|

Apartment complexes in Yongsan-gu and Yeouido in Seoul (Yonhap) |

Reflecting the Moon Jae-in administration’s stubborn efforts to steady the bubble-prone real estate market, the 22nd set of policy actions were rolled out last week to curb prices.

The “July 10 measures” focused on increasing the tax burden for multiple-home owners, but was also seen as part of its series of flustered responses to underperforming measures.

Despite a series of restraint measures, housing prices in Seoul and major cities across the country have been on a steep rise this year, sparking concerns particularly among non-homeowners that they have become prey to such policy drive theoretically targeted at multiple-home owners.

In its recent move to curb housing prices here, the Ministry of Economy and Finance announced Friday that it will raise property ownership tax rates for multiple-home owners. Under the enhanced rules, those who own three or more homes and those who own two or more homes in “adjustment target” areas will see their comprehensive real estate tax rate climb from the current 0.6-3.2 percent range to the 1.2-6 percent range.

“The government has announced the latest measures under the grave judgment that we now stand at a crossroads when it comes to housing problems,” Vice Finance Minister Kim Yong-beom said Monday in a radio interview.

“Our clear message to the people is that houses can no longer and should no longer be seen as speculative assets.”

The market reality, however, is the opposite so far.

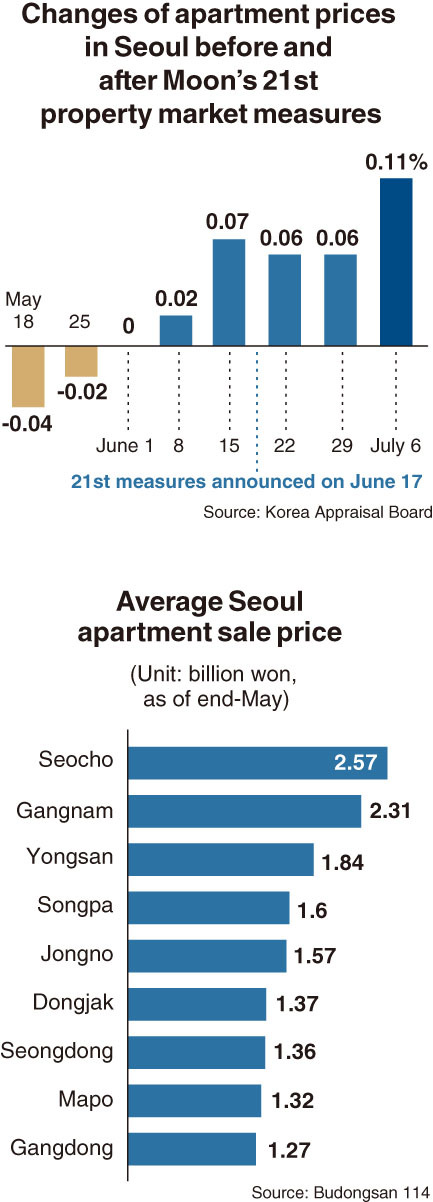

According to the Korea Appraisal Board, the cumulative fluctuation rate for apartments across the nation marked a 2.74 percent rise so far this year as of June 29 -- shortly after the government’s June 17 measures.

What stood out in this year’s market trend is the rapid price hike observed in key nonmetropolitan cities such as Sejong and Daejeon, which are home to a majority of the government complexes and state-run institutes.

The two cities marked 16.07 percent and 9.42 percent, respectively, in cumulative apartment price increases during the first half of the year, in contrast to the slight fall or marginal rise a year earlier.

Market observers attributed the rapid hike to market participants’ change of stance, citing the soaring demand of end-users, especially first-time buyers in their 30s.

“The key variable (for the market trend this year) is that the relatively young homebuyers in their 30s have all plunged at once into the (housing) market,” said Park Won-gab, a senior adviser for real estate at KB Kookmin Bank.

“Such anxiety of young buyers, combined with the excess liquidity due to the low interest trend and COVID-19, is adding heat to the asset market.”

While acknowledging that the latest buying craze is largely a reflection of actual demand rather than speculative intentions, the expert underlined the urgent need to alleviate the bottleneck phenomenon among young consumers.

“Despite the government’s struggle to further enhance its previous real estate regulations, the latest July 10 actions will only have limited impact on the market,” said Seo Young-soo, an analyst at Kiwoom Securities.

For instance, the increase of the property ownership tax cannot induce speculative buyers to sell off their surplus houses, he pointed out.

