I expect the Korean Stock Exchange to pass its April 27, 2011, historical high of 2,231 by the middle of 2013. The KOSPI suffered a knee-jerk plunge after the Greek crisis erupted in mid-2011, and entered a gradual-but-choppy upchannel in August of that year. The upper range of this upchannel will cross 2,231 around mid-June 2013.

Goldman Sachs, Morgan Stanley, Citi and UBS have all forecast the KOSPI will rise to 2,300 by the end of 2013. I agree with these forecasts, which are supported by a second trend line that runs from 2,085 on Nov. 1, 2007, to the April 27, 2011, historical high.

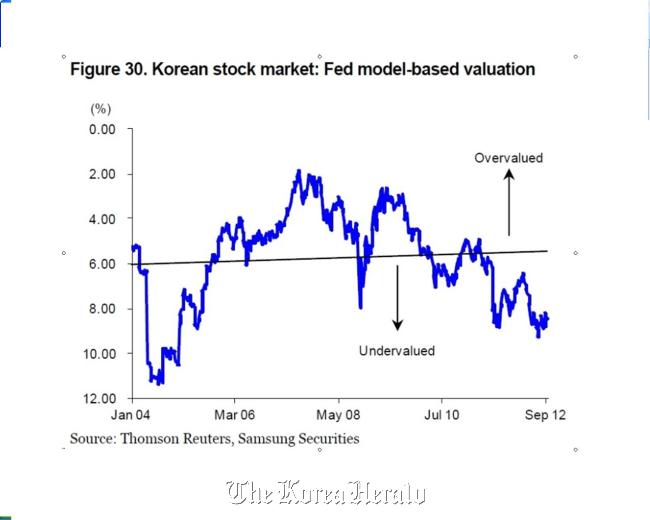

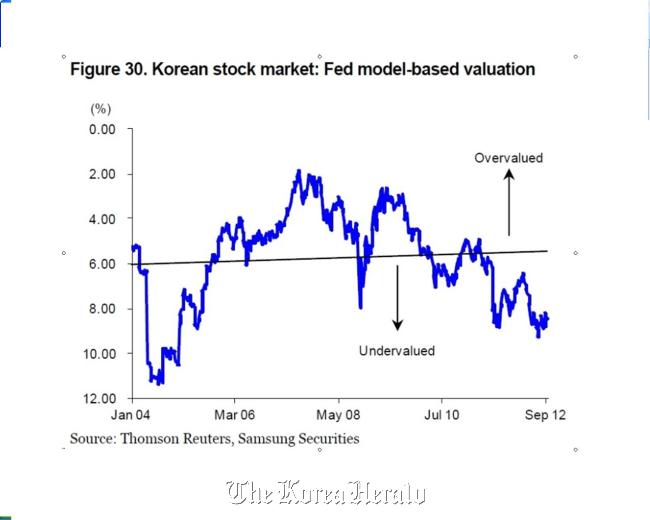

A key rally-driving factor, as Samsung Securities points out correctly, is that “the Korean stock market is now at its most undervalued level since 2005.”

A bullish KOSPI will also result from a rebound in GDP growth, from 2.3 percent this year, to 3.7 percent in 2013, to 4.2 percent in 2014. The engine behind this will be earnings growth of listed companies in Korea: Citi forecasts that its universe of stocks will enjoy 27 percent net profit growth in 2013. Inventories are bottoming out, which will trigger re-stocking and widening margins.

Any discussion of economic growth must include the fact that fully two-thirds of worldwide GDP growth now comes from Asia. Korea has been extremely wise over the past 15 years to focus its export destinations on ASEAN and China, where monetary easing is expected to push growth back towards double-digits. The rebound in the U.S. housing market may be healthy, but more healthy is how much less Korea now relies on North America and Western Europe, both which seem to be in the midst of a Lost Decade.

Their woes of course derive from an endlessly postponed de-leveraging process. For Korea, it’s “been there, done that,” already having slashed net debt from 300 percent to 44 percent, which greatly reduces earnings volatility and prevents productivity gains from being devoured by debt servicing. Goldman Sachs correctly shows that Korea is now No. 1 in fiscal room.

Fiscal room means more money across the board for capital expenditures, research and development, hiring, business expansion, new ventures, opportunistic asset acquisitions ― plus government stimulus on an as-needed basis. The bottom line is that, as we move into 2013, right now is a great time to buy South Korean equities.

By Henry Seggerman

Henry Seggerman manages Korea International Investment Fund, the oldest hedge fund in Korea. The opinions in this article are his own. ― Ed.