|

A signboard for the issuance of credit cards and household loans is seen at a commercial bank branch in Seoul. (Yonhap) |

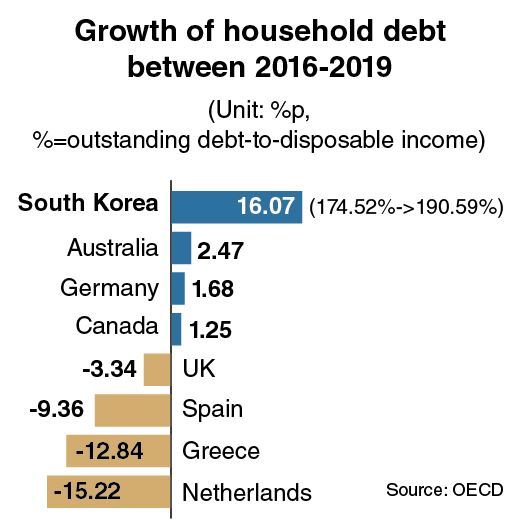

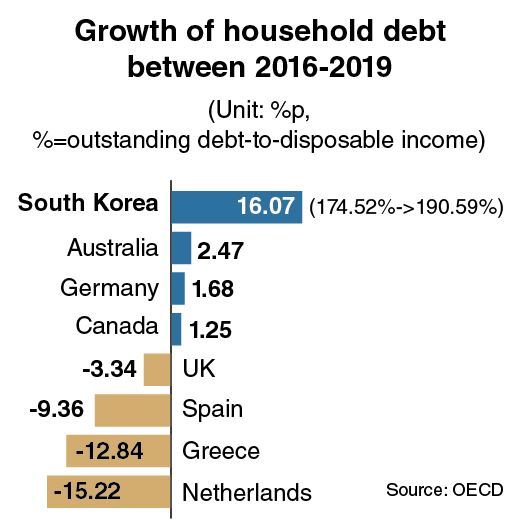

SEJONG -- In 2016, South Korea saw collective household debt to net disposable income reach 174.52 percent, according to the research by the Organization for Economic Cooperation and Development.

The figure grew further to 181.81 percent in 2017, 184.99 percent in 2018 and 190.59 percent in 2019 amid a continuous climb in financial services firms’ outstanding loans, such as mortgages and credit-based lending, issued to the household sector.

The 16.07 percentage point increase of Korea during the 2016-2019 period marked the second-fastest figure among 24 OECD countries. Of the total 37 members, figures for 13 countries have yet to be compiled.

This contrasts with a climb of 8.75 percentage points in Switzerland, 6.29 percentage points in France, 4.93 percentage points in Sweden and 2.47 percentage points in Australia.

Germany (1.68 percentage points), Canada (1.25) and Italy (0.49) posted less than 2 percentage point growth over the corresponding three-year period.

|

(Graphic by Kim Sun-young/The Korea Herald) |

The countries whose household debt levels were curbed include the UK with minus 3.34 percentage points, Spain with minus 9.36, Portugal with minus 11.75, Greece with minus 12.84, the Netherlands with minus 15.22 and Ireland with minus 34.69.

Only Finland held a figure higher than that of Korea, as it posted a 16.56 percentage point increase in the ratio of debt-to-disposable income of the household sector.

Of the members, which have yet to make public their 2019 data, Japan posted growth of 1.8 percentage points from 105.22 percent in 2016 to 107.02 percent in 2018.

While the figure for Colombia inched up 1.11 percentage points to 47.16 percent in 2018, the US saw the ratio declined by 3.82 percentage points from 108.4 percent in 2016 to 104.58 percent in 2018.

Alongside the growth pace, the level of debt-to-disposable income (190.59 percent) held by Korean households was quite high in the OECD. It marked No. 5 among the 24 countries that publicized their 2019 figures.

For the corresponding 2019 figures, it contrasted from 141.65 percent in the UK, 122.26 percent in Portugal, 122.13 percent in France, 104.97 percent in Spain, 96.21 percent in Germany and 88.18 percent in Italy.

Latvia recorded the lowest figure with 40.52 percent. The next-lowest were Hungary with 42.21 percent, Lithuania with 43.7 percent and Slovenia at 55.32 percent.

Among other members with figures below 100 percent were the Czech Republic (76.26 percent), Estonia (76.43 percent), Slovakia (79.03 percent) and Austria (89.79 percent), which means their disposable income exceeded their household debt.

The top two with the highest ratios of household debt to disposable income were Denmark at 256.67 percent and the Netherlands at 235.66 percent as of 2019.

Korea’s many online commenters and analysts share the view that de facto failures in real estate policies have caused the failure in curbing mounting consumer debt.

The Moon Jae-in administration has implemented a variety of regulations in the housing market, including restrictions on mortgages.

But more people, including the younger generation in their 20s and 30s, have actively joined the move to buy apartments by taking out credit-based loans to make up for lowered permission in the ratio of bank mortgages to house value.

The fever of buying homes has been aggravated in 2020 amid young people’s impetuosity -- or a Korean syndrome that they feel they might not be able to buy apartments forever if the timing is delayed -- amid quickly climbing apartment prices despite the government-led anti-speculation measures.

The low interest rates set by the Bank of Korea have also fanned a fever of loans. During Moon’s term since May 2017, the nation’s benchmark rate has ranged between 0.5 percent and 1.75 percent per annum. It has remained at the all-time low of 0.5 percent since May 2020.

By Kim Yon-se (

kys@heraldcorp.com)