|

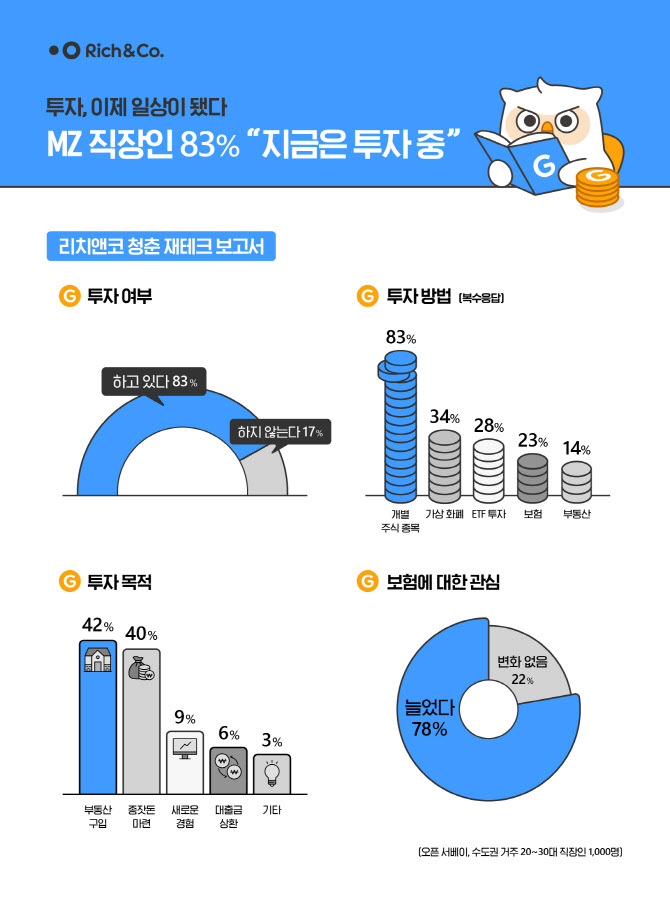

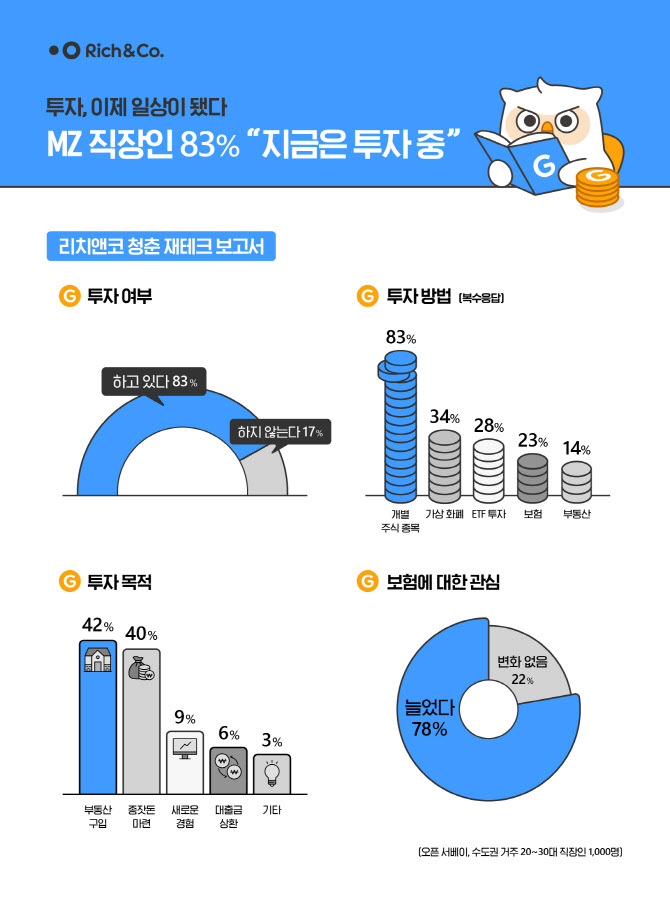

A graph shows trends in young Koreans’ investing. (Richanco) |

Eight out of 10 young Koreans are currently investing in stocks, funds, cryptocurrencies and other assets, and their main purpose behind making such investments is to buy a home, a survey showed Thursday.

According to the survey conducted by insurance agency Rich Planner Consulting Co. on 1,000 Koreans in their 20s and 30s, 88.2 percent of them answered they are investing in stocks. Nearly 35 percent said they are trading cryptocurrency.

For the purpose of investment, 42.2 percent of young investors answered they are making investments to buy a home and 40.4 percent said they are preparing seed money for large-scale investments.

Some 52 percent said they have made profits through investments this year, while the other 48 percent answered they made no profit or lost money.

Also 28.5 percent answered they are spending less than 10 percent of their monthly income on investments. Some 11 percent were investing aggressively by spending more than half of their monthly income buying stocks and other assets.

Experts say asset investment is essential for younger generations to buy a house, one of the safest properties to build wealth here.

“Due to soaring housing prices, it is impossible for young people to buy homes by just saving their money like older generations did (in their prime income-earning days). In the era of pandemic-driven market liquidity, coupled with a rapid development of fintech that provides platforms for convenient asset investments, it is no surprise that the youth are pouring their money through those channels,” said Hong Sung-il, senior researcher at Korea Economic Research Institute.

But Hong warned that although investment in everyday life has become the new normal, one must also consider the risks.

“The fact that around 50 percent of the young investors made profit means that almost half of them have lost or gained nothing from their investments. Since there is a high risk of bubble burst, people should diversify their investment portfolios,” Hong said.

By Byun Hye-jin (

hyejin2@heraldcorp.com)

![[AtoZ of Korean mind] Ever noticed some Koreans talk to themselves?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/03/20241103050186_0.jpg)