|

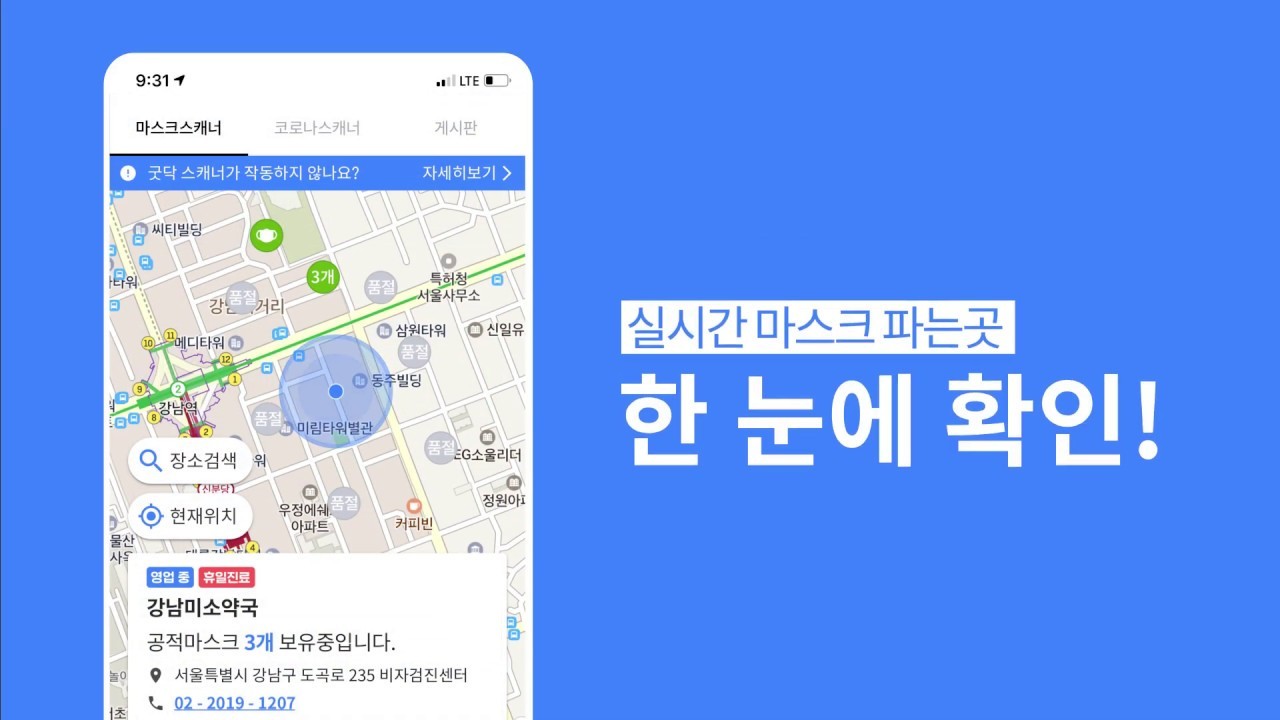

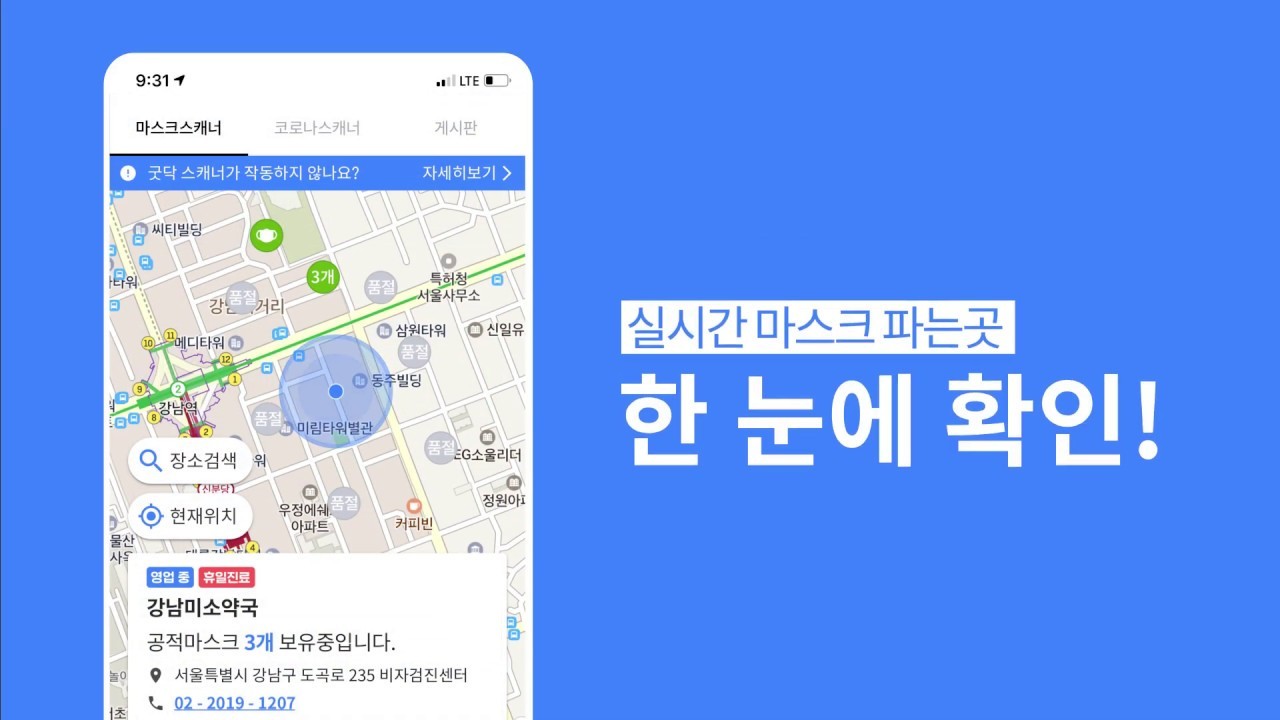

A promotional image of Gooddoc (Carelabs) |

Busan-based venture capital Maple Investment Partners has been selected as the preferred bidder to become the largest stakeholder of Carelabs, a South Korean company listed on the development stock bourse Kosdaq, a regulatory filing showed Friday.

Carelabs operates a mobile app Gooddoc, which allows users to track the nearest hospitals and drugstores. The app began to feature real-time face mask inventory tracking function earlier in March.

Facing a mounting fallout of COVID-19 here and the consequent supply-demand imbalance of protective face masks, the Korean government has recently initiated a rationing system to distrube masks through pharmacies.

Under the current plan, Maple will acquire 33.5 percent of Carelabs shares owned by Yello Mobile’s affiliates including Dayli Blockchain, as well as bond warrants and convertible bonds by financial investors that exercise tag-along rights.

Carelabs said in a filing it would announce a further progress in the deal, when the two reach an agreement and fix the acquisition price.

Maple, formerly known as MG Investment, was one of the bidders in final bidding round along with SG Private Equity. Maple created a project fund backed by Korean biopharma firm Green Cross for the deal.

The stock price of Carelabs slipped 7 percent as of 3 p.m. Friday in an apparent market rout, bringing its market cap to 89.4 billion won ($73.3 million).

Carelabs logged a 529.6 million won net profit in 2019, down 86.2 percent on-year, while its revenue surged 25.6 percent on-year to 68.3 billion won, according to its preliminary estimate released in February.

Carelabs was founded in 2012 and launched the service in 2016 to locate hospitals and pharmacies through a series of spinoffs and acquisitions. The firm began trading on Kosdaq in 2018.

By Son Ji-hyoung (

consnow@heraldcorp.com)