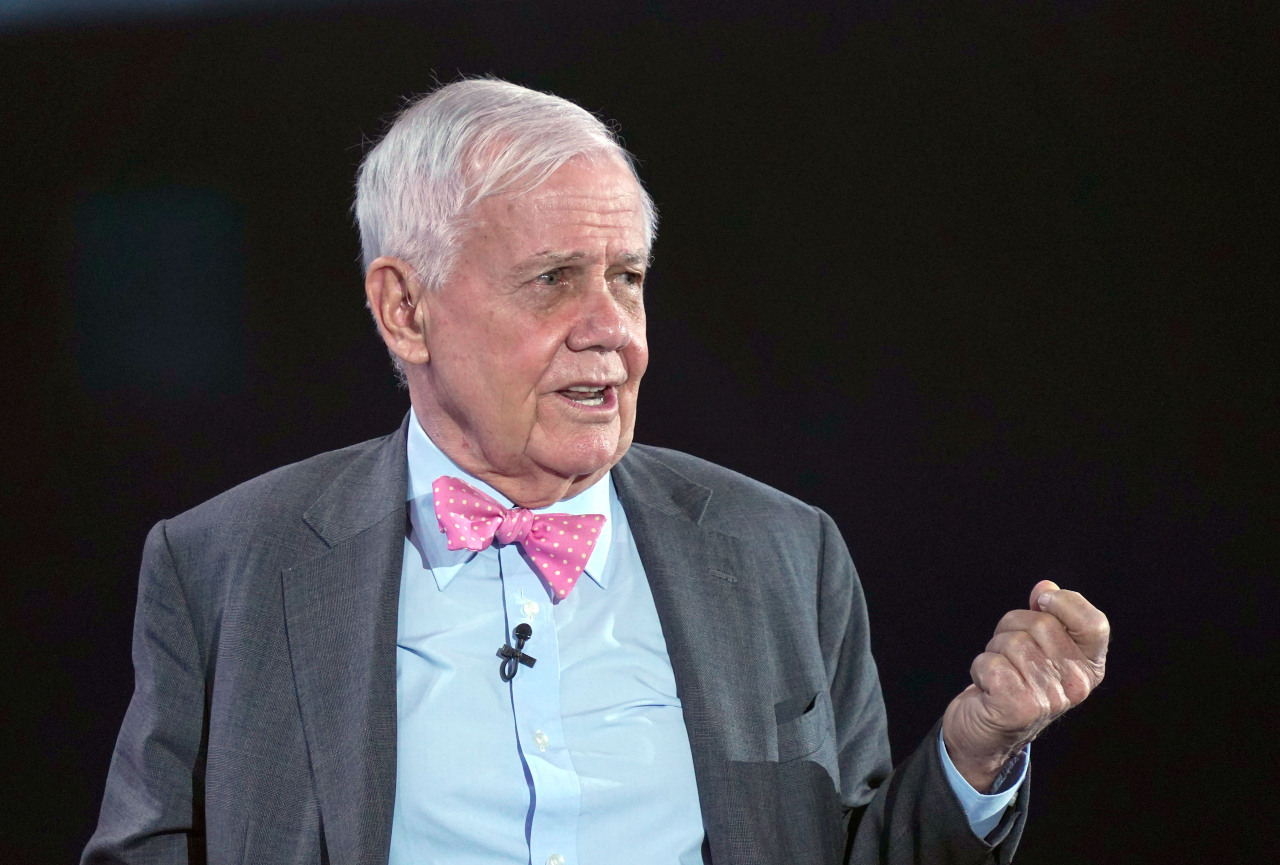

PYEONGCHANG, Gangwon Province -- The renowned American investor Jim Rogers still bets on the Korean Peninsula as the most exciting place for investment in the next 20 years once the heavily fortified border opens up, despite no signs of Pyongyang abandoning nuclear weapons and returning to diplomacy with the outside world.

“Once we open the 38th parallel, this is going to be the most exciting country in the world,” Rogers said during an interview with The Korea Herald on the sidelines of the PyeongChang Peace Forum on Tuesday. “I would like to invest in North Korea, but I am not allowed to now, because I am an American and it’s illegal.”

The 79-year-old investor, however, noted that opening the border won’t happen immediately, but could take more than 20 to 25 years.

“You will be a country of 80 million people on the Chinese border, which is a huge market,” said Rogers. “The transportation and railroads of the East Coast and the West Coast would open again. You could tie into the Trans-Siberian Railroad, you could try into the One Belt One Road.”

The Trans-Siberian Railway is a network of railways connecting Moscow with the Russian Far East, while the One Belt One Road, now known as the Belt and Road Initiative, is Chinese President Xi Jinping’s signature infrastructure development program and foreign policy stretching all continents.

When combining the North’s ample amount of natural resources and disciplined, educated labor force, with the South’s manufacturing capability and money, the peninsula has “enormous opportunities,” he said.

Rogers, however, clarified that he is not necessarily suggesting a political unification, but more of an opened society and market on the peninsula.

The investor, chairman of Beeland Interests and co-founder of the Quantum Fund, has been bullish about opportunities concerning North Korea since 2018 when a series of inter-Korean summits and a historic US-North Korea summit renewed hopes that the reclusive regime is ready to open and engage with the world.

But since the collapse of the Hanoi summit in 2019, nuclear diplomacy with Pyongyang has stalled, and meanwhile, the North has recently ramped up tensions with a barrage of missile launches to start this year.

Rogers, however, appeared unfazed by Pyongyang’s reluctance for diplomacy and latest hostile acts, noting that the country’s leader Kim Jong-un, who grew up in Switzerland, still wants to open his country.

“(Kim) doesn’t want to live in North Korea, but he has to. He cannot leave, so he is trying to change North Korea,” he said. “My reading is that he would like to make North Korea better and the way to do that is to open the 38th parallel and let all of you get rich together.”

During the interview, Rogers also shared his outlook of the global economy this year, warning that the next looming recession will be the “worst in my lifetime,” due to overleveraging and inflation.

“Inflation is rising, which means interest rates are going to rise again,” he said. “So I would suspect by the end of this year or next, this will come to an end on the economic boom that we’ve had, then we will have a recession ... and the next one will be very bad because there’s so much debt.”

In 2008, the world had an economic problem because of too much debt. Since then, the debts have grown everywhere, including South Korea and China, he said.

“So the next recession has to be the worst in my lifetime because the debt is the worst of my lifetime.”

When asked for advice on investment opportunities, the veteran investor said to invest in what one understands and knows.

“My best hot tip to you is, do not listen to hot tips. Hot tips will ruin you,” he said. “My advice to you is stay with what you know.”

But Rogers also suggested putting money in agriculture, noting countries with strong agricultural development, like Australia, Argentina, Brazil and Canada, are going to get better in the next few years.

“I am buying agriculture to this date. Agriculture is depressed and there are great opportunities.”

He also warned that once the central banks around the world end their money-printing spree, the housing bubble will burst, including in South Korea.

“Once the money printing stops, property in Korea is going to go down a lot because interest rates are going to go higher,” said Rogers. “So all the countries that have real estate bubbles, (including) New Zealand, (South) Korea and Mumbai, they’re going to suffer a lot but agriculture is going to boom.”

By Ahn Sung-mi (

sahn@heraldcorp.com)

![[Out of the Shadows] Seoul room clubs offer drugs to compete for clientele](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/05/20241105050566_0.jpg)