|

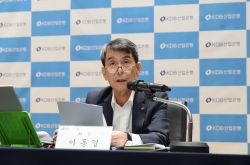

Korea Development Bank Chairman Lee Dong-gull speaks at a virtual press conference held in KDB headquarters in Seoul on March 15. (KDB) |

This is a part of a series of interviews and analyses of South Korea’s top bankers, policymakers and investors leading the financial industry here. This is the fourth installment. -- Ed.

Korea Development Bank Chairman Lee Dong-gull, the first KDB chief in 26 years to serve a second term, has sought to change the public image of the state-run investment bank as an inconsiderate spender of unlimited amounts of public money to indebted companies.

Since assuming office in 2017, Lee, 68, has landed a number of exits from state-sponsored investment banking strategies for troubled companies. But SsangYong Motor, a troubled South Korean carmaker currently under a court-mediated debt restructuring process, appears to be a black sheep to the chairman.

Lee, often described as a hard-nosed deal maker, is now left with a question mark on how to seek a new deal for the carmaker’s exit from court receivership.

Eyes are also on whether the KDB, a main creditor of the South Korean arm of India-based carmaker Mahindra & Mahindra, would extend additional financing to the debt-ridden sport utility vehicle-maker before it finds a new investor, which could come at the cost of reneging on its earlier pledge to rule out a new bailout.

Before the court receivership, the nation’s fourth-largest carmaker had to shut down its production line in Pyeongtaek, Gyeonggi Province, several times this year due to a liquidity crunch. It now faces a threat of delisting on the stock market, months after the company declared in December that it had defaulted on a combined 150 billion-won ($134 million) loan repayment and filed for bankruptcy.

Viewed by the media as a straightforward and uncompromising person, Lee has openly blasted SsangYong’s board and labor union in March for failing to display their “excruciating effort” to salvage their company. He also expressed regret about SsangYong’s “uncooperative” attitude in attracting fresh capital.

This is consistent with his earlier remarks last year that SsangYong’s “sustainability of business operations“ must precede to deserve new financing. In January, he ruled out financing to SsangYong without its reorganization effort.

Lee’s outpouring of criticism to SsangYong, however, could not help the company avert court receivership, as the prospective buyer led by US car retailer HAAH Automotive stopped short of submitting a letter of intent, a document that sets the groundwork for further negotiations, by the March 31 deadline. Lee has also had to face protests from SsangYong labor union against downsizing.

This is not the first time that Lee, a former scholar and high-ranking official of the country’s financial regulator, has criticized a company for depending on state loans and taxpayers’ money.

In 2018, Lee slammed Hyundai Merchant Marine, one of its distressed portfolio companies, for a moral hazard that highlights its need to “exercise a downsizing to dismiss negligent employees for poor performance.“ The company and the creditor were then under fire for employees’ extravagances and alleged bribery.

Lee also has a history of criticizing the deal counterpart for its lack of sincerity.

Lee refused to accept Hyundai Development Co.’s request for an extra round of 12 weeks of due diligence for its proposed acquisition of Asiana Airlines, considering creditor and seller Kumho Asiana’s bona fide effort, saying, “If the deal falls apart, all the blame must go to HDC.”

|

Korea Development Bank Chairman Lee Dong-gull (Korea Development Bank) |

The nature of straightforwardness came along with Lee’s move to put back on track troubled companies under the supervision of the KDB, using a market-oriented corporate restructuring strategy. Lee argued that such an approach could expedite the process of ending costly debt restructuring of troubled companies, revitalize the ecosystem in the industry and take advantage of ample liquidity of investors eyeing distressed opportunities.

“The era of creditor-centered corporate restructuring is giving way to the market-oriented era,” Lee said in a March press conference. “Macroeconomicwise, it is crucial to normalize a troubled company as soon as possible.”

His approach allowed numerous deals involving distressed companies to be signed. Kumho Tire was acquired by Chinese rival DoubleStar in 2018 and Sungdong Shipbuilding has been under the umbrella of HSG Heavy Industries since 2020.

Lee’s track record continued to build in his second term.

As Hyundai Development Co. walked away from its trillion-won Asiana Airlines deal amid the pandemic, KDB swiftly brought Korean Air Lines to the negotiating table, in a bid to salvage the pandemic-hit aviation giants. The scheme allowed KDB to use the minimum amount of state funds to allow Korean Air Lines to increase capital through a 3.3 trillion-won public share offering and use part of its proceeds to acquire Asiana Airlines.

In the meantime, STX Offshore & Shipbuilding’s control is also about to be handed over to a consortium comprising KH Investment and United Asset Management Co., while KDB Life Insurance’s control went to local private equity firm JC Partners. As for Daewoo Shipbuilding & Marine Engineering, proposed buyer Hyundai Heavy Industries is awaiting antitrust approvals from Korea, Japan and the European Union.

Most recently, KDB led a group of creditors to sign a deal to sell Hanjin Heavy Industries & Construction, which formerly controlled the Subic shipyard in the Philippines, to a group led by construction rival Dongbu Corp.

Market watchers are paying attention to whether Lee could bring HAAH to the negotiating table or find a new bidder to save SsangYong’s 4,800 workers and some 200,000 jobs in the automaker’s vendors without injecting extra state money.

Lee’s stance toward SsangYong was in parallel with the government -- which has the power to nominate the KDB chief -- as to whether SsangYong deserves additional financing, irrespective of the new capital injection from the prospective buyer.

In fear of headwinds and costs to be faced if SsangYong and its subcontractors both collapse, Financial Services Commission Chairman Eun Sung-soo urged the financier in February to ”let (SsangYong) survive as long as it can“ if it costs ”less than expected.”

Lee was formerly a president of the Korea Institute of Finance and a vice chairman of the Financial Supervisory Commission, a precursor to the Financial Services Commission. The KDB chief’s second term ends in 2023. He holds a Ph.D. in economics from Yale University.

By Son Ji-hyoung (

consnow@heraldcorp.com)