Major solar power investments are put on hold amid growing uncertainties

The solar energy business has long been touted as one of Korea’s future growth engines. Major conglomerates have started related businesses or taken over firms with solar power technologies at home and abroad.

But doubts over the profitability of solar energy are growing fast, following the recent fall of Woongin Group, which runs two solar energy-related arms.

Woongjin Holdings, the holding company of the nation’s 32nd-largest conglomerate, filed for court receivership on Sept. 28 as part of its last-ditch efforts to save the group. Behind the trouble were two struggling solar power affiliates ― Woongjin Energy and Woongjin Polysilicon ― along with its debt-ridden construction arm Kukdong Engineering and Construction.

Woongjin Group, whose traditional core businesses are water purifying and publication, was among the local pioneers of the solar energy business, establishing Woongjin Energy in 2006, followed by Woongjin Polysilicon in 2008.

A number of companies, big and small, rushed to get involved in the solar power industry at a time when the global economy was struggling with the aftermath of the 2008 financial crisis. Solar power, seen as the most profitable clean energy to replace fossil fuels, was touted as a promising business to help put the world’s sagging economy back on track.

Boom and bust

Woongjin’s solar power businesses enjoyed a boom between 2006 and 2010 thanks to the explosive growth of the global solar power market. During that period, the market grew about 700 percent over the period, according to a report by Korea Ratings. But the market has contracted rapidly since the second quarter of last year, mainly due to a flood of cheap Chinese products subsidized by the government.

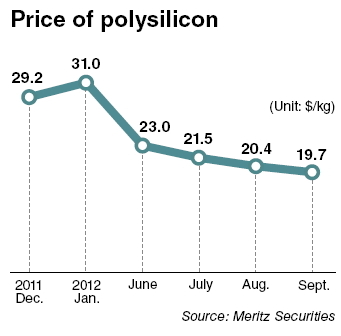

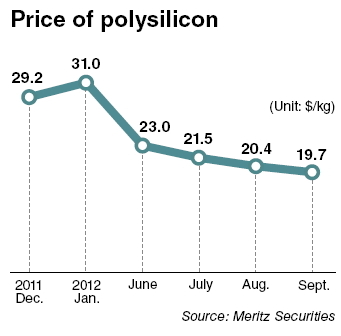

Woongjin Polysilicon, which mainly produces polysilicon, a key material used in solar panel production, has been suffering losses since the second quarter of last year. Oversupply led polysilicon prices to nosedive to the degree that polysilicon manufacturers expect no margin after deducting production costs. The company has allegedly halted production, while six creditor banks are considering putting the company up for sale to get their money back.

The business environment for Woongjin Energy, which manufactures ingots and wafers, key parts needed to generate solar power, deteriorated for similar reasons. Falling product prices led the company to post a net loss worth 2.86 billion won ($2.57 million) in the second quarter of this year from the same period last year. Industry watchers forecast that creditor banks would not be in a hurry to auction Woongjin Energy as it is financially healthier than Woongjin Polysilicon, but it is uncertain whether or not the energy company can stay afloat on its own unless the solar power market shows signs of recovery in the near future.

|

Solar panels (123RF) |

Spillover effect to other firms

The demise of Woongjin’s two solar power firms has affected other major solar power players such as OCI and Hanwha Group.

“It is true that both companies have decided to put additional investments in their solar power businesses on hold due to growing doubts over the profitability of their solar energy business after the fall of Woongjin,” a Seoul-based management consultant said on condition of anonymity.

Both companies have sought a different strategy in entering the solar power industry. OCI has put its focus on the polysilicon business, while Hanwha has sought to become a vertically integrated solar power player in the global market. To offer expertise and power solutions across the entire solar power chain, Hanwha has continued to acquire solar power companies with different business portfolios over the past few years, including Chinese module manufacturer Solarfun and German photovoltaic manufacturer Q-Cell.

Despite the differentiated strategies of OCI and Hanwha, both companies failed to become profitable in their market segment in the first half of this year.

Mixed outlook for recovery

When it comes to the outlook for the solar power business, market analysts are divided into the two groups.

“The global solar power industry is suffering due to a variety of reasons such as overcapacity, declining prices and dwindling subsidies by the U.S. and European governments which lead demand for solar power,” Kyobo Securities said in a recent report. “It is like all the bad news came into the market at once and it seems to be taking a while to see those issues be resolved,” it added.

Lee Hak-moo, an analyst from Mirae Asset Securities, however, took a different stance, citing a business cycle as an example.

“In history, most new businesses have gone through dramatic ups and downs before they entered the maturing stage. The industry will face a restructuring soon and survivors from the turmoil will enjoy reaping profits.”

By Seo Jee-yeon (

jyseo@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)