Amid the escalating US-China rivalry in recent years, South Korea’s conglomerates have struggled to strike a balance in their Chinese business. Even though no immediate breakthrough is seen in geopolitical tensions, Samsung Electronics and Hyundai Motor Group -- the nation’s top makers of smartphones and cars -- are seeking a turnaround in their reduced market shares in China, an all-important market that is too big to ditch.

|

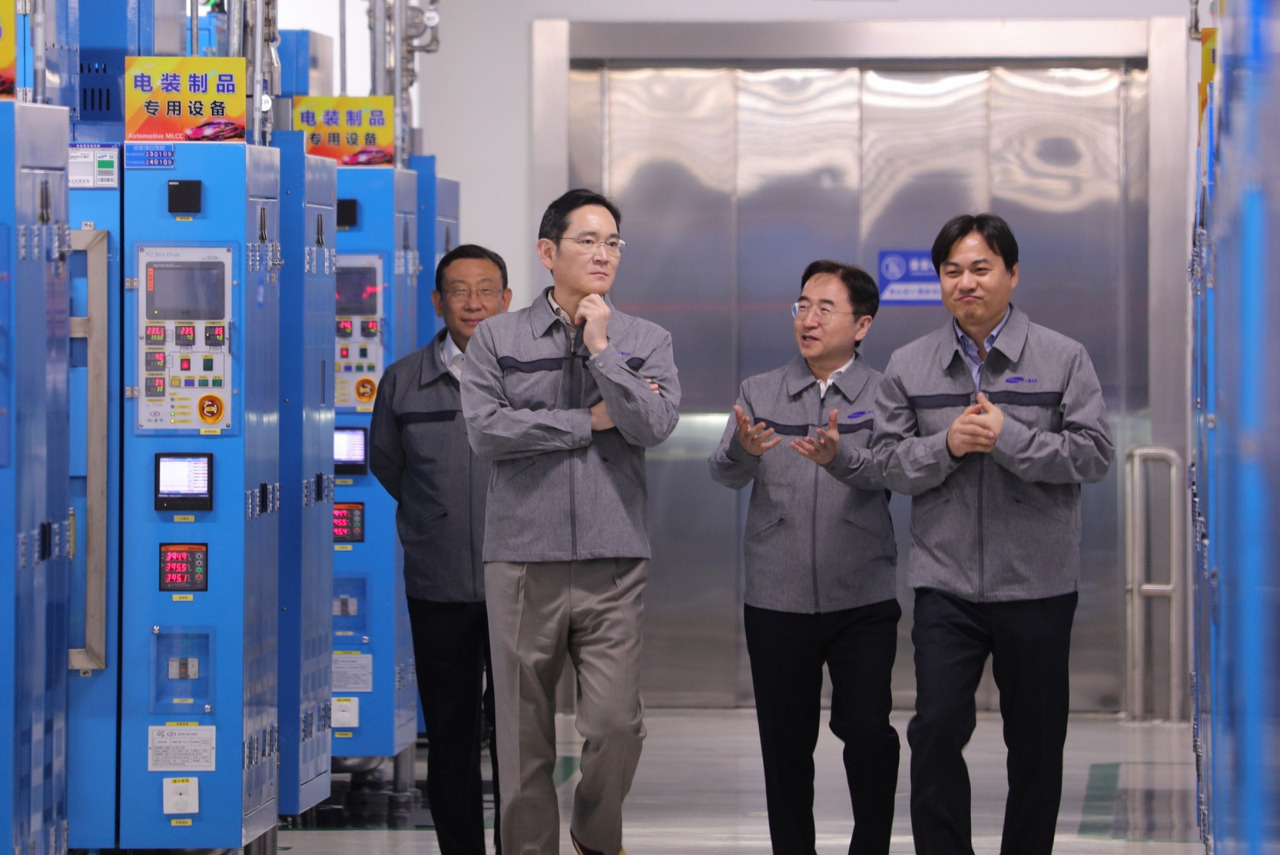

Samsung Electronics Chairman Lee Jae-yong (second from left) inspects the Samsung Electro-Mechanics’ key production facility for Multilayer Ceramic Capacitor in Tianjin, China, Friday. (Samsung Electronics) |

Samsung

In its earnings guidance last week, Samsung predicted its quarterly operating income for the January-March period to be 600 billion won ($455 million), the lowest quarterly profit in 14 years.

While the severe downturn in the chip industry, hit by weakened demand and falling prices, is driving down the world’s largest memory chipmaker’s profits overall, a drastic fall in exports to China is also viewed as one of the key reasons for Samsung’s recent struggles, according to industry watchers here.

“South Korea is heavily reliant on China for its chip exports, with almost 40 percent of the nation’s total chip exports going to China. In March, the nation’s chip exports to China halved, and I believe the decline was a critical blow to Samsung,” said Kim Hak-kyun, the managing director at Shinyoung Securities.

Samsung has been facing a balancing act as competition between the US and China intensified, more recently on chips. While Washington hints at cutting subsidies for chipmakers that make additional investments in China, Beijing is also seen to crank up the pressure, saying Korean chipmakers appear to have “borne the brunt” of the US chip hegemony.

"It is the US that has ratcheted up pressure on its allies to ban their companies from selling chips at will and is making chipmakers the cannon fodder in the US 'chip war,'" Global Times, Beijing's state-operated English media, wrote Saturday.

But Samsung appears to be seeking ways to regain its presence in China, especially in the smartphone market where it holds less than 3 percent market share.

