A seismic shift appears to be about to occur in Korea’s financial sector, where the newly appointed Financial Services Commission chairman Shin Je-yoon has shown his determination to overhaul the country’s major financial holding companies.

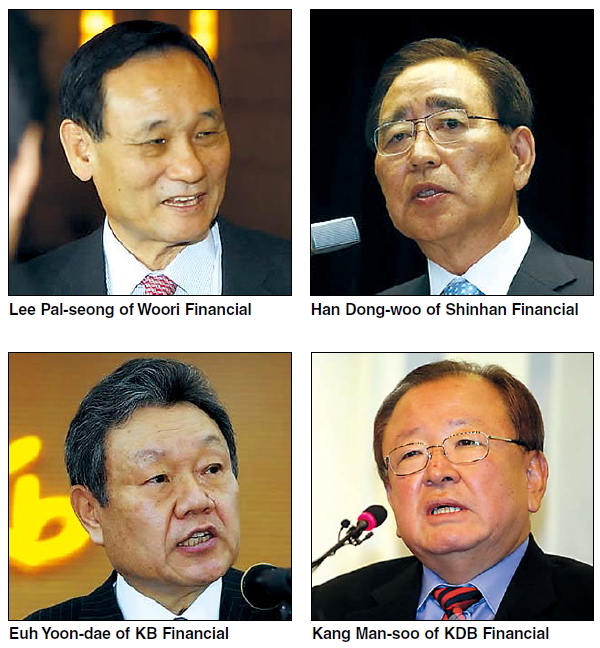

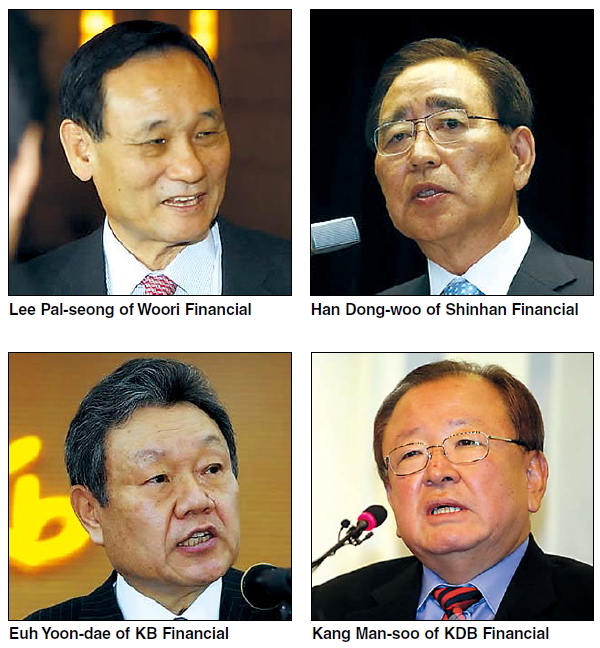

Heads of financial holding companies such as KDB Financial, Woori Financial and KB Financial are expected to be pressured to step down as Shin said during his inauguration speech last week that he would reform their weak governance structures.

Shin claimed they turned out to be completely different than initially intended when the country adopted financial laws promoting holding companies to enhance efficiency and transparency more than 10 years ago.

“It is time to deeply worry” over the current status of Korean financial holding companies, Shin said.

“We need to gather the wisdom (of many people) to create a sound financial holding company in this country,” he emphasized.

This came as most local holding companies were found to be oppressively interfering with management of their subsidiaries and affiliates, while continuing to exert influence on the boards. Heads of holding companies, meanwhile, generally managed to stay out of trouble when such malpractice emerged before the public.

Internal feuding at Shinhan Financial involving its top executives over a scandal as well as at KB Financial over director appointments, and the practice of seating top financial executives with whom former administrations have had close personal relationships have become growing issues.

To this end, the financial regulators are devising a set of rules to hold top executives more accountable for irregularities.

There has been very little effect from the introduction of financial holdings companies in terms of synergy and profitability over the last 10 years as “banking operations still account for an excessive share of holdings companies’ businesses, which have not yet made improvements in diversification” through the system, said a researcher at Hana Institute of Finance in a report.

Shin said that the FSC planned to set up a task force comprising of financial experts, civic groups and professors to deal with holding company reform. Also, as head of the financial regulatory body, Shin will push those companies to abide by basic ethical principles by sternly enforcing laws in the professed belief that financial companies should be socially responsible and operate in the best interests of the public.

A number of Korean financial companies that teetered on the edge of collapse during the Asian financial crisis of the late 1990s were rescued with taxpayers’ money worth some 17 trillion won, the FSC chief noted.

“It is time for those companies to repay their gratitude to the public,” he said.

Shin refrained from naming specifically which companies he was eyeing for governance reforms, or how exactly or through what model he sought to change their governance structure.

However, market analysts said that his remarks could be aimed at pressuring the heads of major holdings companies such as Woori Financial, KB Financial and KDB Financial to step down as Shin previously mentioned that he would seek to replace top executives of financial companies and organizations under FSC jurisdiction.

The replacement would be in line with efforts to place suitable professionals that could share their policy vision with President Park Geun-hye but also root out “parachute appointments.”

KDB Financial, headed by Kang Man-soo, Woori Financial, headed by Lee Pal-seung, and KB Financial, headed by Euh Yoon-dae, are all run by close confidants of former President Lee Myung-bak. KDB and Woori are state-owned, while KB is private but has generally been under government influence given its dominance as Korea’s leading retail banker. Kim Seung-yu, a former chairman of Hana Financial, was known to be close to President Lee.

Overlapping laws and policies governing Korean holding companies’ management of subsidiaries and affiliates require fine-tuning at a similar level to those implemented in the U.S. and Europe, suggested Hana Institute of Finance.

“Laws, including antitrust regulations, governing financial holding companies are abstract,” it said. “They remain inadequate in specifying a set of rules over management of their subsidiaries.”

By Park Hyong-ki (

hkp@heraldcorp.com)