The nation’s import car market is rushing into a fierce sales war. With Korean carmakers planning only five launches this year, foreign brands are hinting at intensified offensives, with around 50 new models.

For import brands, their main goal, among others, is taking even a tiny bite out of the growing sales pie of German carmakers, especially BMW, the best-selling foreign brand here for three consecutive years.

German brands ― BMW, Mercedes-Benz, Audi and Volkswagen ― topped import car sales last year. Their combined market share reached 78 percent as of November, up 24 percent from the same period in 2011.

BMW sales alone increased more than 20 percent last year, selling 26,916 vehicles as of November. Its combined market share with the Mini brand amounted to almost 27 percent within the import car market.

|

The BMW Z4 roadster |

|

The Mini Paceman |

Aiming to further expand its presence this year, the German premium brand is equipped with powerful lineups, ranging from the New 3 Series Grand Turismo to the facelift version of the BMW Z4 roadster and the full-changed X5 sport utility vehicle.

BMW Korea is also preparing for the Korean launch of Paceman, the seventh-generation Mini model, in March.

Amid a strong performance by BMW, other German carmakers are bracing for fiercer competition this year.

Mercedes-Benz will heat up the premium compact market with the first launch of its cheapest and smallest A-Class in the latter half of this year. The model will compete directly with BMW’s 1 Series, Audi A3 and Volkswagen’s Polo in the 30 million won-range.

Volkswagen Korea aims to sell 23,000 vehicles this year, including new Polo and Golf cars, while Audi Korea will focus more on high performance models such as the New A5 Sportback and New R8 sports car.

Although German makers will maintain sales momentum for the time being, industry watchers say, Japanese and U.S. companies are expected to up their ante in the Korean market.

“Japanese and U.S. carmakers like Toyota and Ford think that they should not lose market shares any more to German rivals here,” said Yoon Dae-sung, executive managing director of the Korea automobile Importers and Distributors Association.

“Based on the price competitiveness of their U.S.-made vehicles following the Korea-U.S. free trade agreement, they will step up offensive more aggressively than ever.”

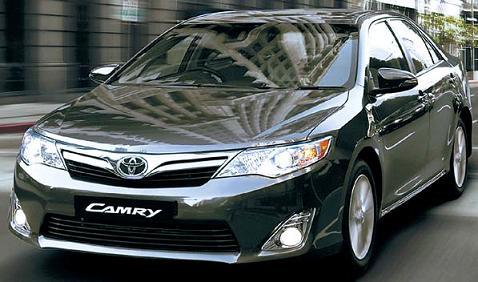

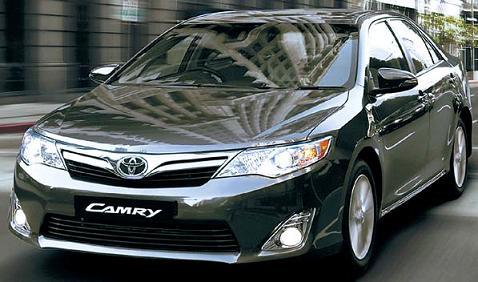

Toyota Korea, after being hit hard by a devastating earthquake in northeastern Japan in 2011, saw its sales surge 113.4 percent last year. Largely driven by the Camry sedan, the Japanese carmaker sold 9,785 vehicles as of November. Lexus sales also increased 16.4 percent to 4,245 units.

“We are still hungry,” said Kim Sung-hwan, a spokesperson of the Korean unit. “Based on the strong performance of volume models, the Camry and the Lexus ES300 that were launched last year, we are pinning high hopes on new models such as the U.S.-made Avalon sedan.”

Kim expected his firm to sell some 16,000 cars this year, outperforming the sales growth of the import car market that is estimated to stand at 8 percent according to the KAIDA, the business lobby for import car brands here.

|

The Toyota Camry |

|

The Ford Fusion |

Ford, which poured new models into the Korean market last year, is also hoping to gain ground this year. The Korean unit of the U.S.-based carmaker sold some 5,000 vehicles last year.

“We will put more emphasis on renewing consumer awareness about our brand rather than the sales figure itself,” said Noh Sun-hee, a Ford Korea spokesperson. “We believe more consumers would find the affordable luxury of Ford cars.”

Together with the mid-size Fusion hybrid, Ford will unveil the new Lincoln MKZ sedans, the first models after the luxury brand’s recent rebranding.

According to the KAIDA, this year’s new registrations could reach 143,000 units, about 8 percent growth from last year.

Additional tariff reduction on Europe- and U.S.-made cars and the strong Korean won will enhance price competitiveness of import cars, especially compact models.

“Hyundai and Kia brand cars are also expected to focus more on the domestic market as they have no killer launch globally. The Korean car market would see die-hard competition this year,” said Yoon of the KAIDA.

By Lee Ji-yoon (

jylee@heraldcorp.com)