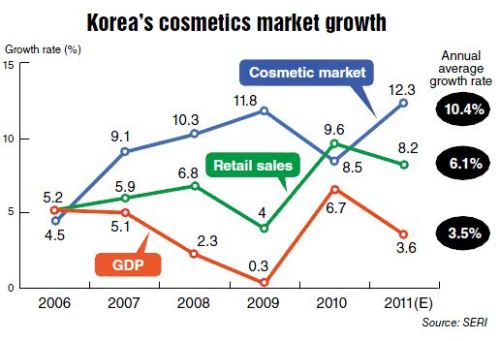

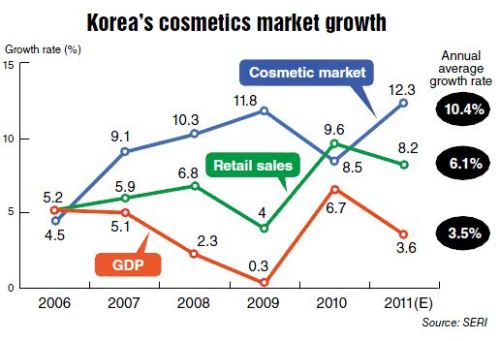

There is no stopping the Korean cosmetics market. The value of the cosmetics market grew to 8.9 trillion won ($7.9 billion) in 2011 from 5.6 trillion won in 2006, an annual average increase of 10.4 percent. Even when the economy came to a near-standstill with GDP growing 0.3 percent in 2009 in the wake of the global financial crisis, the domestic cosmetics market grew 11.8 percent, proving itself to be recession-resistant.

The rapid growth derives from new dynamics in the cosmetics industry. Rising life expectancy and desire for a better quality of life have propelled demand for wellness and anti-aging products. Also, there is a general perception that a youthful and healthy appearance is an advantage in Korea’s highly competitive society. Now, youths and senior citizens, men and teenagers, are making cosmetics part of their daily routine, not just women.

|

Customers look through cosmetics at a shop in Seoul. (Bloomberg) |

The skin care segment has been a particularly key growth contributor, with consumers gravitating away from simple glamour makeup. They are more youth and health conscious, recognizing that skin impacts aging, health and physical appearance. Skin care accounts for 48 percent of Korea’s total cosmetics market and is growing much faster than other segments like makeup and perfumes.

Furthermore, this personal care industry is going high-tech. As cosmetics technology development accelerates and converges with various high technologies, the paradigm governing the competitiveness of the cosmetics industry is focusing not only on changes in the market conditions and trends but also technology and effectiveness.

Three driving forces of the cosmetics industry

The cosmetics industry will undergo a paradigm shift in overall product creation from basic research to development to marketing.

In basic research, biotechnology will become increasingly more important due to advanced research in protecting skin from aging. In the development stage, electronics, information technology, food and medical technologies will intersect, leading to the development of converged products and solutions. In marketing, as consumers’ knowledge increases, advertising highlighting research and development and stressing high-tech materials will be an appealing point rather than emphasis on image.

1. Biotechnology

Deeper understanding of human biological phenomena, including the interpretation of human genetic maps, has facilitated the shift of cosmetics technology research from formula and texture to skin aging prevention and treatment.

Some global cosmetics companies already have become early developers of high-function cosmetics based on biotechnology. L’Oral, the world’s largest cosmetics company, devoted 10 years of research to 4,400 genes and 1,300 proteins that have the most relevance to skin aging. It resulted in gene-activating serum, Gnifique, which became an instant global sensation. One Gnifique product is sold every four seconds.

Korean cosmetics companies are also actively applying biotechnology in product development. AmorePacific, Korea’s No. 1 cosmetics manufacturer, established a bioscience R&D center, while LG Household and Health Care, another leading Korean cosmetics company, formed a technology partnership with renowned women’s hospital Cha Medical Center on stem cell research.

2. Convergence solutions

To deliver enhanced effects and quality, medical and other technology-based solutions are being added to cosmetics. Cosmetics that converge with other industries such as electronic devices, smartphones and health foods will also gain popularity.

Nutricosmetics, or combining cosmetics with food, is a segment that is already having a pronounced presence. Japanese cosmetics giant Shiseido launched “In & On” in 2010, formulated to maximize skin care effects by combining cosmetics with beauty drinks and supplements.

Beauty consulting businesses that diagnose individuals’ skin condition for recommendation of optimal products or sell customized products are also rising.

One of the companies that attracted attention at this year’s Consumer Electronics Show was Ahrong Eltech, a Korean facial beauty products manufacturer, which presented “DermaScan,” a sensor skin assessment which can deliver the results to a smartphone and is linked to a guide to online shopping sites.

3. Technology and ingredient marketing

As beauty-related information proliferates on the Internet and TV, knowledge about cosmetics is rapidly being accumulated among consumers. On “PowderRoom,” Korea’s leading beauty community site, 230,000 members exchange beauty tips and product experiences daily. Korea’s cable TV program “Get It Beauty” is becoming increasingly popular by broadcasting blind tests that compare only the quality of beauty products, rather than their brand or image. Cosmetics experts and ordinary people participate in reviewing products for spreadability, stickiness and color, etc., with products ranked No. 1 or 2 on the show becoming bestsellers.

Proctor & Gamble’s leading brand, SK-II, has actively used the development story behind its “Pitera” ingredient based on yeast culture; it noticed that brewers had baby soft hands. By doing this, SK-II was able to simultaneously attract customer attention and increase consumer confidence in its brand.

Implications

The Korean government and companies need to expand investments and support for the cosmetics industry given its growth potential and value. Along with the Korean Wave including the K-pop boom, Korea’s cosmetics exports climbed to $600 million in 2010 from $80 million in 2001. No. 1 company AmorePacific jumped to 16th in global ranking of cosmetics makers in 2011 from 25th in 2005.

However, Korea still lacks technologies to lead the future cosmetics markets such as dermatology, bio cosmetics and beauty convergence solutions. Domestic cosmetic firms are far behind their overseas peers in R&D. For example, L’Oreal’s R&D investment is more than seven-fold that of the total Korean cosmetic industry. Korea’s cosmetic companies must rapidly cultivate their technological capabilities through a “choose and concentrate” strategy, focusing on specific areas such as the genetics of aging and stems cells.

Product planning strategies should change from the current passive stance of only seeking to satisfy consumer tastes to more aggressive approaches ranging from discovering potential niche markets through technological innovations to influencing consumer preference. For this to happen, interaction between R&D and marketing must be energized, and the fostering of high-quality talents who have “ambidextrous” skills in both technology and marketing must be made a priority.

|

Kang Chan-koo |

By Kang Chan-koo

Research fellow, Samsung Economic Research Institute

This article was contributed by the Samsung Economic Research Institute. ― Ed.