Central bank cuts 2012 growth outlook to 2.4%

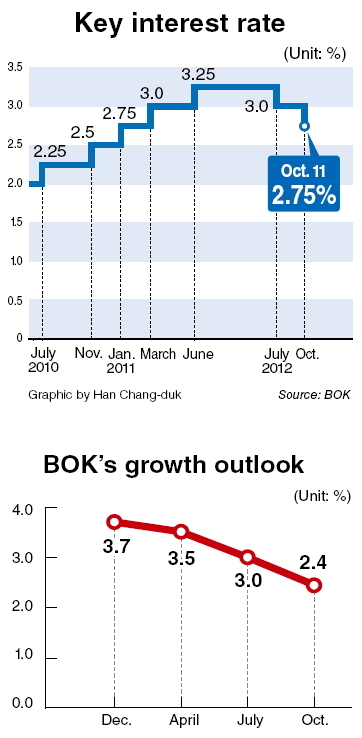

Korea’s central bank cut the nation’s economic growth forecast for this year to 2.4 percent and slashed its key interest rate to 2.75 percent, as exports and consumption showed no signs of recovery.

The Bank of Korea’s monetary policy committee announced on Thursday it decided to cut the key interest rate by 0.25 percentage point after freezing it at 3 percent for two consecutive months.

The last time the nation’s key interest rate was in the 2-percent range was in February 2011.

BOK Governor Kim Choong-soo said cutting the key interest rate would bring more gains than losses during the press conference at BOK headquarters in central Seoul after the monetary policy meeting.

“Lowering the rate will cut costs and therefore support the economy. Some worry that it may cause inflation but the possibility of that is weak. Right now, we have to think about the global financial crisis,” Kim said.

“A preemptive move is the key to effective monetary policy. It should not miss the timing considering other things. Lowering the rate 25 basis points is appropriate in terms of not making the situation worse.”

Kim said, however, that the decision was not unanimous, but there were no talks about a 0.5 percentage point rate cut.

“A deeper rate cut could give economic players unnecessary concerns about economic growth,” he said.

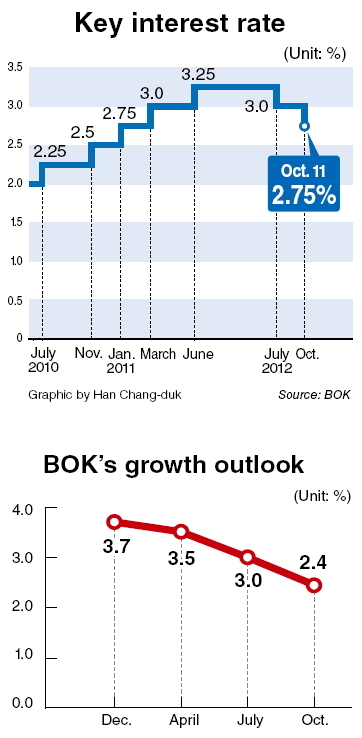

The central bank slashed its 2012 economic growth estimate to 2.4 percent as exports are feared to cool amid a global economic slowdown.

Kim said that internal and external economic factors worsened since July when the central bank had announced the growth forecast of 3 percent.

The nation’s economy is suffering from falling exports and sluggish domestic demand, raising concerns Korea may be entering a phase of low growth trend.

“Next year’s growth outlook will be lowered by 0.6 percent point from the previous 3.8 percent to 3.2 percent as well,” Kim said.

The BOK said that it anticipates the slowing domestic output to persist for a considerable time, due mostly to the prolongation of the eurozone fiscal crisis and sluggishness of the global economy.

Amid the protracted global economic stagnation, domestic consumption has been going through a slump and both imports and exports have been lackluster, declining for three consecutive months, according to the BOK.

Consumer price inflation and core inflation excluding the prices of agricultural and petroleum products continued to run at low levels at 2.0 percent and 1.4 percent, respectively, in September.

The BOK forecast inflation to remain below the 3-percent midpoint of its target for the time being. Its inflation target for 2013-2015 is between 2.5 and 3.5 percent.

Additionally, the BOK said housing prices in Seoul and the metropolitan area declined at a relatively faster pace, while those in the rest of the country generally stabilized at the levels of the previous months.

In the financial markets, stock prices have risen and the Korean won has appreciated against the U.S. dollar, due mostly to improvements in international financial market conditions and inflows of foreigners’ security investment funds.

By Park Min-young (

claire@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)