|

An employee at the headquarters of Hana Bank in Seoul looks into a batch of US dollar bills to single out counterfeits, if any. (Yonhap) |

SEJONG -- The Korean currency has lost its value against the US dollar, in another phase of the fluctuations that have occurred since COVID-19 started hitting the world a year ago.

The pandemic situation has increased volatility in the won-dollar foreign exchange rates, which has become a factor aggravating difficulties, held by a large portion of local businesses.

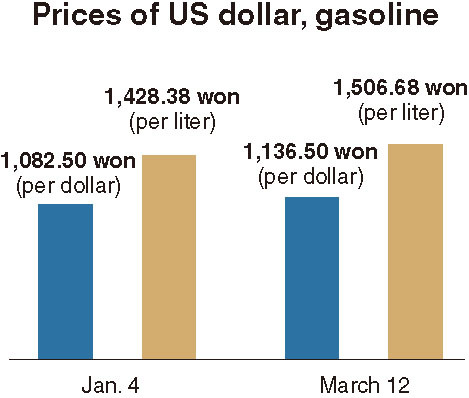

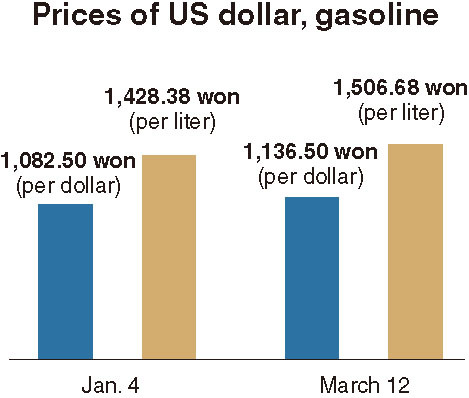

The dollar, which traded at 1,082 won during the first trading session (Jan. 4) of the year, climbed 5 percent in only two months to reach 1,136.5 won as of March 12.

The cheap won could pose a burden on businesses in terms of higher manufacturing costs from a rise in import prices of raw materials. Korean people -- many of whom have been active in global online shopping and in US stocks -- will have no choice but to pay more for the dollar-denominated assets.

The weakness in the local currency also weaken attractiveness of Korean stocks among overseas investors.

But it seems that policymakers are glossing over the situation as this could certainly benefit the nation’s export performance, which was sagging throughout last year in the wake of the epidemic.

|

(Graphic by Kim Sun-young/The Korea Herald) |

A futures trading analyst in Seoul said monetary policymakers should intervene in the market, if necessary, to block further weakness of the local currency.

“A cheap won is not always beneficial to local exporters. If the dollar prices reach 1,250 won, export-driven businesses should also bear huge cost burden from price hikes in imported manufacturing parts,” he said.

The strong greenback is attributed to growing optimism on a fast recovery in the US economy, buoyed by a full-fledged stimulus package by the US policymakers to reinvigorate the economy.

In contrast, the Korean government appears to have few options to boost the economy at the currency stage.

The Moon Jae-in administration had already fostered a series of supplementary budgets over the past four years, which has been threatening fiscal soundness. Further, many people are questioning the efficacy of the past extra budgets in terms of creating jobs and boosting the domestic demand.

Former administrations generally used stimulus for the construction sector to boost the economy by easing regulations in the real estate market drastically. The Bank of Korea is estimated to have assisted it by cutting the benchmark interest rates.

But the option via the construction-deregulation is not suitable for the present situation: Interest rates have been set at the record-low of 0.5 percent per annum, while apartment prices have already been skyrocketing due to de facto failures in real estate policies.

Further, uncertainty over the supply of COVID-19 vaccines for ordinary people is still hampering a recovery in private consumption and sales of retailers including the self-employed, who make up more than 20 percent of the total workers in the nation.

The daily tally for virus infections across the nation is also climbing again, which would undermine hopes for a fast recovery in the economy.

Alongside the falling value of the local currency, a core index, which could be harmful to the economy, is international oil prices.

In line with a steady rise in crude prices, Korea’s gasoline price climbed to 1,509.97 won ($1.32) per liter as of Saturday. This marked the highest in 12 months since it posted 1,510.79 won on March 8, 2020.

The gasoline price rose by 14.6 percent in less than four months after dipping to 1,317.12 won on Nov. 18, 2020.

By Kim Yon-se (

kys@heraldcorp.com)