Small vehicles with low engine displacement are expected to account for 50 percent of the total sales of import vehicles in South Korea as early as the third quarter.

The ratio of cars with an engine capacity of less than 2.0 liters to the total number of cars sold came to 45.2 percent in May.

They sold 3,969 small-sized cars ― at low and medium priced ― out of the total 8,777 units last month, according to the Korean Automobile Importers and Distributors Association.

Sales of the small-sized import cars have continued to increase over the past several months, posting noteworthy growth compared to 1,876 units (or 42.6 percent of the total sales) in April.

A year ago, the ratio of small cars to the total import vehicles stayed at 26.1 percent.

Dealers attribute Korean consumers’ active buying of small import cars to the recent trend that prices of some imported automobiles are as low as popular sedans of Korean carmakers.

Some European sedans are also priced at a similar level to Hyundai Motor and Kia Motors’ luxury sedans such as Grandeur and K7.

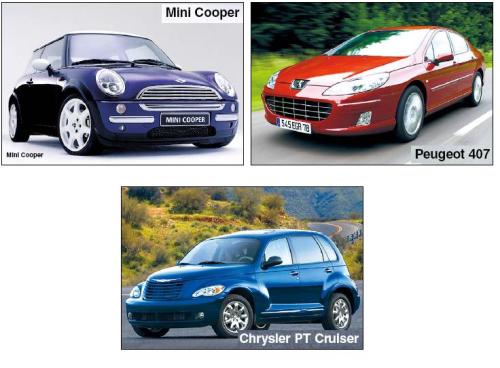

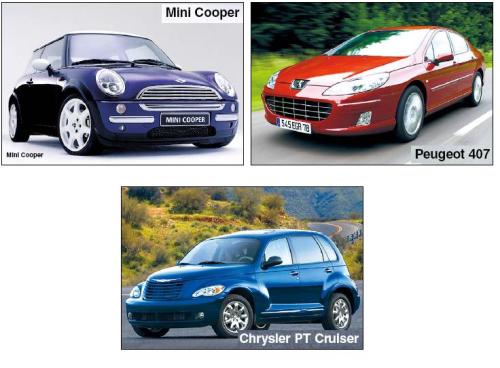

Prices of the Peugeot 407, Volvo V50 2.4i, Saab 9-3 Linear and Volkswagen’s Passat 2.0FSI are fixed between 40 million ($37,000) and 50 million won.

The New Beetle and Mini Cooper of the Volkswagen Group are also priced around 40 million won.

Consumers can buy the PT Cruiser of Chrysler, the Golf 2.0 of Volkswagen and the Mondeo of Ford Motor for around 30 million won.

Honda Motor’s CR-V, priced at less than 40 million won, has become the bestseller in the imported sport utility vehicles sector.

“As imported automobiles become increasingly commonplace in Korea, the market is shifting towards smaller, cheaper vehicles,” a foreign carmaker’s spokesman said.

In addition to the shift toward smaller engine capacity and lower price ranges, younger motorists make up an increasingly large proportion of imported car buyers.

According to industry data, about 40 percent of imported vehicles sold in May were bought by those in their 20s and 30s.

For a long time foreign cars were considered extravagances and only for the rich and powerful. There were even rumors that owning one was cause enough to get a tax audit.

Import car dealers predict that sales of imported cars priced under 50 million won will continue to increase in the coming years and push up the sales ratio of lower-price cars among imported automobiles.

They say that more and more customers want to buy an imported car but not just because it’s foreign or more expensive.

“Korean cars are great now, but they believe there is too little choice and the price differences aren’t all that much these days anyway,” a dealer said.

“In the past imported cars were more of a status symbol than they are now,” he said. “But they just want something that is different.”

“I never did have a foreign car and I probably won’t get one before I die, but my daughter drives a German car and I don’t think there is anything wrong with buying a luxury car as long as the money was made honestly,” a retired businessmen in his 70s said.

In 2010, sales of imported cars from consumers in their 20s to 30s increased rapidly, according to the KAIDA.

By ages, sales of imported cars to drivers in their twenties and thirties climbed as much as 3.4 percentage points from the average of 35.4 percent of imports in 2009.

In particular, the purchases from consumers in 30s has reached a record high of 32 percent.

In terms of prices, sales of imported cars that are relatively low and vehicles between 30 million won and 40 million won took up 25.7 percent of the market, a 5 percentage-point increase from 2009.

Meanwhile, the import market share of cars priced at 50 million won to 70 million won dropped from 30 percent in 2009 to 27.2 percent in 2010 to register the lowest since 2003.

The same figure for imported cars priced at 40 million won to 50 million won increased from 24.6 percent to 26 percent.

By Kim Yon-se (

kys@heraldcorp.com)