|

Signboard for the Finance Ministry at Government Complex Sejong (Yonhap) |

SEJONG -- South Koreans owning homes worth 900 million won ($775,000) or less have an exemption from capital gains taxes when they sell them, as long as they are not multiple home owners. They pay only property taxes as usual.

But Koreans holding stocks of a listed company worth 300 million won or over will likely be obliged to pay taxes on gains from trading the stocks, starting from next year.

Further, the tax rates will range between 20 percent and 25 percent of their gains, as the specified investors will be classified as major shareholders, according to regulations being considered by the Ministry of Economy and Finance.

As a result, more and more stock investors are claiming that the policy goes against the principle of equity in taxation on between stock traders and real estate owners -- two of the main targets for tax revenue.

“An apartment per household might be approached as a residence, rather than an investment. Nonetheless, there should be equivalence in taxation between real estate and stocks in proportion to asset levels,” said one online commenter.

“There are many houseless stock investors, who try to increase their cash in order to purchase apartments,” a commenter said. “Given that the average trading price per apartment unit in Seoul has exceeded 1 billion won, it is nonsense that holders of equities worth only 30 percent (300 million won) of the apartment value would legally be considered major shareholders.”

|

(Graphic by Kim Sun-young/The Korea Herald) |

In Gangnam-gu, Seoul, the average trading price for 84-square-meter apartment units hovered over 2 billion won in September.

Apartment prices across the 25 wards in Seoul have also climbed by 50 to 100 percent since the Moon administration took office in May 2017. In contrast, it is almost impossible for ordinary investors to achieve 50 percent gains in their stock values in only three years.

The Finance Ministry is considering drastically widening the territory of major stakeholders from the “current 1 billion won” or more for stocks in a single company to 300 million won or more.

There are two major criticisms among the public over the scheme.

One argument is that the Moon Jae-in administration has been in a desperate struggle to collect as much taxes as possible to pay for a series of huge supplementary budgets.

The other speculation raised among them is that the left-wing administration is striving to block people in the middle-income bracket from becoming rich.

In addition, there is also a taxation disparity between small investors and foreign institutional investors.

Foreign institutions are exempt from capital gains taxes if their stakeholding in a local company is less than 25 percent.

In a similar vein, local institutional investors are not affected by the coming revised rules on major shareholders. They are only subject to corporate taxes.

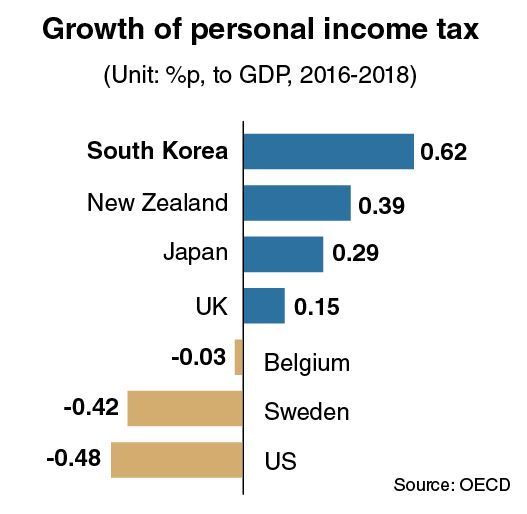

During the 2016-2018 period, South Korea ranked 4th among the members of the Organization for Economic Cooperation and Development in terms of growth of tax on personal (or household) income. The OECD compared 34 of its 37 members, excluding Australia, Colombia and Greece.

In 2016, total individual income tax receipts were equivalent to 4.61 percent of gross domestic product. The nation saw the figure climb by 0.62 percentage point to 5.23 percent to the GDP in 2018.

The figure compares to a 0.29 percentage point growth to the GDP in Japan, a 0.15 percentage point growth in the UK and a negative 0.48 percent point growth in the US.

By Kim Yon-se (

kys@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)