Benchmark interest rate unchanged as central bank assesses impact of last month’s cut

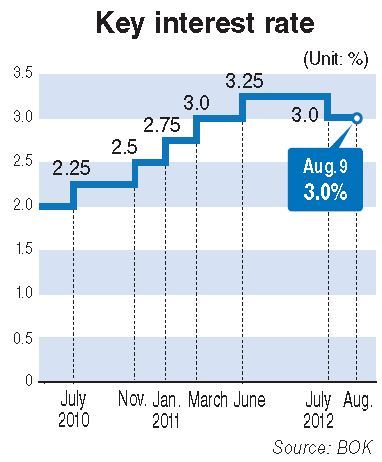

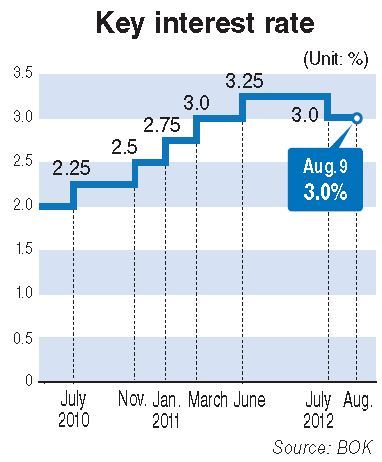

The Bank of Korea on Thursday kept the key interest rate unchanged at 3 percent, as widely predicted, in a bid to size up the after-effects of its surprise rate cut in July.

The central bank cut the benchmark seven-day repo rate by 0.25 percentage point a month ago after freezing it at 3.25 percent for 13 months since June last year. It was the first time the BOK lowered the key interest rate since February 2009.

The BOK’s monetary policy committee unanimously decided not to further lower the rate this month as rate cuts for two months in a row could aggravate fears of an economic slump. Analysts expect rate cuts later in the year.

The domestic economy is anticipated to sustain a negative output gap for a considerable time, due mostly to the increase in eurozone risks and the sluggish economies of its major trading partners, the committee said in a statement.

“The committee expects the pace of global economic recovery to be very moderate, with the uncertainties surrounding the euro area fiscal crisis and the international financial markets persisting,” the committee said, adding that it considers the economic recovery in the U.S. to have weakened and the sluggishness of economic activities in the euro area to have deepened.

“Growth has also continued to slow in emerging market countries, due mostly to the impact of the economic slumps in advanced countries.”

BOK Governor Kim Choong-soo brushed aside the latest concerns about deflation.

“The growth of inflationary expectations is stabilizing. But Korea is not facing a situation bad enough to worry about deflation risks,” he said.

As last month’s growth of consumer inflation slowed to below 2 percent on-year, some market observers warned that Korea may face deflation in asset prices, given the high household debts and the stagnant property market.

The BOK said that consumer inflation is expected to remain low for the time being despite potential upward risks including hikes in public utility fees and unstable grain prices.

Analysts forecast additional rate cuts later this year, pointing to dismal economic outlooks.

“The economy doesn’t look good, with some lowering their projections for this year’s GDP growth from slightly over 3 percent to the mid-2 percent range,” said Shin Min-young, head of the macroeconomic division of LG Economic Research Institute.

“The benchmark interest rate is likely to be lowered once or twice in the second half.”

Standard Chartered Bank Korea said the central bank is likely to implement a 25 basis point rate cut in September and another 25bps cut sometime in the fourth quarter.

“Admittedly, the sustained weakness in industrial production and exports and the surprisingly low headline inflation have led to expectations that the BOK would implement a more aggressive monetary-easing campaign to support growth,” Oh Suk-tae, senior economist at Standard Chartered Bank Korea, said in a report.

By Kim So-hyun (

sophie@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)