|

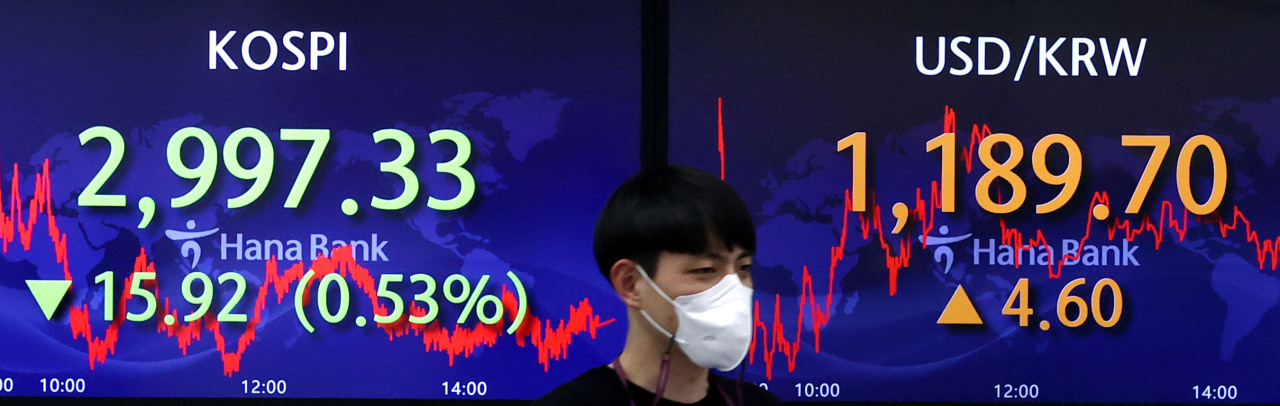

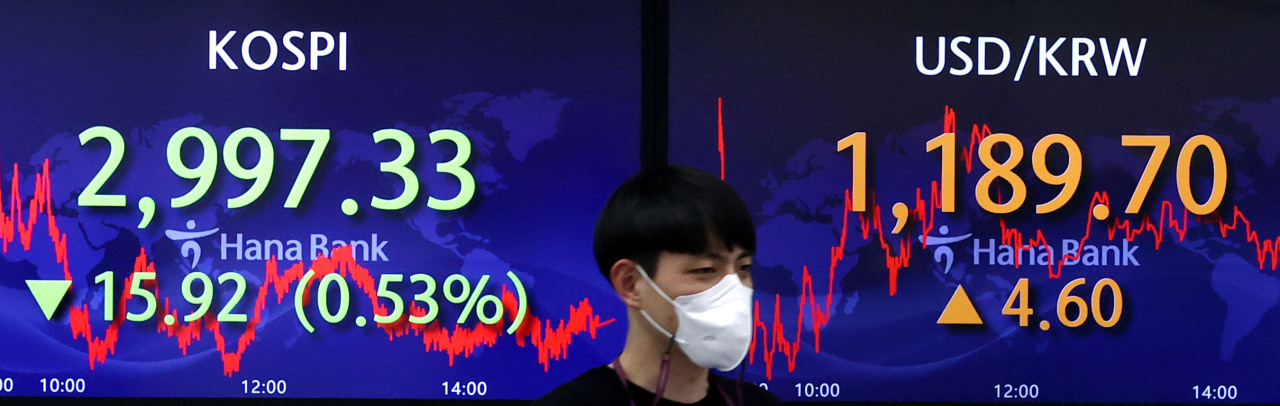

The benchmark Korea Composite Stock Price Index (Kospi) figures are displayed at a dealing room of a local bank in Seoul, Wednesday. (Yonhap) |

South Korean stocks closed slightly lower Wednesday as investors took to the sidelines ahead of the central bank's monetary policy meeting. The Korean won rose against the US dollar.

The benchmark Korea Composite Stock Price Index (Kospi) slipped 3.04 points, or 0.1 percent, to close at 2,994.29 points.

Trading volume was moderate at about 540 million shares worth some 10.7 trillion won ($9 billion), with losers outnumbering gainers 477 to 373.

Institutions sold a net 592 billion won, while foreigners sold 316 billion won and retail investors purchased 240 billion won.

The key stock index started strong on bank and insurance shares' gains, backed by expectations that the Bank of Korea might raise the key interest rate Thursday.

But stocks lost ground as tech and bio heavyweights turned to losses amid institutional sell-offs.

"The (rise in) US Treasury yields seems to have driven up certain sectors, such as energy and banking, and tomorrow's monetary policy meeting also kept investors from making bold transactions," said Kiwoom Securities analyst Kim Sae-hun.

Market bellwether Samsung Electronics dropped 0.66 percent to 74,800 won, while No. 2 chipmaker SK hynix increased 0.42 percent to 119,500 won.

Internet portal operator Naver moved down 1.25 percent to 395,000 won, with its rival Kakao closing flat at 124,500 won. Pharmaceutical giant Samsung Biologics declined 0.7 percent to 849,000 won.

Kakao Bank lost 0.31 percent to 64,700 won, but leading payment service provider Kakao Pay jumped 3.39 percent to 183,000 won.

The local currency closed at 1,186.5 won against the US dollar, up 3.2 won from the previous session's close. (Yonhap)