|

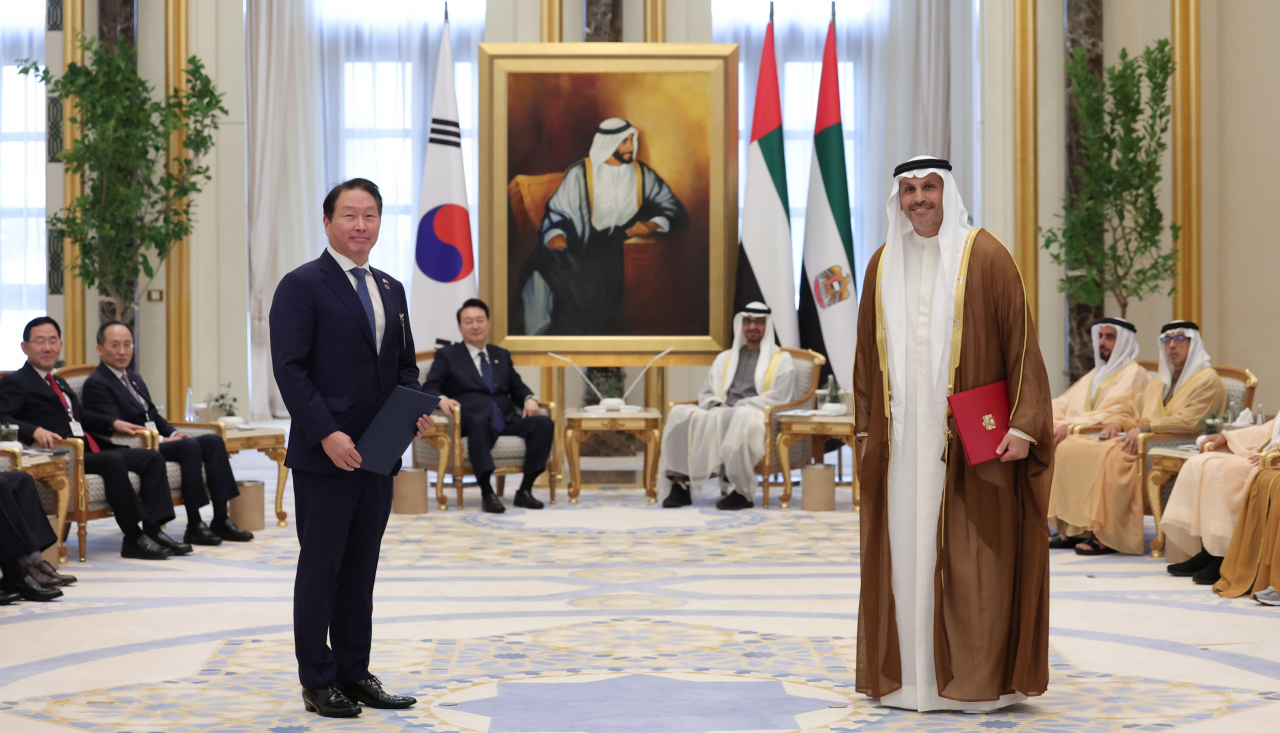

SK Group Chairman Chey Tae-won (left) poses for photos with Mubadala Investment Company's CEO Khaldoon Khalifa Al Mubarak after signing a memorandum of understanding on reducing carbon emissions at the United Arab Emirates presidential palace in Abu Dhabi on Sunday. (Yonhap) |

SK Group, South Korea’s semiconductor-to-telecommunications conglomerate, said Monday it had signed a partnership deal with the United Arab Emirates’ sovereign wealth fund to tackle climate change together by establishing a carbon credit market in Asia.

SK Group Chairman Chey Tae-won, who doubles as chairman of the Korea Chamber of Commerce and Industry, signed a memorandum of understanding with Khaldoon Khalifa Al Mubarak, CEO and managing director of the Mubadala Investment Company, at the United Arab Emirates presidential palace in Abu Dhabi, Sunday.

Under the agreement, SK and Mubadala will join hands to create a voluntary carbon market, a privately led carbon market where carbon credits certified by private entities can be traded. Once the market is activated, it is expected to lead companies and institutions in Asia regions to voluntarily participate for social responsibility and environmental protection, SK officials said.

SK officials further added that the two sides will seek measures to form a working group to materialize the partnership on how to establish the methodologies to certify the carbon reduction and build transparency and credibility of the market. Shared areas of interest are also part of the discussions to include more Asian participants, both public and private.

Both SK and Mubadala have accumulated experience and know-how in the field of carbon reduction certification and trading.

In line with the South Korean government’s drive to go carbon-neutral by 2050, the chief executives of all SK affiliates agreed to make concerted efforts to achieve the goal in June 2021.

The group also established an in-house body dedicated to reviewing and verifying its subsidiaries’ programs to reduce greenhouse gas emissions as the first private firm in Asia in the same year. The SK carbon reduction certification center evaluates the greenhouse gas emissions by its affiliates and certifies their performance in carbon reduction efforts.

As of end-October, SK companies certified 16 methodologies, including low-power semiconductors and fuel-efficient lubricant oil through the certification center. They also showed that they had a reduction of 740,000 metric tons in carbon emissions.

Mubadala, which has $284 billion in assets, owns an 80 percent stake in the joint venture, with the remainder held by Alpha Dhabi. The wealth fund has a wide range of investment portfolios in eco-friendly areas around the globe, including a strategic equity investment in Singapore-based AirCarbon Exchange.

The high-profile agreement came during the SK chief's stop at the Middle Eastern country alongside President Yoon Suk Yeol on a four-day state visit. Chey is traveling as part of a business delegation representing some 100 Korean companies.

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)