Last month, Chairman Lee Jae-yong traveled to Beijing for the first time in three years to take part in a state-organized, high-profile corporate summit that brought together many global tech giant leaders.

Lee also took the opportunity to inspect the company's business in Tianjin, where Samsung affiliates, including Samsung Electro-Mechanics and Samsung Display, have their key manufacturing plants.

There, Lee met with the party secretary of Tianjin, Chen Miner, who is also a confidant of Chinese President Xi Jinping, during the trip.

In 2022, Samsung was the No. 1 smartphone maker in terms of shipment with 22 percent market share, followed by its archrival Apple with 19 percent. But in China, the company has long struggled to elevate its tiny market share, outpaced by smaller rivals such as Oppo, Xiaomi and Vivo.

According to market tracker Counterpoint Research, Samsung had a 2.3 percent share in China last year, while the top two players, Vivo and Apple, owned 19.2 percent and 18 percent, respectively.

“China is notorious for its patriotic consumption, and the stronger appetite of Chinese consumers goes to the local brands. So it is extremely difficult for foreign companies to compete there,” an industry official told The Korea Herald under the condition of anonymity.

The patriotic consumption trend is not the only factor holding back Samsung, the company appears to have lost its target group, industry watchers say.

In the premium smartphone segment, Samsung is less competitive against Apple that has its own unique operating system. In the lower price segment, China's local brands such as Oppo, Xiaomi and Vivo -- all operating with Android -- hold an upper hand.

As Samsung continues to struggle to secure its footing in the Chinese market, the tech giant has established a special task force team directly led by CEO Han Jong-hee in December 2021.

The CEO who oversees smartphone and home appliance businesses has pledged to elevate Samsung’s ailing presence in the Chinese market, by launching more tailored products and services exclusively for Chinese consumers.

"We have found what the problem is. To give an example of our TV lineup, our strategy was largely centered on the US and Europe, but we have learned China has its own system of preference,” he told reporters during the IFA trade show in Berlin last year.

Samsung’s mobile business chief Roh Tae-moon also said, "Samsung's China strategy is to provide the right products that the customers want. We are experiencing difficulties in China, but we will focus on the premium smartphone market for a turnaround."

|

Kia’s EV6 GT (from left), concept cars EV5 and EV9 showcased at the Kia EV Day event held in Shanghai on March 20. (Hyundai Motor Group) |

Hyundai

Hyundai Motor Group has vowed to turn the tables in China, the world’s largest clean car market following Europe and the US, to strengthen its shrinking market presence.

The carmaker’s smaller affiliate Kia recently unveiled the concept version of its all-new, full-electric midsize sport utility vehicle EV5 for the first time in China. The EV model will make its China debut this year together with EV6 GT, a high-performance model of Kia’s first midsize electric SUV. In 2024, it will roll out its large-sized electric-powered SUV EV9 as well.

Industry insiders say the newest electric SUV model is highly likely to make its world premiere in China, not in Korea, considering that Hyundai is going all out to up its game there with its renewed strategy: quality over price.

“Although the Chinese government ended EV subsidies (last year), Kia’s EV5 and EV6 are unlikely to compete on price with China-made electric cars,” said an official from Hyundai Motor Group.

“Our plan is to challenge them with high-quality cars.”

As of April, Kia EV6 is priced at around 50 million won, more expensive than the Chinese automaker BYD’s electric SUV Song Plus’ 34 million won. Even after the EV subsidy expired, BYD and other carmakers carried out promotional discounts.

Rather than focusing on pricing strategy, Hyundai Motor Group plans to expand car lineups running on its E-GMP EV platform. Currently in China, the carmaker’s premium brand Genesis’ GV60 is the only EV using the operating system.

“The platform exclusive for EVs comes with several perks -- wider interior and trunk space, longer driving range and better driving performance than electric cars that use a converted platform based on the internal combustible engine car system,” said Park Cheol-wan, an automotive engineering professor at Seojeong University.

The automaker’s E-GMP also allows for 800-volt fast-charging service when its rival Tesla is only offering 400-volt charging, according to Park.

“Chinese companies are scrambling to develop Hyundai’s vehicle-to-load system -- a world first -- as well,” he added. The V2L technology enables battery-powered EVs to use their stored energy to power external electronic devices.

But Hyundai’s electric sports car Lafesta EV and the electric version of its bestselling sedan Mistra Electric, which debuted in China in 2019 and 2021, use the cost-effective sedan Avante’s and Sonata’s platforms, respectively.

“There are already a large number of China-made EVs using converted platforms. So Hyundai cars have held little comparative advantage in terms of price and quality,” Park said.

Kia’s EV lineups for China -- EV5, EV6 GT and EV9 -- running on E-GMP are expected to give growth momentum for the carmaker, whose sales have been dwindling since 2016 when South Korea deployed the US’ THAAD anti-missile system.

Last year, the combined China sales of Hyundai and Kia extended the slump to its seventh consecutive year. It plummeted 8.4 percent to 403,000 units from a year earlier, posting a 1.7 percent market share, according to data from the China Passenger Car Association. Hyundai’s Chongqing plant shut down in the cited period due to declining sales there, leaving only three plants in China.

Stressing that they cannot leave out China when discussing the global EV markets, Park said, “The Chinese auto industry is changing with burgeoning demand for medium-priced EVs with better performance, rather than cheap price being the first choice for buying electric cars.”

Kia’s boxy EV designs might appeal more to Chinese consumers than Hyundai electric cars, he added.

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)