|

Flags of the members of the Organization for Economic Cooperation and Development are seen at its headquarters in Paris. Three more added to 37 in total after the photo was taken. (OECD) |

SEJONG -- South Korea’s tax revenue was found to have increased fastest among the members of the Organization for Economic Cooperation and Development.

The Korean government’s tax revenue -- the state’s income from taxation -- was equivalent to 28.42 percent of the nation’s gross domestic product in 2018 (the latest available), according to OECD comparison data.

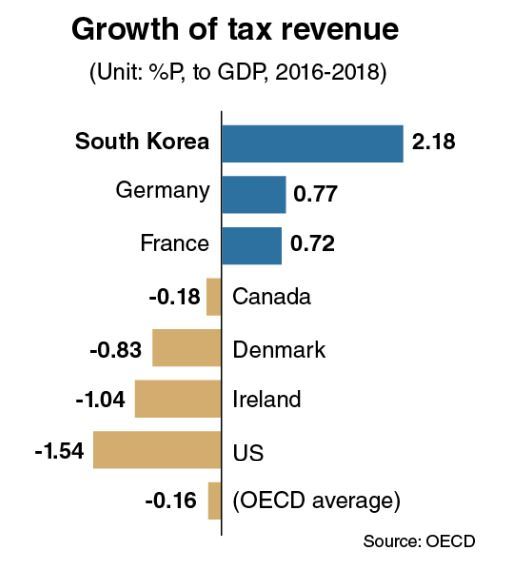

The figure posted an increase of 2.18 percentage points in only two years, compared to 26.24 percent of GDP in 2016. President Moon Jae-in took office in May 2017.

The growth was the highest among 34 OECD members for the corresponding period (The 2018 data for Australia, Colombia and Japan were excluded of the total 37 OECD members).

The average for the 34 economies stayed at minus 0.16 percentage point -- from 34.42 percent to the GDP in 2016 in tax revenue to 34.26 percent in 2018.

A noteworthy point in the tax-revenue growth comparison was Switzerland, which posted a 0.23 percentage point growth from 27.71 percent of GDP to 27.94 percent, meaning South Korea overtook Switzerland during the 2016-2018 period.

|

(Graphic by Kim Sun-young/The Korea Herald) |

The US saw the figure retreat by 1.54 percentage points from 25.87 percent to 24.33 percent. Ireland and Turkey, whose figures for the ratio of tax revenue-to-GDP are also in the 20-percent range, also posted a negative growth -- minus 1.04 percentage points and minus 0.95 percentage point, respectively.

Luxembourg was only one of the two, alongside Korea, which recorded over a 2 percentage point growth. Its figure rose 2.11 percentage points.

While Poland and Portugal posted 1.49 percentage point and 1.27 percentage point growth, the growth held by the UK (0.81), Germany (0.77), France (0.72) and Austria (0.27) was less than 1 percentage point.

Among the countries whose tax burdens eased were Canada with minus 0.18 percentage point, Italy with minus 0.26 percentage point, Sweden with minus 0.28 percentage point, Mexico with minus 0.49 percentage point and Denmark with minus 0.83 percentage point.

The biggest decreases were seen in Ireland (minus 1.04), Finland (minus 1.36) and Hungary (minus 2.6).

Iceland posted the biggest decrease among the 34 members with a minus 14.12 percentage point growth, but this was due to one-off taxes of financial services firms in earlier years inflating the baseline figure.

Meanwhile, South Korea ranked fourth in terms of growth of tax on personal (or household) income over the corresponding two-year period. The OECD compared 34 of its 37 members -- excluding Australia, Colombia and Greece -- as for the 2018 data.

In 2016, the Korean government levied income tax on households, whose collective amount was equivalent to 4.61 percent of GDP. The nation saw the figure climb by 0.62 percentage point to 5.23 percent to the GDP in 2018.

Only three -- Iceland (a 0.96 percentage point increase), France (0.91) and the Netherlands (0.87) -- ranked above Korea in the growth of personal income tax for the 2016-2018 period.

The ratio of income tax to the GDP grew less than 0.5 percentage point among the members including Germany (0.44), New Zealand (0.39), Japan (0.29), Luxembourg (0.16) and the UK (0.15).

The countries with a negative growth in the ratio of personal income-to-GDP included Belgium at minus 0.03 percentage point, Sweden (minus 0.42), the US (minus 0.48) and Finland (minus 0.71).

“The arithmetic level of tax revenue and household income of Korea are relatively low compared to ordinary OECD members,” an analyst in Seoul said. “But the high rankings in terms of growth suggest that the government has become more active in collecting taxes.”

By Kim Yon-se (

kys@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)