Korea’s trade balance swung to a deficit in January for the first time in nearly two years on falling demand from Europe, underscoring concerns about how sharply the trade-dependent economy is hurt by external risks.

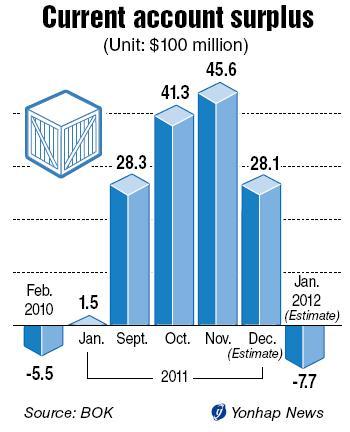

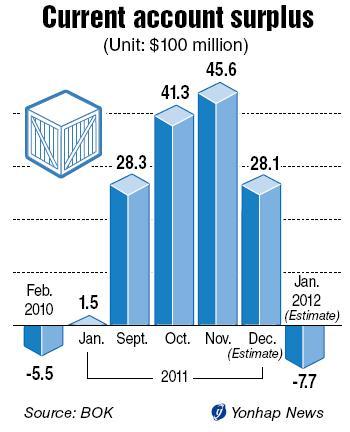

The country’s current account posted a deficit of $772 million in January, logging the first monthly loss since February 2010, from a revised surplus of $2.8 billion in December, the Bank of Korea said on Tuesday.

The drop in exports has been exacerbated by economic turmoil in Europe and an early Lunar New Year holiday, the central bank said, which slows shipments of manufacturing goods and electronics to Asian countries.

“There were fewer working days in January which slowed the exports of ships, telecommunication devices and display panels,” the BOK said in a statement.

Shipments to Europe fell 38 percent in January from same time last year, compared to a 20 percent on-year fall in December. Total exports fell to $41.4 billion in January from $47.7 billion in December. Imports shrank to $43.4 billion from $45.5 billion, the BOK said. The capital and financial account, representing cross-border investment, logged a net income of $1.22 billion in January, reversing a net outflow of $3.5 billion from December.

The bank is optimistic that the trade balance will return to the black in February.

“Exports of automobiles and steel products are strong and there are more working days in February, which will help the country run a current account surplus that’s more than enough to cover January’s deficit,” senior bank official Yang Jae-ryong told reporters.

But analysts expect the balance to shrink further should oil prices stay volatile. Morgan Stanley projected the country’s current account surplus to fall 0.8 percent from its total GDP for every $10 increase in crude prices. It said the book may end up in the red for this year with a $40 increase in crude price from the current level. Crude oil jumped 15 percent in February to $125 per barrel, hitting a nine-month high.

“Oil cannot be substituted and companies won’t be able to reduce import of crude even as prices shot up. Trade balance will inevitably be affected by oil price as the tension in the Middle East intensifies,” Lim Hee-jung, economist at Hyundai Research Institute said.

By Cynthia J. Kim

(

cynthiak@heraldcorp.com)