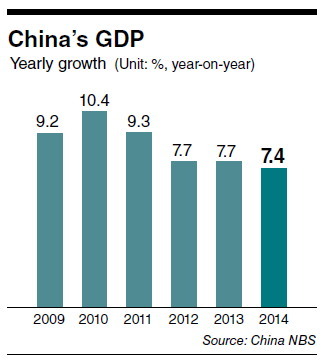

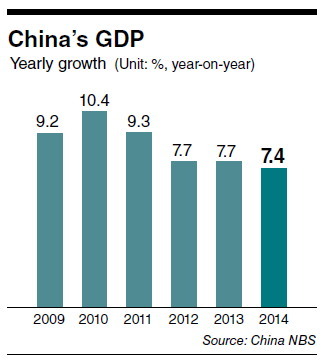

BEIJING (AFP) ― China’s gross domestic product grew 7.4 percent in 2014, official data showed Tuesday, slumping to a 24-year low with authorities describing the slower pace as the “new normal” for the world’s second-largest economy.

The figure announced by the National Bureau of Statistics was slower than the 7.7 percent seen in 2013, but exceeded the median forecast of 7.3 percent in an AFP survey of 15 economists.

Growth in the final quarter of the year also came in at 7.3 percent year-on-year, the NBS said, matching the previous three months and beating the 7.2 percent median forecast in the AFP survey.

“China’s economy has achieved stable progress with improved quality under the new normal in 2014,” NBS chief Ma Jiantang told reporters.

“However we should also be aware that the domestic and international situations are still complicated and economic development is facing difficulties and challenges.”

|

An investor is seen at a trading hall of a securities firm in Hefei, China, Monday. ( Xinhua-Yonhap) |

The full-year result, the worst since 3.8 percent recorded in 1990, comes after one of the pillars of the global economy was hit by manufacturing and trade weakness as well as declining prices for real estate, which has hammered the key property sector.

Beijing had set an official target of “about” 7.5 percent for last year.

The goal is traditionally pegged at a level that is easily achieved, and is usually approximated to provide room for positive spin just in case it is missed. The 2014 result is the first miss since 1998, during the Asian economic crisis.

The Shanghai benchmark index rallied 1.80 percent in late morning trade.

Economists were largely upbeat on the results, but said they did not alter the outlook for further slowing this year.

“The 2014 GDP result is better than market expectations and barely missed the target,” ANZ economist Liu Li-Gang told AFP. “This result is not too bad.”

Nomura economists expect GDP to trend lower following the “short respite” at the end of last year “given deep-rooted domestic challenges such as tighter controls over local government debt, the property market correction and deleveraging,” they said in a note following the figures.

For this year, the economists in the AFP survey see a median 7 percent expansion.

In its latest World Economic Outlook update, released Tuesday, the International Monetary Fund projected even slower growth this year, of 6.8 percent.

The NBS also said industrial production, which measures output at factories, workshops and mines, accelerated to rise 7.9 percent year-on-year in December from 7.2 percent in November.

Retail sales, a key indicator of consumer spending, also grew at a slightly faster 11.9 percent in the same month.

Fixed asset investment, a measure of government spending on infrastructure, expanded 15.7 percent on-year for the whole of 2014, weakening from the 15.8 percent recorded for the first 11 months of the year.

Despite the slowdown last year, authorities say they intend to stick to the path of transforming the economy into one where growth is increasingly driven by consumer spending rather than big ticket investments, and emphasizing quality of expansion over size.

Premier Li Keqiang has said slowing growth is no worry so long as job growth in the world’s most populous country does not suffer.

Ma, the NBS chief, said China’s “internal survey rate” for unemployment in 2014 was about 5.1 percent, but refused to provide a comparative figure for the previous year.

Authorities last year did not take an entirely hands off approach to the growth slowdown, implementing a series of targeted measures analysts described as “ministimulus.” And in November the central People’s Bank of China cut interest rates for the first time in more than two years to try to put a floor on the slowdown.

Li told China’s State Council, or Cabinet, on Monday that authorities would strike a balance between stabilizing growth and pushing structural reforms in 2015, state media reported.

“As the global economy is undergoing a deep restructuring and slow recovery, China’s government will likely face heavy tasks in tackling the difficulties,” he said, according to the official Xinhua news agency.

Economists are broadly expecting further monetary policy tinkering this year, including at least one more interest rate cut, but say the focus will be on reforms over the temptation of major stimulus.

“There should be further easing, but large-scale easing is unlikely,” Liao Qun, Hong Kong-based economist for Citic Bank International, told AFP.

“The economy does not need a strong stimulus, as long as it’s enough to help it stabilize and not slide further.”

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)