|

A view of apartment complexes in Seoul (Yonhap) |

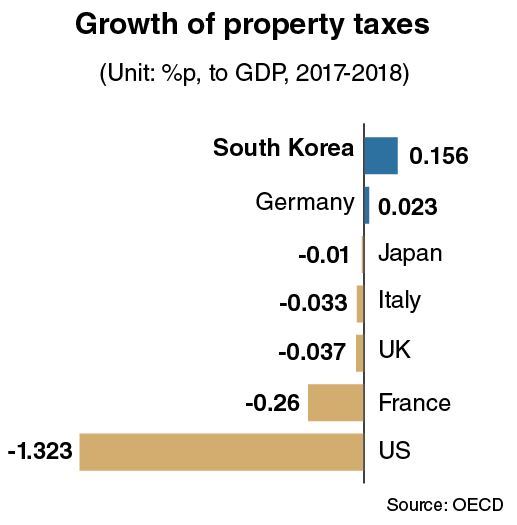

SEJONG -- Compared with other members of the Organization for Economic Cooperation and Development, in recent years South Korea saw its property taxes grow at the second-fastest rate.

Taxes levied on property in Korea -- including real estate and other wealth -- came to 3.3 percent of the gross domestic product in 2018, the latest year for which figures are available. By comparison, those taxes amounted to 3.144 percent of the nation’s GDP in 2017.

The increase -- 0.156 percentage point on-year -- was second on a list of corresponding figures for 34 OECD members. The Paris-based organization did not include any data for three of its 37 members: Australia, Colombia and Mexico.

The OECD specified that the comparison included taxes on immovable property or net wealth, taxes on changes of ownership of property through inheritance or gifts, and taxes on financial and capital transactions. The changes were measured both in percentage of GDP and percentage of total taxation.

In terms of growth in property taxes, Korea outstripped Portugal, which posted 0.082 percentage point from 1.358 percent of GDP in 2017 to 1.44 percent of GDP in 2018. Korea was also ahead of Denmark (0.05 percentage point), New Zealand (0.035 percentage point), Ireland (0.03 percentage point), Germany (0.023 percentage point), Belgium (0.008 percentage point) and the Netherlands (0.007 percentage point).

Many of the 34 economies posted negative figures. Among them were the US with minus 1.323 percentage points, France (minus 0.26), Finland (minus 0.102), Canada (minus 0.054), Sweden (minus 0.042), the UK (minus 0.037) and Japan (minus 0.01).

|

(Graphic by Kim Sun-young/The Korea Herald) |

Only Luxembourg, which posted 0.185 percentage point, saw its property taxes grow faster than Korea’s relative to its GDP.

The international data indicates that the Moon Jae-in administration, which came to power in May 2017, actively raised tax rates for real estate and other financial wealth held by households and enterprises during the early part of its tenure. The figure is estimated to have climbed further in 2019 and 2020 due to a government policy favoring increased tax revenue.

In a similar vein, Korea was No. 3 among the OECD members in terms of increasing taxes on corporate earnings over the corresponding 2017-2018 period.

Taxes levied on the net profit (gross income minus allowable tax relief) of enterprises in Korea reached 4.47 percent of the GDP in 2018, having climbed from 3.83 percent of GDP in 2017.

Korea’s 0.64-percentage-point growth was the third-highest among the 34 OECD members. Three members -- Australia, Colombia and Greece -- were excluded from the comparison.

Korea outpaced Japan, which showed a 0.42 percentage point advance, as well as Sweden (0.17), Portugal (0.14), Germany (0.11) and the UK (0.07).

Further, 14 of the 34 economies posted negative growth of corporate taxes relative to GDP growth.

Those included Hungary with minus 0.91 percentage point growth, the US (minus 0.67), Iceland (minus 0.52), Denmark (minus 0.37), the Czech Republic (minus 0.26), France (minus 0.22), Canada (minus 0.09), Mexico (minus 0.07) and Switzerland (minus 0.06).

Only two members -- Norway (positive growth of 1.12 percentage points) and Luxembourg (0.68 percentage point) -- were faster than Korea in this respect.

In an arithmetical comparison, Korea ranked No. 5 in 2018 with corporate taxes standing at 4.47 percent of GDP, whereas it was No. 7 with 3.83 percent in the previous year.

The figure far exceeded the 1.06 percent of GDP posted by the US in 2018, 1.17 percent by Hungary, 1.88 percent by Italy, 2.11 percent by France, 2.14 percent by Germany, 2.47 percent by Spain, 2.56 percent by Finland and 2.88 percent by the UK.

By Kim Yon-se (

kys@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)