opportunities to boost existing business and enter new ventures. In April this year, General Electric purchased oil pump maker Lufkin for $3.3 billion, increasing its presence in the energy sector. At Sony and Panasonic, health care has become a new focal area in an attempt to both reenergize and explore.

Some companies are transplanting core capabilities to other fields to expand business scope. IKEA will build some 150 budget hotels in Europe over the next 10 years by introducing the “modular” technique it uses to build furniture. Room parts will be pre-constructed, shipped and assembled on site. It will also gain hotel management experience, which it lacks, in its joint venture with Marriot.

Relocating production and R&D

Moving production bases is an increasingly common global strategy. Rising wages and taxes in global production bases such as China and India are prompting manufacturers to relocate.

In some cases, job-creation measures taken by advanced countries such as corporate tax cuts are prompting manufacturers to repatriate their assembly operations.

For example, Apple plans to invest $100 million to set up a production line in the U.S., and Google will produce its new wearable computer, Google Glass, in the U.S.

Mexico and South America are gaining more attention as alternatives. Honda, which is building an automobile plant in Mexico for operation in 2014, said it will invest an additional $470 million to establish a transmission plant there. Lenovo took over Brazilian PC maker CCE at $150 million in January this year to use its production base for North America and to secure a foothold in Brazil.

Emerging markets

Leading global companies are expanding into emerging markets, where large populations and rising incomes promise long-term growth. To this end, they are reducing their presence in Europe, where growth vitality has weakened. Aiming to reach the No. 1 global ranking in sales by 2018, German auto major Volkswagen is targeting emerging markets to realize that goal. Revamping organization and management practices are being accompanied.

Early this year, Toyota consolidated its business into four units, inside which a division for China and Latin America was created. The African market in particular, which enjoys an average 6 percent GDP growth rate and increasing democracy, is receiving considerable attention as the next frontier.

Forming partnerships

Businesses are increasingly forming alliances, creating a new level of competition. Pairings of companies in different categories, such as fusing information technology and common products, are rolling out new services.

One key battleground is in wearable devices. Nike and Apple collaborated to release a running application, Nike+, and Google and Adidas responded with Talking Shoe, an interactive running shoe designed to motivate its owner.

There is also active strategic cooperation between businesses to address insufficient internal capabilities through outside skills. Sony and Olympus established a joint medical venture to develop a new high-quality surgical endoscope by aligning the former’s digital imaging and the latter’s endoscope technologies. Apple and Yahoo began discussing a mobile partnership to respond to Google and Android.

Converging technologies and functions

Efforts are also being made to merge various technologies and functions to create new value. Both IT and manufacturing companies are seeking to link big data analysis with existing businesses to improve efficiency and create new markets. GE will make massive investments in software and analytics with the aim to win in the “industrial Internet.” IBM is focusing on its “smarter planet” initiative, which emphasizes data analysis and melds information technologies such as machine-to-machine technology with manufacturing and medical services. Competition between these two companies is likely to intensify.

Cheap and competitive

The low-priced goods market is expanding as consumers increasingly seek value. One of the 10 trends in 2013 surveyed by Harvard Entrepreneurships was “frugal customers.” Companies are trying to respond to customers who want to save money, while retaining differentiated products and services. HP recently released its plan to unveil a $169 tablet PC and Intel a $200 level laptop.

Emerging market companies are also launching low-priced products to bolster market share. Taiwan’s Acer unveiled plans to sell a $99 tablet PC, and Lenovo introduced a low-end PC at the Mobile World Congress 2013 held in Barcelona, Spain, in February.

Implications

The strategies being adopted by leading global companies to cope with prolonged global low growth and imbalance suggest that competition is experiencing rapid structural changes. This juncture also is an opportunity for trailing companies such as those that leaped when consumer electronics shifted from analog to digital. Lower-tier companies who adjusted emerged as new leaders.

However, strategic shifts do not necessarily require a change in identity and core characteristics. Nike, named the most innovative company by Fast Company, has never lost its core branding as a sports shoe maker as it advanced into clothing and golf accessories and new products in cooperation with IT firms.

It is important to escape from the “average trap,” which most companies are in, and provide solutions that specifically answer customer needs. Differentiated products and services will help avoid the price competition trap and will boost growth.

Similarly, searching beyond the obvious is needed to fully exploit the changing landscape. Global companies are channeling resources and capabilities in selected business or region.

“Taking big bets on carefully chosen markets, categories or technologies offers the best chance of securing a sustainable competitive advantage,” according to professional services provider Ernst & Young.

The article was contributed by Samsung Economic Research Institute. The opinions reflected in the article are its own. ― Ed.