“As of last year, only 510,000 peoplewere subject to the comprehensive tax, and these people have the financial capacity to endure the hike on the back of credit loans and other means,” Seo said.

“Meanwhile, the government’s move to reduce the acquisition tax for non-homeowners may ironically trigger a price hike in the lower-price tier, which will consequently weigh upon (nonspeculative) end users.”

Faced with criticism, however, the government has continued to push ahead with its policy stance, underlining that the financial restrictions will take effect in time.

Policymakers are working on increasing the real estate acquisition tax rate for multiple-home owners.

The plausible tax rate under discussion is a hike to an 8-12 percent range from 4 percent, according to officials of the Ministry of Economy and Finance and the ruling Democratic Party of Korea. Such a scenario seeks to discourage speculative asset owners from transferring their surplus house to family members as a tax-evading expedient.

“The financial restrictions carried out so far had their limits in steadying the overheated housing market, as they have not yet been legislated into effective laws,” Land Minister Kim Hyun-mee said in a recent interview, underlining that the government has consistently sought to block speculative actions and to protect end users.

Addressing the fundamental supply shortage and the call for reconstruction deregulations, however, the minister refrained from providing details, only adding that the central government will continue to consult with provincial governments.

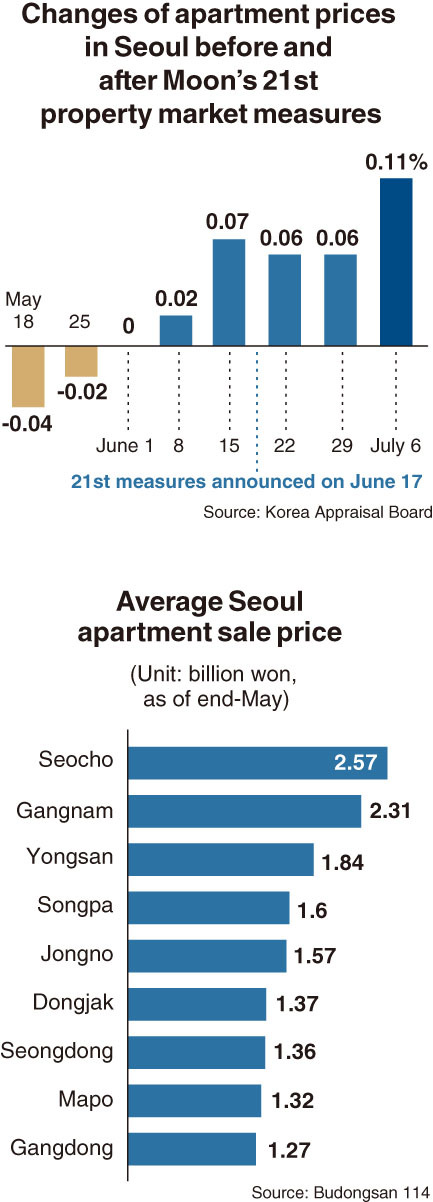

According to a report issued last month by the Citizens’ Coalition for Economic Justice based on KB Kookmin Bank’s data, the median price of Seoul apartments had climbed 52 percent from 606 million won ($505,000) to 920 million won during the three years of the Moon administration as of May this year.

Adding to the financial burden of aspiring homebuyers is growing fatigue over the excessive frequency of real estate policy announcements and the intricate rules on loans and taxation.

Such a backlash has not only dragged down the public’s support for the incumbent administration, but also led to growing calls for the land minister’s resignation.

A regular poll by local research firm Realmeter showed Monday that President Moon’s support rating stood at 48.7 percent as of the second week of July, lingering in the 40 percent range for two weeks straight after seven weeks of straight declines.

While also affected by other political reasons -- such as the ongoing feud between Justice Minister Choo Mi-ae and Prosecutor General Yoon Seok-youl, as well as the controversial death of progressive Seoul Mayor Park Won-soon -- the key factor for the public sentiment was mostly attributed to turbulent housing prices.

Opposition camp figures, including United Future Party interim chief Kim Chong-in and People’s Party Chairman Ahn Cheol-soo, demanded that the land minister step down to take responsibility for what they saw as the “policy failure” of the government.

Cheong Wa Dae, however, apparently has no plans to heed such calls.

“I understand that no replacement has been planned for Minister Kim,” a senior official of the Blue House told reporters last week, in answer to related questions.

By Bae Hyun-jung and Jung Min-kyung (

tellme@heraldcorp.com)(mkjung@heraldcorp.com">

tellme@heraldcorp.com)(mkjung@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)