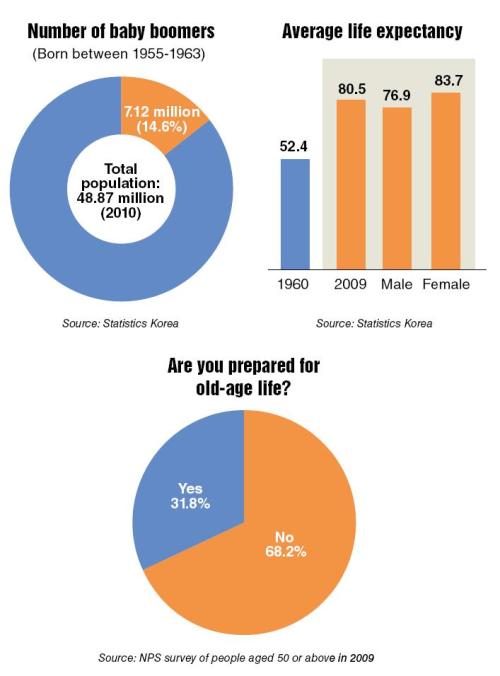

With those born in 1955 reaching corporate retirement age usually set at 55 to 58, an average of 500,000 baby-boom generation workers are set to retire every year through 2017, Employment and Labor Ministry officials forecast.

Many experts are highlighting the problems arising from the massive retirement of baby boomers, most of whom, like Sohn, are not prepared for life after retirement.

Coupled with prolonged life expectancy, they warn, the retirements could lead to a “social catastrophe.”

“The baby boomers are the last generation who consider it their duty to care for their parents and the first generation who cannot expect their children to take care of them,” said Woo Jae-ryong, who heads the Samsung Life Retirement Research Center. If no proper measures are taken, many retirees from the baby-boom generation will fall below the poverty line, he said.

Double duty

In a 2010 survey of 3,027 baby boomers, over 51 percent of the respondents held themselves responsible for financially supporting their parents, while a mere 3.3 percent expected to be looked after by their children in their declining years.

The survey by the Korea Institute for Health and Social Affairs also showed that more than half of the baby boomers were willing to support their children well beyond adult age. Of those ready to help their adult children, 41.5 percent said they would do so until their children married.

The features of the baby-boom generation sandwiched between duties for their parents and children make it difficult for them to prepare for life after retirement.

A 2009 survey by a research institute affiliated with the National Pension Service found that nearly seven out of every 10 people aged 50 or above had made no effective preparation for post-retirement life.

Another survey by a Seoul National University research institute of 4,668 baby boomers, which was released in March, showed that they saved an average of 170,000 won ($155) per month while they thought at least 2.11 million won would be needed to meet their monthly living expenses after retirement. Their current household income averaged 3.86 million won per month.

Most baby bombers are increasingly aware of the need to prepare for life after retirement but have difficulties setting aside money for that purpose under the heavy burdens of educating their children and paying off mortgages, said Lee Chang-seong, chief economist at the retirement research center.

In a recent survey by the research center, nearly half of the respondents financially unprepared for their old age cited the cost of their children’s education (37 percent) and marriage (12 percent) as the main reasons for their failure to save money for life after retirement.

He said parents, long before getting retired, should begin talking with their children on the limit of the financial support they can provide. Lee, 48, said he has tried to talk about the matter with his son and daughter who go to high school and middle school, respectively.

“But they don’t seem to listen too seriously,” said Lee.

Noting that Korean households retain over 80 percent of their assets in the form of real estate, Lee advised baby boomers approaching retirement age to secure more cash by reducing housing expenses.

Long life expectancy

Experts are concerned that the predicament of the baby-boom generation retirees is likely to be prolonged and complicated as their life expectancy gets longer.

According to figures from Statistics Korea, the average life expectancy of Koreans, which was 52.4 in 1960, increased to 80.5 in 2009 ― 76.9 for men and 83.7 for women. If the average life expectancy grows at the current annual pace of 0.5 year, a Korean currently aged 35 can expect to live until he or she turns 100.

The number of senior citizens aged 65 or above is estimated to account for 24.3 percent of the population by 2030, doubling from 11 percent in 2010.

The prolonged life expectancy is likely to result in more baby boomers being plunged into poverty with the cost of medical treatments sharply increasing in their old age, experts say. Female senior citizens, in particular, are more likely to fall below the poverty line as they usually outlive their male spouses.

According to statistics from the NPS, over 35 percent of elderly households were below the poverty line in 2009, compared to 14.1 percent of all households.

“A large group of poor senior citizens will become a destabilizing factor for society,” said Woo, the head of the retirement research center. He stressed that serious social debate must be had as soon as possible to work out a scheme to ensure baby boomers will live a secure life after retirement. Woo said more efforts should be made to create more decent jobs for senior citizens in order to lessen the burden on the government and the coming generations.

The gloomy old days may be more painful for the baby-boom generation which is more educated and more inclined to regard itself as belonging to the middle-income class than previous generations.

The KIHSA survey of 3,027 baby boomers showed that more than 75 percent of them had a high school diploma or higher, compared to 11 percent of their parent’s generation. Nearly 90 percent of them put themselves in the middle-income bracket.

“Most baby boomers seem to be unprepared psychologically as well as financially for life after retirement,” said Woo. “They have a very weak vision for post-retirement life.”

Social roles

Juch Myong-yong, who heads the Korean Association of Retired Persons, suggests that the retirement age be delayed by seven to eight years and education on life after retirement should be provided at least five years before reaching retirement age.

“In reality, such an education is offered just two to three months before retirement only at large companies,” Juch said. “Most small- and medium-sized companies, which hire more than 90 percent of the whole workforce, have no such programs.”

He emphasized that retirement doesn’t mean the end of life but a starting point for walking a new path.

“Retirees should try to find social roles regardless of their financial status,” said Juch. “People can feel completely secure only when they take roles in society.”

Experts advise younger generations to take on planning for life after retirement at an early stage to avoid the predicament facing the baby-boom generation.

“The sooner, the better,” said Lee of the retirement research center.

He cited the “caffe latte effect,” which means that if a young worker stops his or her daily habit of drinking a cup of premium coffee worth 4,000 won to 5,000 won and saves the money for about 30 years, he or she would save nearly 200 million won.

By Kim Kyung-ho (

khkim@heraldcorp.com)