|

A view of Sejong earlier this month, where the Government Complex is located (The Korea Herald) |

SEJONG -- South Korea’s national debt is projected to surpass 800 trillion won ($682 billion) in the coming weeks, marking the first time in its history. The growth pace is proving serious in the wake of the government’s active allocation of supplementary budgets.

The national debt is a core indicator for fiscal soundness, reflecting liabilities held by the central and local governments at home and abroad.

According to the National Assembly Budget Office, the sovereign debt was estimated at 799.4 trillion won as of Wednesday.

Given that Korea’s nominal gross domestic product was estimated at 1,930 trillion won (or $1.64 trillion, according to the estimate from the Organization for Economic Cooperation and Development) in 2019, the ratio of national debt to GDP is assumed to have already surpassed the 40 percent mark to post 41.4 percent -- on the basis of an arithmetical calculation.

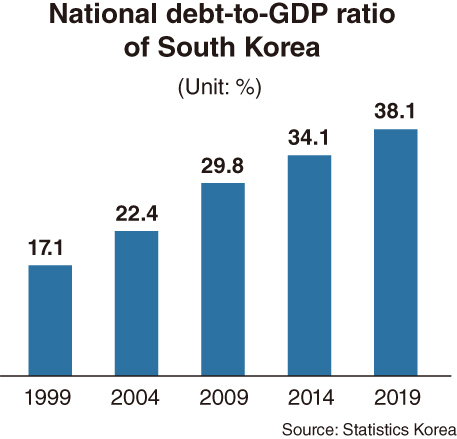

Statistics Korea data showed that the national debt-to-GDP ratio reached an all-time high of 38.1 percent at the end of 2019, compared to 35.9 percent at the end of 2018.

Outstanding debt increased by 48.3 trillion won, or 7 percent, from 680.5 trillion won in 2018 to 728.8 trillion won in 2019.

|

(Graphic by Kim Sun-young/The Korea Herald) |

Given the debt-to-GDP ratio, just 29.7 percent in 2010 and 17.1 percent in 2000, it is irrefutable that alarm bells have been ringing over the nation’s fiscal soundness.

But some ruling party lawmakers and government officials placate the people, saying the debt-to GDP level far falls below the OECD average.

Government officials say the stimulus measures, including active issuance of treasury bonds and use of taxpayer money, have benefited the overall economy. Government expenditure has become more vigorous this year as countermeasures against a sagging economy hit by the novel coronavirus.

On the contrary, critics have continued to question the efficacy of fiscal expansion via increasing debt under the Moon Jae-in administration. They pointed to a sharp increase only in nonregular jobs and to disappointing GDP growth -- 2 percent in 2019, the lowest rate in a decade.

The estimates from the National Assembly Budget Office also suggest that the national debt per capita came to 15.42 million won for a population of 51.8 million.

The figure surged by about 1 million won in only seven months, compared to February 2020, when the coronavirus started dealing a blow to the economy, after topping the 13 million won mark for the first time in February 2018.

The per capita sovereign debt stayed at 11.59 million won at the end of 2015. This means that an ordinary citizen’s national debt burden has surged by 33 percent in less than five years.

A finance research analyst said that “whenever the Finance Ministry issues state bonds for the purpose of reinvigorating the economy, this inevitably causes a surge in national debt and increases the tax burden, which will ultimately be borne by ordinary households.”

Earlier, a ruling Democratic Party of Korea lawmaker was quoted by a news provider as saying that the ministry was backing away from its earlier plans to limit the national debt-to-GDP ratio to about 41.6 percent for the 2018-2022 period, and was now prepared to tolerate a figure that approaches 45 percent by 2022.

If his remarks are convincing and going in line with policies of the presidential office, the Moon administration may possibly continue to use taxpayers’ money too freely and issue bonds just as freely for 19 more months until his term expires in May 2022.

By Kim Yon-se (

kys@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)