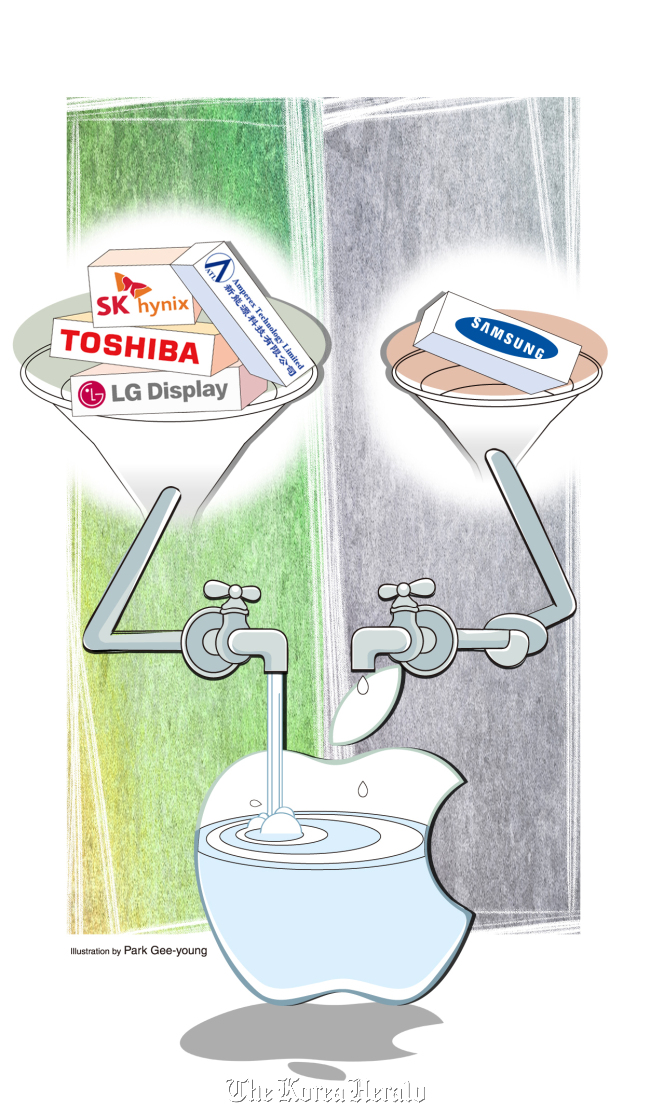

Gone are the days when rival electronics firms set apart their parts supply businesses from current affairs such as patent disputes.

It was in April of last year when Apple Inc. filed a lawsuit involving patent infringement against Samsung Electronics at a court in San Jose, and the two have been putting forward multiple suits against each other in nine different countries ever since.

While Samsung has stressed numerous times that it will maintain its partnership with the Cupertino-based IT behemoth in parts supply ― trying to completely separate it from the worldwide patent battle ― the relationship is fast souring.

Apple depending less on Samsung

According to data from market research firm NPD DisplaySearch, Apple has substantially lowered the number of liquid-crystal display panels it receives from Samsung Display for the 9.7-inch iPad throughout the year.

Data said the portion of the LCD displays provided by Samsung Display to Apple for the iPad had shrunk to 7.2 percent, or 428,000 units, in October, from over 2.57 million units ― taking up 70 percent of panel shipments to Apple ― in March.

Industry sources also confirmed that Apple is no longer using the battery produced by Samsung SDI for its latest iPad mini.

Samsung SDI is thought to be still supplying its batteries to the 9.7-inch iPad and Macbook laptop, but putting a pause to battery supply for Apple’s most recent product shows that a twist exists in the two’s relationship, they said.

Application processors are another area to focus on, with the U.S. firm having contacted Taiwanese firm TSMC to make mobile processors for the iPhone 5. But the two so far could not finalize the deal due to technological requirements.

Samsung, too, is reducing its supply to Apple, the biggest buyer of its components. Industry sources said the Korean tech firm is feeling the need to diversify its supply line and in fact, deals with other buyers are increasing. They said the company seems to be confident as it has advanced technology in producing mobile digital devices’ core parts such as application processors. Samsung reportedly hiked AP prices by more than 20 percent and Apple had no choice but to accept it because of the high quality of the key parts.

“It does seem like the Samsung-Apple relationship is falling apart, and this will inevitably impact Samsung in the short term since it will have to look for an Apple replacement,” said an industry source. “But it seems like Samsung also made a big decision to distance itself from Apple to look at the matter on a greater scale.”

Apple has been Samsung’s top customer in terms of parts purchases, reportedly buying more than 10 trillion won ($9.2 billion) worth of parts a year.

The source also said that the recent repositioning of a key Samsung executive who dealt with chip sales business to Apple reflects the Korean electronics firm’s intent to handle business with the U.S. company in a different way.

Hong Wan-hoon, executive vice president of Samsung’s memory business, was transferred into the Global Marketing Office earlier this month.

“Neither side is backing down at this point so it is most likely that they will go their own separate ways, but it doesn’t indicate that they will end their relationship forever,” the source said. “It will naturally be sorted out when one side seals a victory in the patent litigation.”

Others benefiting from the patent suit

Amid the global patent litigation between the two IT giants, other local and foreign firms like LG Display, SK Hynix and Taiwanese AUO are benefiting from the situation as the U.S. firm is diversifying its suppliers.

NPD DisplaySearch pointed out that LG Display has been getting increasing display orders from Apple in recent months, even for Apple’s latest iPad mini, which was released ahead of the iPhone 5 this month.

Its display shipments to Apple for the 9.7-inch iPad have increased to over 7.73 million units in the second quarter of this year, jumping from about 4.6 million units in the previous three months.

The LG Display’s shares surged to reach a three-month high last Monday, closing at 36,950 won per share. The three-month low had been 25,700 won per share recorded on Aug. 31.

Chipmaker SK Hynix, which supplies dynamic random access memory and NAND flash memory chips to Apple, has also been enjoying its heyday on the back of the Samsung-Apple patent litigation.

Many industry sources have stated in the past that offering key components to Apple is not that profitable since the deals are usually set at a relatively low price.

However, that seems to be changing with the chipmaker reportedly raising the price of its NAND flash memory for Apple by up to 20 percent in October.

AUO has also seen a rise in profits since it was selected as Apple’s display supplier ― along with LG Display ― for the iPad mini, though the Taiwanese firm is reportedly facing quality issues.

“Taiwan competitor AUO is meeting difficulty in maintaining quality and yield rate involving the production of 7.9-inch display for the iPad mini, so it is expected to offer a positive light on LG Display,” said Kang Jung-won, an analyst for Daishin Securities.

“It adds meaning in that AUO’s display production problem could threaten the industry’s future production capacity and even lead to the withdrawal of the firm in the global market.”

LG Display’s share closed at 35,750 won per share on Wednesday.

By Cho Ji-hyun (

sharon@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)